What happened

After flying higher on Tuesday, shares of TMC the metals company (TMC -10.08%) hit a bump in the road yesterday and gave back some of their earlier gains. Today, however, investors are choosing to click the buy button again on the mining company that has its sights set on the sea floor. Besides soaring nickel prices, Tesla's (TSLA -5.03%) decision to raise prices may also be motivating metals-minded investors.

As of 10:55 a.m. ET on Thursday, shares of TMC were up 12.3%.

So what

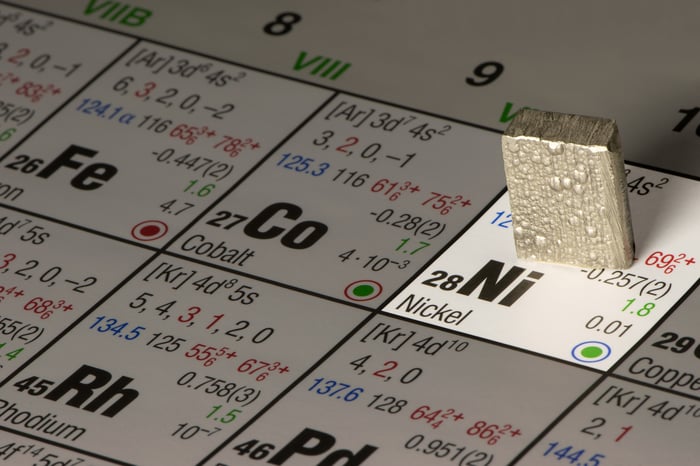

With the price of nickel spiking to an all-time high this week, companies that have nickel-rich assets are receiving attention from investors. TMC, for example, estimates that its portfolio of assets represents the largest undeveloped nickel project in the world: about 16 metric tons. For context, the company identifies the next-largest undeveloped nickel project at 5.8 metric tons.

Moreover, management aims to produce nickel while keeping expenses low. On the company's third-quarter conference call, management projected that when it commences operations, TMC will represent the second-lowest-cost producer of nickel worldwide.

Image source: Getty Images.

The rising price of nickel is having a material impact on electric-vehicle (EV) companies because the metal is an important material in EV batteries. Tesla is raising prices on select models. According to Electrek, an industry website that follows the EV industry, the automaker raised the prices of the long-range versions of its Model 3 and Model Y.

Although Tesla didn't directly attribute the price hikes to the escalating cost of nickel, Electrek notes that while it "can't confirm that the two are related, but interestingly, Tesla has only increased the price of vehicles with nickel in their batteries."

Now what

While there are clear reasons why investors might be interested in TMC today, it's crucial for potential investors to recognize that it will be another three years before TMC scales up its nickel production.

At this point, it's unclear how successful TMC will be in its metal-producing endeavors; consequently, the stock should only be a consideration for investors with ample tolerance for risk. For more-conservative investors, there are plenty of other choices to consider.