The crypto market isn't short on investment options. Even though cryptocurrency has only been around since 2009, there now are more than 17,000 coins listed on CoinGecko, and that's far from all of them -- there have been millions of coins created over the years. For comparison, U.S. stock exchanges list abour 12,000 stocks.

If you're a new crypto investor wondering where to start, Motley Fool Chief Executive Officer Tom Gardner recommends sticking with the big two: Bitcoin (BTC +1.38%) and Ethereum (ETH +3.60%). Here's more on his crypto advice and why he suggests this approach for beginners.

Image source: Getty Images.

Tom Gardner's advice for new crypto buyers

Gardner's comments on crypto came in a recent interview when he was asked about what to avoid during the first few years of investing. On the crypto front, he said, "You are not allowed to buy any digital assets or cryptocurrency other than Bitcoin, Ethereum, maybe one or two others." So, there's a little wiggle room, but his advice is to keep it simple in the early going.

Two cryptocurrencies might not seem like enough for a diversified portfolio. After all, when it comes to stocks, The Motley Fool's investing philosophy is to build a well-diversified portfolio of about 25 to 30 companies. But the crypto market is much different from the stock market.

CRYPTO: BTC

Key Data Points

Cryptocurrencies are extremely risky investments. Gardner went on to explain that the market is full of fraud, self-interest, and greed and that many crypto founders are only doing it to make a quick buck. There's hardly any barrier to entry to launch a cryptocurrency -- you could create your own for less than $100. Because of that, crypto pump-and-dump scams are common.

Scams aren't the only risk. Many cryptocurrencies simply never catch on or can't build on their initial success. In an analysis earlier this year, CoinGecko found that 53% of the coins listed on GeckoTerminal since 2021 have failed. While smaller cryptocurrencies are more likely to fail, larger coins aren't entirely safe, either. Terra (LUNA 0.81%) is a perfect example. On May 1, 2022, Terra was the eighth-largest cryptocurrency, with a market cap of $28.4 billion and a price of $82.24 per coin.

But Terra would soon collapse. Just two weeks later, Terra's market cap was down to $1.4 billion, and its price had plummeted to $0.0002151. If you had bought $10,000 of Terra on May 1, 2022, your investment would have been worth $0.03 on May 15.

With stock investing, diversification is a way to reduce your risk by holding a variety of companies across different market sectors. Because so many cryptocurrencies fail or underperform, diversification doesn't provide the same security there.

Why Bitcoin and Ethereum?

I wouldn't call any cryptocurrency safe, but Bitcoin and Ethereum are arguably the safest options for a few reasons. They've been around longer than most cryptocurrencies. Bitcoin was the first cryptocurrency, launching in 2009, and Ethereum in 2015. They've each been through multiple bear markets and stuck around.

They're also the two largest coins by market cap. Bitcoin has always ranked No. 1, and with a market cap of about $2.2 trillion at the time of this writing, it accounts for about 64% of the total crypto market. Ethereum has been in second place since 2018 and currently has a market cap of about $320 billion. It accounts for 9% of the total market.

While both coins go through their ups and downs, it's unlikely that either will fall off the map, and they each have unique benefits that give them value. Bitcoin has a limited maximum supply of 21 million coins. That, and its status as the first cryptocurrency, has made it popular as a digital store of value.

CRYPTO: ETH

Key Data Points

Ethereum pioneered the concept of smart contracts, which are programs built into a blockchain. Smart contracts significantly expand on what can be done with blockchain technology by allowing developers to build decentralized apps (dApps). Ethereum isn't the only smart contract blockchain anymore, but it's still the most successful. There's $66 billion in total value locked (TVL) onto Ethereum through dApps, more than the TVL on every other blockchain combined.

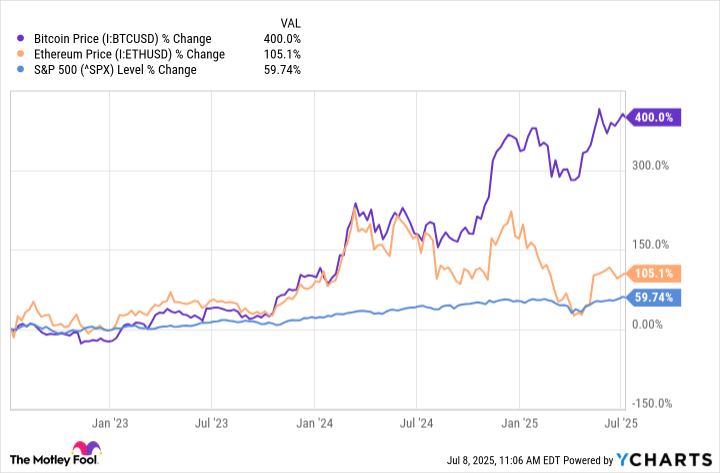

Even though Bitcoin and Ethereum are firmly established as the top cryptocurrencies, they've still been delivering exceptional returns. During the past three years, Bitcoin is up by 400% and Ethereum by 105%. Both have outperformed the S&P 500 over the same time frame, as seen in the chart below.

Bitcoin Price data by YCharts

It's not easy to choose good long-term investments in the crypto sector. The market is full of coins that don't pan out or serve as get-rich-quick schemes for their creators. Bitcoin and Ethereum have shown they have staying power and aren't scams, so they're a smart starting point for new crypto investors.