Pfizer (PFE -0.19%) won the world's most-watched race when it scored the first emergency authorization for a COVID-19 vaccine. The U.K. gave Pfizer and partner BioNTech the nod in early December. And the U.S. and other countries followed soon afterward. Moderna's vaccine also entered the market in December.

But there's more to Pfizer's coronavirus story. This past week, Pfizer said it has launched a phase 1 trial of an oral antiviral treatment for COVID-19. The big pharma company also is studying an intravenously administered therapeutic in a phase 1b trial.

Pfizer may be on its way to becoming a coronavirus powerhouse. Yet it's share price hasn't followed. Let's take a closer look.

Image source: Getty Images.

A vaccination leader

The U.S. has so far administered more than 65 million doses of Pfizer's vaccine and has ordered a total of 300 million doses from the company. And countries around the world are using the Pfizer vaccine, too. For example, the European Union recently ordered more -- for a total of 500 million doses to be delivered this year.

Pfizer predicts coronavirus vaccine revenue will total $15 billion this year. Of course, the company has to split the profits with BioNTech, but this still represents a blockbuster level of sales for both companies.

Now let's look at Pfizer's treatment candidates. Both are protease inhibitors that work by binding to a part of the virus and preventing replication. The most recent trial is to study dosage levels and the safety and tolerability of the oral candidate. It includes healthy adult volunteers only.

Preclinical work showed anti-viral activity against SARS-CoV-2 and other coronaviruses. The goal would be to use such a treatment at the first sign of infection to prevent hospitalization and severe disease.

Pfizer's trial of the intravenous protease inhibitor involves patients hospitalized with COVID-19. If it's successful, it would eventually be used as a treatment for that patient group.

These candidates represent possible future revenue for Pfizer. They most likely would be used in a post-pandemic world. And if they're successful, Pfizer would become a leader in coronavirus prevention and treatment.

Share-price performance

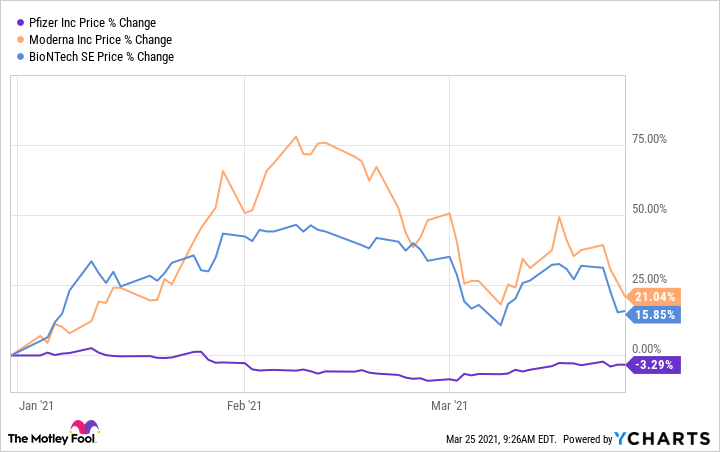

With that news, you might wonder why this year's share-price performance versus rivals looks like this:

And Pfizer's performance last year looked like this:

Clearly, Pfizer's shares haven't been sensitive to its coronavirus news. And Pfizer isn't alone. Other big pharmas selling coronavirus vaccines are having a similar experience. For example, Astrazeneca and Johnson & Johnson shares rose 0.3% and 7.9%, respectively, last year.

As you can see in the charts above, rivals Moderna and BioNTech have been sensitive to news from their programs.

Why are biotech players posting massive gains while Pfizer and big-pharma peers lag behind? Moderna and BioNTech depend on coronavirus vaccine revenue. They didn't have commercialized products prior to launching their vaccines. So every bit of good news leading up to authorization -- and now news of sales -- is reason for investors to cheer.

These product launches represented the first product revenue ever for Moderna and BioNTech -- and the revenue happens to be in the billions. The product launches also are proof that the companies' technologies work -- and that they can bring safe and efficacious products to market.

An array of products

Like other big pharmas, Pfizer sells a vast array of products. Full-year 2020 revenue topped $41 billion, so the company's success doesn't depend on the coronavirus vaccine. News about it generates far less excitement among investors because the coronavirus vaccine isn't transformative for Pfizer.

This doesn't mean Pfizer's coronavirus work will never boost the company's stock price. But this program won't do it alone -- and it won't happen overnight. Pfizer investors are looking at progress of the whole product portfolio over time.

And here, things are looking good. Pfizer's spinoff of its Upjohn business is complete, and Pfizer is all set for faster growth. The company says 2021 revenue may rise as much as 47% year over year. Looking into the future, potential COVID-19 treatments could be another valuable addition to Pfizer's portfolio.

All of this should translate into steady share gains. And that makes Pfizer a winning pick for investors who want to buy a solid healthcare player and hold on to it for the long term.