Block (XYZ -0.02%) Chief Executive Officer Jack Dorsey is a Bitcoin (BTC -1.44%) extremist. I know extremist is kind of a charged word. I don't necessarily mean it in a negative way. Many people are extremists. I like extreme sports. If I'm playing poker, I love to say, "I'm all-in." That's an extreme move. My religion was founded by a man who said things like "Give all your money to the poor" and "Love your enemies." One of my favorite rock bands says, "All you need is love." Extremism can be fine and fun and right. But it can also be highly risky and dangerous.

So why do I call Dorsey a Bitcoin extremist? He says things like "Bitcoin changes absolutely everything." He suggests that the dollar will disappear. His hope is that Bitcoin will bring about world peace. To my ear, these are extreme things to say. (And more than a little ridiculous. When has money ever brought about world peace?)

Image source: Getty Images.

More worrisome -- it's not just talk. Dorsey quit the CEO position of Twitter (TWTR), in part I think because the company would not let him buy Bitcoin with the company's money. And now Dorsey has changed the name of his company, Square -- a company I loved -- to Block, to signify the company is going to focus on the blockchain. And for Dorsey, apparently, blockchain is Bitcoin and there is no other.

Here's the danger with going all-in on Bitcoin

When you go all-in on one thing, you have to be right. There's no room for error. If you're wrong, you're in a world of hurt. If you're doing an extreme sport like skiing, and you mess up, you can break your leg. If you're wrong in poker when you say "I'm all-in," you've lost all your money. If you're an extremist in a bad religion, you can end up killing people.

So what concerns me about Mr. Dorsey is not that he loves crypto. I think he's right on crypto, and Warren Buffett is wrong on crypto. What's worrying me about Jack is that he seems to be all-in on Bitcoin, and he's ignoring the entire altcoin universe. That's dangerous. If we invested like that at the Motley Fool, back in the 20th century we would have bought AOL and no other internet stock. That would have been a disaster.

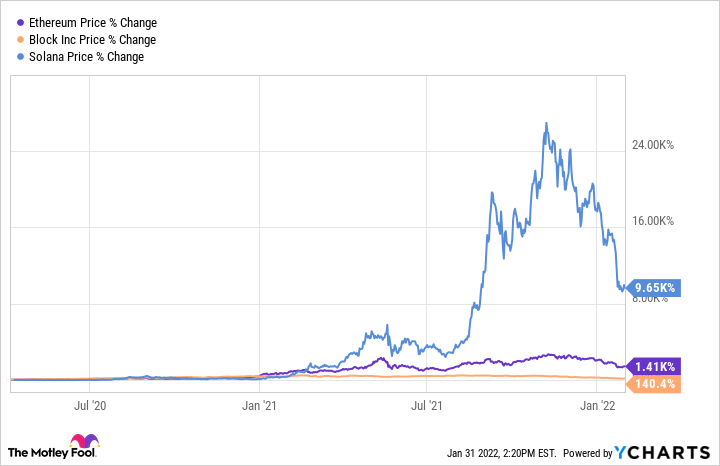

Dorsey's single-minded focus on Bitcoin is why I've recently reduced my family's exposure to Block. Of course, the stock has made us a lot of money over the years. I'm pulling for Jack to shift gears and start giving some love to Ethereum (ETH -2.89%) and Solana (SOL -2.80%) and maybe some other crypto, too. And if he can't do that, I'm thinking we might get out of Block altogether and shift that money to other crypto stocks like PayPal (PYPL 0.41%), Coinbase (COIN 0.34%), and Silvergate Capital (SI).

While I'm convinced that crypto is going to be a huge part of our future -- and Jack Dorsey is one of the people who convinced me -- I think it's a dangerous mistake to think that Bitcoin will replace all the currencies in the world. And that the altcoin universe is worthless has so far proven to be a ridiculous idea.

Ethereum Price data by YCharts

Cash App is a major part of Block's business, but the company is leaving a lot of money on the table

On his last earnings call, Dorsey was asked a question by Bernstein analyst Harshita Rawat.

Rawat: Jack, I want to follow up on your prepared remarks regarding bitcoin. Are you looking to expand into crypto beyond bitcoin buy and sell, for example, buy and sell of other cryptocurrencies and also enabling your users to kind of engage in defined NFT ecosystems?

Dorsey: We're not. Our focus is on helping bitcoin to become the native currency for the internet.

I hate this answer. And this is not some minor thing.

If you're a crypto enthusiast, you'll need to go someplace other than Block to buy Ethereum or Solana or Fantom (FTM -5.61%) or any other crypto. And crypto enthusiasts will do that. PayPal offers more crypto than Block. Robinhood (HOOD -3.60%) offers more crypto than Block. Coinbase offers way more crypto than Block. On Block's Cash App, you can buy only Bitcoin. It's like Henry Ford saying you can buy the Model T in any color, "as long as it is black."

I don't want to make fun of Ford, or Dorsey. I believe that single-mindedness (i.e., focus) is underrated as an ingredient in success. But I'm also a big believer in being open-minded about things, particularly things that are in a state of flux (like crypto). Ford was spectacularly wrong in thinking that all cars have to be black. General Motors understood that consumers wanted many different designs and colors, and the company flourished. I think Block should be selling Ethereum and Solana on Cash App, and the failure to offer those coins is leaving money on the table. And ignoring the non-fungible token market is a mistake, too.

You should take advantage of your options, not close them off without considering them. Optionality is a key to investing success. And going all-in on Bitcoin is an extreme move, and a dangerous one.