Heico (HEI 0.22%) has been an outstanding stock -- up 843% in the last decade -- and it's a great company with exciting growth prospects. However, do these characteristics add up to make the stock a buy right now? Let's take a look at what you need to know before buying Heico shares.

How Heico makes money

For readers unfamiliar with Heico, the company designs, produces, and services niche products mainly to the aviation, defense, and space industries. Operating out of two segments, the flight support group (FSG) is the largest independent producer of Federal Aviation Administration approved aircraft and engine parts. Meanwhile, the electronic technologies group (ETG) produces electronic components for aerospace, defense, space, and electronics industries.

Part of the reason why Heico has done so well in the last 10 years comes down to the fact that Heico offers customers a cost-effective way to source Federal Aviation Administration (FAA) approved products other than from the original equipment manufacturers (OEM).

Heico makes FAA-approved parts for engines. Image source: Getty Images.

The table below shows what a difficult year it's been for the company. The sales declines demonstrated below led to a 26% decline in operating income to $89 million in the fourth quarter of 2020 and a 17.6% decline to $377 million for the full year 2020.

In case you are wondering, the reason the ETG outperformed the FSG comes down to its extra exposure to the defense industry. In fact, according to Cannacord Genuity research, the decline in commercial aerospace-related revenue means that Heico's defense and space revenue was roughly the same as its commercial aerospace related sales in 2020.

| Heico Segment |

Fourth Quarter 2020 Sales |

YOY Change |

Full Year 2020 Sales |

YOY Change |

|---|---|---|---|---|

|

Flight support group |

$193.6 million |

(40.4%) |

$924.8 million |

(25.5%) |

|

Electronic technologies group |

$236.7 million |

7.8% |

$875 million |

4.9% |

|

Total* |

$426.2 million |

(21.3%) |

$1,787 million |

(13.1%) |

Data source: Heico presentations. *Total figures do not tally with segment data due to intersegment sales. YOY = year over year.

The investment case for Heico

Putting all of this together, the bulls' case for buying the stock comes down to three main parts:

- The commercial aviation industry will undergo a multi-year recovery and FSG revenues will recover in time.

- The downside is limited by Heico's defense and space exposure, mainly in the ETG.

- The company's long-term earnings driver, the ability to offer FAA-approved components for better prices than OEMs, isn't going anyway anytime soon.

It's a compelling case, but I think there are three key arguments against it.

3 Reasons not to buy Heico

The first is that there's a significant amount of near-term risk around the stock and the commercial aerospace sector in general. The commercial flight data was weaker than many had hoped it would be in the fourth quarter. Moreover, recent trading updates from two UK based aerospace and defense component suppliers, Meggitt and Senior cause for concern.

Image source: Getty Images.

Meggitt's management thinks it will "take time" for the positive impact of COVID-19 vaccines to feed through into flight growth and aftermarket demand. Meanwhile, Senior's management thinks its revenue won't make a "meaningful recovery" until 2022 with "Aerospace is set to be at least as challenging as 2020 given the current customer-announced production rates" in 2021.

Second, it's always a good idea to check what assumptions you are making about buying a stock and then look at other stocks in order to see whether you could buy another option that was better priced using the same assumptions.

In this context, Heico looks expensive when matched up against its peers like Raytheon Technologies (RTX 0.84%) and TransDigm. Raytheon is currently generating two-thirds of its revenue from its defense business, and its commercial aviation businesses (Pratt & Whitney engines, and Collins Aerospace systems and components) are similarly tied to a recovery in passenger traffic and flights.

Granted, Heico has better long-term growth potential, but on a risk/reward basis I think Raytheon is the better buy. For reference, the valuation metric below compares enterprise value or EV (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization or EBITDA.

Data source: marketscreener.com. Author's analysis.

Third, on an absolute basis Heico's valuations don't suggest you are getting to buy a stock with any discount priced into it. In other words, the market seems to be assuming a favorable outcome for the company over the next few years.

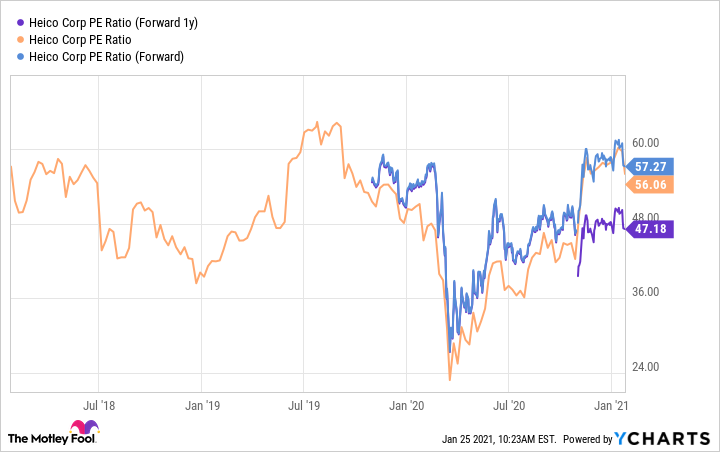

The chart below shows that Heico trades on 57 times its estimated earnings for 2021 and 47 times estimated earnings for 2022. The price to earnings ratio is another widely used valuation metric.

Heico's track record and ability to generate superior returns from its assets certainly mean it deserves a premium to many of its peers. However, valuations still matter and there are plenty of other growth stocks, in other industries, you can buy trading on similar valuations but without the uncertainty around the aviation industry hanging over it.

Data by YCharts

Is Heico stock a buy?

There's definitely a case for aviation bulls to buy Heico as a recovery play, but not at this price. Given the disappointing conditions in the aerospace market in the fourth quarter and the uncertainty in 2021, there's clearly some near-term risk around the stock.

Moreover, the stock looks like it's been priced for perfection in 2021 and beyond. In other words, any disappointments with earnings could see the stock sliding. As such, it makes sense to wait for a better buying opportunity.