For decades, fuel cell companies are trying to make their operations profitable. Though they haven't been successful so far, an ever rising focus on cleaner energy sources could change that. This enthusiasm drove stock of top fuel cell maker Plug Power (PLUG) up by around 1,000% last year. Bloom Energy (BE 3.43%) stock too surged 280% in 2020. However, both the stocks are right now more than 50% off their 2021 highs. After so much volatility, which way could these two stocks be headed? Let's see the key factors that may drive the performance of the two stocks in the future.

Fuel cell technology

Though both Plug Power and Bloom Energy offer fuel cells, their products differ in significant ways. Plug Power offers proton exchange membrane (PEM) fuel cells. Its fuel cells generate electricity by taking hydrogen as an input fuel. By comparison, Bloom Energy's fuel cell offerings right now use natural or biogas as an input fuel. Its solid-oxide fuel cells produce electricity through an electrochemical process, without combustion of the fuel. So, it produces far less emissions compared to the traditional process of burning fuel to generate electricity.

Image source: Getty Images.

By comparison, hydrogen fuel cells generate only water as a by-product and are therefore the cleanest way to generate energy. However, that hydrogen, if produced using natural gas, still isn't really clean. For that reason, fuel cell companies' end objective is to produce hydrogen using electrolysis of water -- the most environment-friendly way to generate energy. Yet, this is an expensive process, and fuel cell companies continue to find ways to reduce costs to make this process commercially viable.

While Plug Power already offers hydrogen fuel cells, Bloom Energy's hydrogen-based fuel cells are expected to ramp up sometime after 2023.

Financial performance

Though Bloom Energy is just entering into the hydrogen segment, it seems to be progressing well on the financial front with its current offerings.

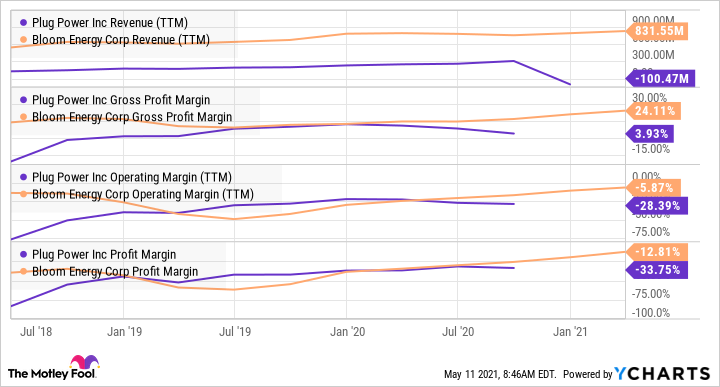

PLUG Revenue (TTM) data by YCharts

Bloom Energy's gross and net profit margins are higher than Plug Power's. In the latest quarter, Bloom Energy grew its revenue by 24% over the year-ago quarter. It expects its cash from operations to become positive by the end of this year.

Plug Power hasn't yet reported its quarterly results and has filed a form with the SEC to extend its due date for filing its quarterly report by a week. The company has also not yet filed its annual report for the year 2020 as it is still working on certain restatements of its previously issued financial statements. Indeed, these delays have concerned investors, and Plug Power stock plunged recently.

Outlook for hydrogen fuel cells

The biggest challenge for both Plug Power and Bloom Energy is hydrogen fuel cells' limited adoption so far. Higher costs compared to available alternatives for energy and storage could be the main reason behind hydrogen fuel cells' tepid growth. Fuel cell companies generally depend on very few customers for the bulk of their revenue and have little bargaining power. As an example, SK Engineering and Construction accounted for 34% of Bloom Energy's 2020 revenue, while Duke Energy accounted for another 28% of its revenue. So, these two customers accounted for 62% of the company's 2020 revenue.

As customers appear unwilling to pay higher prices, fuel cell companies are offering products at competitive prices, while incurring losses. At the same time, their sales and marketing expenses are creeping higher. As an example, Bloom Energy's sales and marketing expenses in Q1 rose 58% compared to the year-ago quarter while its revenue grew by only 24%.

Both Plug Power and Bloom Energy may continue to struggle for profitability if the demand for fuel cells does not improve as the companies are hoping.

This fuel cell stock looks better

At a forward price-to-sales ratio of 3.5, Bloom Energy's valuation looks better when compared to Plug Power's ratio of more than 25. Moreover, with expected positive cash from operations as well as better margins, Bloom Energy's financials look better than Plug Power's. It makes more sense for a company to invest in newer offerings from generated cash rather than relying on borrowed funds or equity.

Having said that, as discussed above, both Plug Power and Bloom Energy face significant risks. Both the companies face stiff competition and margin pressures. Moreover, if fuel cells don't become commercially viable, the companies may continue to incur losses, as they have been doing for years. So, only investors with abundant appetite for risk should consider buying either of the two stocks.