What happened

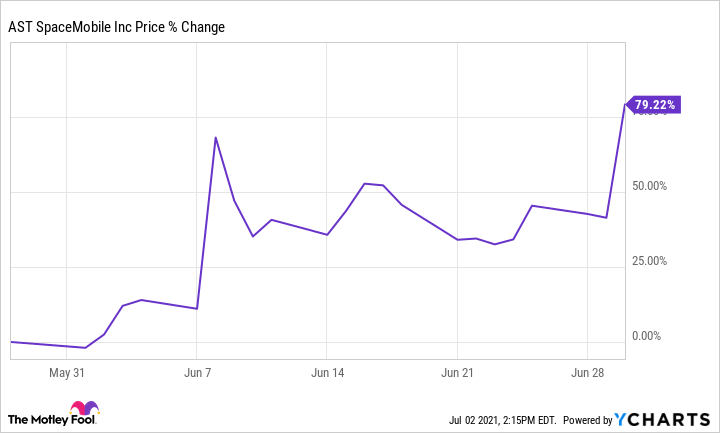

Satellite communications start-up AST SpaceMobile (ASTS 4.39%) rocketed 79.2% in June, according to data provided by S&P Global Market Intelligence, propelled higher by support from both a traditional Wall Street analyst and the Reddit community WallStreetBets.

So what

AST SpaceMobile has been a hot stock since the company joined public markets back in April via a merger with a special purpose acquisition company, or SPAC. The company has a "highly proprietary" technology that it says will turn all the world's cellphones into satellite phones, but is still in the early days of executing on its plan.

The stock's move higher in June came mostly in the form of two massive spikes. The first spike seemingly is attributable to a positive mention on WallStreetBets, where a poster called the company "the SpaceX for mobile phones" and estimated the stock could go to $200 per share if AST SpaceMobile business goes to script.

Image source: Getty Images.

There was also some talk that the stock might be added to an index, which would boost demand by causing funds that track the index to add it to their portfolios.

Deutsche Bank's Brian Kraft was responsible for the second spike, initiating coverage with a buy rating and a $35 price target. Kraft wrote that the target was the average of four scenarios, noting that in the extremes of those scenarios the stock could be "significantly higher" or zero depending on how things go.

Now what

AST SpaceMobile shares have gone on a wild ride since the SPAC merger, initially losing more than 40% of their value before June's rally. The company today is little more than a promising idea, yet the market values that idea at about $2.4 billion.

The truth is, as Kraft notes, there is a lot of potential and a lot of risk to this company, and none of us know how it will all turn out. It's OK to be excited about the potential, but it is also important to be aware of the risks. Investors who buy in should be prepared for continued turbulence, and limit this stock to a small part of a diversified portfolio.