Virtual reality continues to be a technology with both incredible potential and a number of challenges ahead. Meta Platforms (META -1.39%) has certainly taken a lead in developing headsets and software for its vision of the metaverse and virtual reality (VR), but that may not be the best place to invest.

The hardware and software creators will use to build for virtual reality may prove more valuable than Meta's position in building headsets. Here's why I think Unity (U 1.69%), Taiwan Semiconductor (TSM 3.66%), and Microsoft (MSFT 0.62%) are the best ways to invest in virtual reality today.

1. Unity

Unity stock is down 74% this year, but that doesn't mean its VR business has changed at all. Developers building VR content aren't using Meta's platform; they primarily use Unity or Epic Games' Unreal Engine. Some of the most popular VR games like Beat Saber, Job Simulator, and Superhot were all built in Unity. As the only public company among the two, Unity is the best way to play this market niche from an investment standpoint.

The great thing about building in Unity is that developers are familiar with the platform. Unity has the leading market share in mobile games, and it's a relatively easy-to-use tool for developers to get started with.

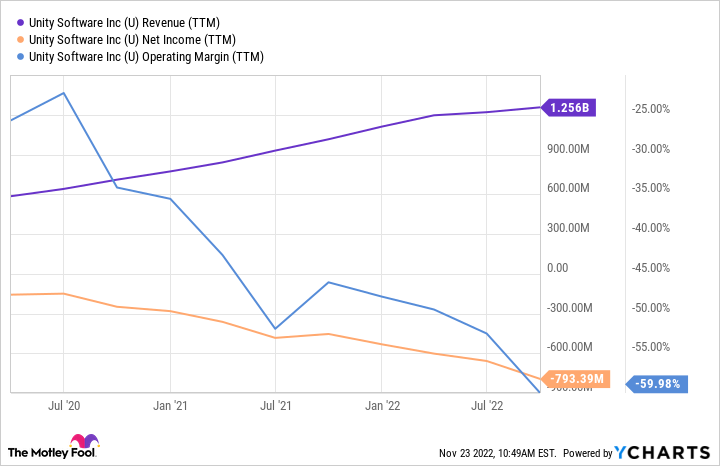

What's challenging for Unity is the same thing that plagues VR -- it's not making money. You can see below that Unity is reporting massive losses, despite growing revenue by 13% in the most recent quarter to $322.9 million.

U Revenue (TTM) data by YCharts

Unity doesn't break out VR specifically in its financial results, but it's the leading game engine in VR and if the industry grows this will be one of the biggest beneficiaries of an estimated increase in market size from $12 billion this year to $22 billion by 2025, which are tailwinds for Unity.

2. Taiwan Semiconductor Manufacturing (TSMC)

Why is a semiconductor manufacturer a top VR stock? The answer simply comes down to VR needing cutting-edge chips to be viable if it is ever going to be built in a small form factor. The company is a supplier to Apple's iPhone and Mac computers (Apple makes up about 25% of TSMC's revenue) and is the go-to supplier for bleeding-edge chips.

We know any Apple VR or AR hardware would likely include Taiwan Semiconductor chips and Meta recently signed a deal with Qualcomm (QCOM 0.11%) to design custom VR chips and Qualcomm has a manufacturing deal with TSMC.

TSMC has a big advantage over manufacturers like Intel and GlobalFoundries in performance on leading-edge nodes and that'll likely be true for many years.

The good news for investors is that TSM isn't reliant on VR for growth because it's currently getting very little revenue from VR companies. The company has grown on the back of mobile devices and other high-end chips, so VR would be additive to an already-strong business, not a requirement for growth. But if Apple or Meta design chips for VR headsets, that would be a tailwind.

TSM Revenue (TTM) data by YCharts

Unlike Meta, which is spending billions of dollars each year to build the metaverse, Taiwan Semiconductor could benefit from VR by doing what it does best: making the best semiconductor chips in the world. And with a price-to-trailing earnings ratio of just 14 times, this is a cheap stock at the moment.

3. Microsoft

On the software side of VR, it's hard to argue that any company is better positioned than Microsoft. It's the biggest name in business productivity software, and I think productivity tools will be the best use case for VR in the near term.

Microsoft's recently announced partnership with Meta (which you can read more about here) was telling for both companies. For Meta, it gives some credence to productivity tools in VR, which the company has struggled to build. For Microsoft, the company can launch productivity tools integrated with Teams or other products it offers, adding value to the hardware Meta or anyone else launches.

The advantage is that Microsoft is an application layer for virtual reality, plugging in where it makes sense. The company doesn't need to bet the farm on VR, and companies like Meta, who are betting the farm, need it as a partner.

Microsoft stock isn't cheap with a price-to-earnings ratio of 27 times, but the company has shown the ability to leverage its enterprise presence to expand into new markets and VR may be next.

Virtual reality is real, but so are the risks

If VR is a technology you want exposure to in your portfolio, it's worth taking a look at companies that are focused on more than VR but would benefit from the technology. I think Unity, Taiwan Semiconductor, and Microsoft fall into that category with already-large businesses that could get additional tailwinds from virtual reality.