The pandemic was a great time to be a video game company, and Activision Blizzard's (ATVI) stock price reflects that. Shares are up 63.9% since a year ago, and they don't seem to be losing momentum.

While the narrative has been great for Activision Blizzard, however, the underlying business trends may not all be pointing up. Big game franchises aren't what they once were, and it's easier than ever to be a game developer, increasing supply across the industry. Activision Blizzard has tailwinds from the pandemic, but it may not be the best way to play video game stocks today.

Image source: Getty Images.

Unpacking the growth story for Activision Blizzard

The last year has been strange for Activision Blizzard, to say the least. It was clearly one of the beneficiaries of the pandemic, which left millions of people out of work with more time to play video games. Revenue rose 24.6% to $8.1 billion, while net income rose 46.2% to $2.2 billion.

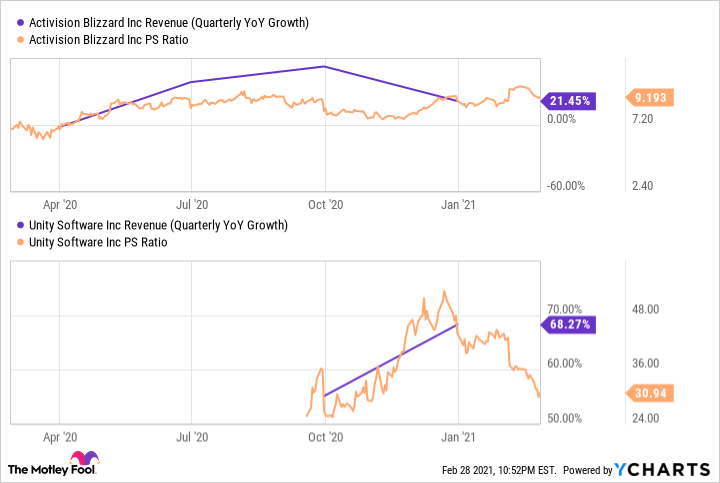

ATVI Revenue (TTM) data by YCharts

The revenue growth has been driven by new consoles coming out and the growth in mobile games like Call of Duty Mobile. The mobile launch of the game helped Activision Blizzard come off a revenue trough in late 2019 -- but you can see above that growth had been sluggish if we look back three or four years.

There are a number of trends that are keeping Activision Blizzard's growth lower than that of some competitors. One is that big-name franchises aren't selling like they did five or ten years ago, and another is that it's easier than ever to be a video game developer.

A better buy in video games

The real power in video games today isn't in the big developers, which could once push out content through their distribution channels and simply out-spend competitors. The distribution barriers have broken down since most games are delivered electronically, and the video game development business has gotten easier with tools like game engine Unity (U 1.59%).

According to Unity's management, 71% of the top 1,000 mobile games in Q4 2020 were built with Unity. That's incredible breadth, and ensures the company will grow as long as mobile gaming grows. Compare that to Activision Blizzard, which is reliant on specific titles in a world where the number of titles competing for eyeballs is growing.

ATVI Revenue (Quarterly YoY Growth) data by YCharts

As the video game pie grows and the market share that big developers have to themselves shrinks, it's companies like Unity that will be the big winners. Plus the company has tools for PC games, VR, AR, and much more. No matter what kind of content people are using in the digital age, Unity has the tools to build up-to-date content, and that's the most valuable thing in video games today.

Unity is the better buy in video game stocks

Activision Blizzard isn't a bad company, and it could indeed continue to grow. But with a P/E ratio of 34 and questions about future growth, this isn't the best buy in video games. My money is on Unity's high-growth future instead.