DigitalOcean Holdings, Inc (DOCN 0.95%) operates a cloud computing platform that services customers worldwide.

The company went public in March of 2021, and the stock has risen in price well over 50% since the initial public offering (IPO). Despite the overall success, the stock is down more than 40% from its recent 52-week high. Growth stocks have fallen out of favor based on macroeconomic fears of interest rate hikes, faster tapering, and general concern over valuations. DigitalOcean has been unfairly caught in this net, which offers investors a compelling entry point.

Everything the big dogs aren't

The cloud-services market is dominated by major players from Big Tech. Amazon (AMZN -1.64%), Microsoft (MSFT 0.37%), and Google (GOOG 0.74%) hold sway over 61% of the market. Going head-to-head with these highly successful giants would be foolish, which is why DigitalOcean's business model focuses on the needs of small and medium-sized businesses (SMBs). While large corporations need the complex, expensive solutions that Big Tech can provide, SMBs are more focused on cost, ease of use, and customer service. DigitalOcean prides itself on its straightforward billing structure, simplicity, and world-class customer service.

SMBs are also a very fertile market that has been overlooked by larger companies in the industry. DigitalOcean estimates that there are 100 million companies with less than 500 employees worldwide, with 14 million new SMBs formed each year. It estimates that the total addressable market will grow to $116 billion by 2024. This is a gigantic opportunity to become the go-to solution for these smaller companies.

Image source: Getty Images.

Stellar growth

DigitalOcean is growing revenue steadily, and the growth is accelerating. As shown below, top-line revenue is expected to grow 34% to $427 million in fiscal 2021. The growth rate is well above the prior year's 25% growth rate, which is a terrific sign for things to come. In addition, while the company is not yet profitable in terms of generally accepted accounting principles (GAAP), it is both cash-from-operations (CFO) and earnings before interest, taxes, depreciation, and amortization (EBITDA) positive. For fiscal 2021, the company expects to make close to $130 million in adjusted EBITDA.

Image source: DigitalOcean.

The revenue growth comes from two sources: new customers and existing customers spending more each period with the company. DigitalOcean reports a net retention rate of 116% for the third quarter of 2021. A rate over 100% means that existing customers are spending more each period in excess of any customers who leave the platform. In fact, monthly revenue per unit has grown from $48.6 in Q3 2020 to nearly $62 in Q3 2021, an annual gain of 28%.

Scalability

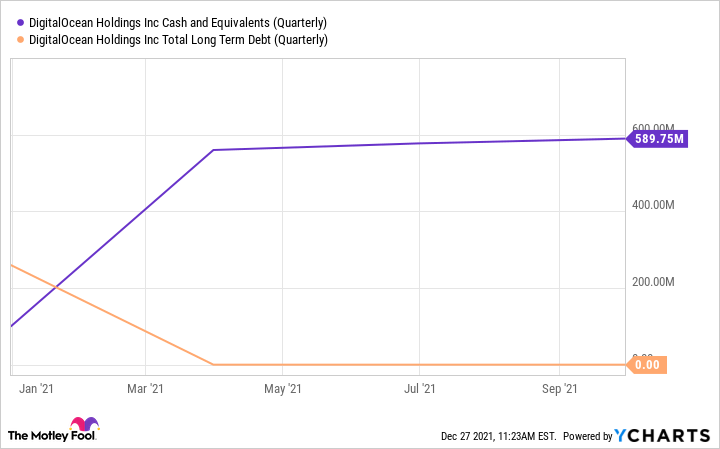

In addition to growth, DigitalOcean has attractive margins which indicates scaling to profitability is likely. First, the adjusted gross margin reached 80% in Q3 2021. The adjusted EBITDA margin for full fiscal 2021 is expected to be over 30%. This allows the company to be cash flow positive in its growth phase. Positive cash flow is great for investors. It suggests that the company will not need to raise cash through either debt or equity financing to pay for general operations. The company also has a significant cash balance from which to make acquisitions. DigitalOcean posted over $589 million in cash and equivalents on hand with no long-term debt at last report.

DOCN Cash and Equivalents (Quarterly) data by YCharts

The high-quality margins and fortress balance sheet indicate that DigitalOcean has a distinct path to healthy profits in the coming years.

The makings of a successful growth stock

DigitalOcean has found a terrific way to coexist in a sector with some of the largest companies on the planet; it simply doesn't compete with them. Instead, it focuses on those customers that don't interest the big tech companies much: independent developers and SMBs. And millions of these will be transitioning to cloud-based operations in the coming periods. Those who may have thought they missed the boat on DigitalOcean have seen the stock come back to port. Revenue is growing at an impressive and accelerating clip. The company is investing in growth and has a stated, and attainable, goal of reaching $1 billion in revenue by fiscal 2024.

DigitalOcean is also not a "growth at all costs" type of stock. The company has quality margins and is cash flow positive, which indicates an inherent route to GAAP profitability in the coming years. All of this, combined with an extremely solid balance sheet, make DigitalOcean stock a strong candidate to consider for long-term growth investors.