Do you feel on track for retirement? If the answer is no, rest assured that you're not alone. According to data compiled by the Federal Reserve, only 35% of all Americans believe they are on track to retire. That's down from 40% in 2021.

I would argue that the best way to get back on track is by increasing savings and adopting a buy-and-hold investment strategy. With that in mind, here are two stocks that could become key building blocks for such a portfolio.

Image source: Getty Images.

Amazon

Let me be clear: I love Amazon (AMZN +2.12%). I've owned the stock for years, and I'll own it for as long as I can.

If there's one reason I would recommend Amazon to any investor -- whether a novice or a seasoned stock-picker -- it would be this: It is one of the best run, most diversified companies there is. Moreover, its stock has consistently outperformed the broader stock market since its introduction nearly 30 years ago.

Consider this: The company is best known for its legendary e-commerce business. That business is huge; it generates around $500 billion in annual revenue, with over $387 billion in e-commerce sales in North America alone.

NASDAQ: AMZN

Key Data Points

Yet, Amazon is much more than just an e-commerce company. Its cloud services division -- Amazon Web Services (AWS) -- is huge. That segment generated $107 billion in revenue last year and is growing much faster (19% year over year) than the e-commerce segment (9% to 10%).

On top of its excellent diversification and impressive growth, I also rate the company's management highly. That quality is difficult to quantify, yet crucial to long-term success. Jeff Bezos founded the company in 1994 and was CEO until his retirement in 2021. The current CEO, Andy Jassy, joined Amazon in 1997 and played a key role in the conception and launch of AWS in 2006.

Steady leadership, along with strong growth and diversified revenue streams, make Amazon stock a strong choice for investors looking to get on track with their retirement.

Meta Platforms

The main reason I view Meta Platforms (META +1.77%) as such a wise investment for retirement planning is that its business model is one of the most efficient. The company makes about 97% of its revenue from advertising, which 30 years ago didn't have much of a footprint in the digital world.

NASDAQ: META

Key Data Points

Nowadays, digital advertising is a huge industry, and Meta is one of the biggest players. That's because its reach is global. The company has over 3.4 billion daily active users, roughly 38% of the world's population. Advertisers can reach almost anyone on the planet on Facebook, Instagram, or WhatsApp.

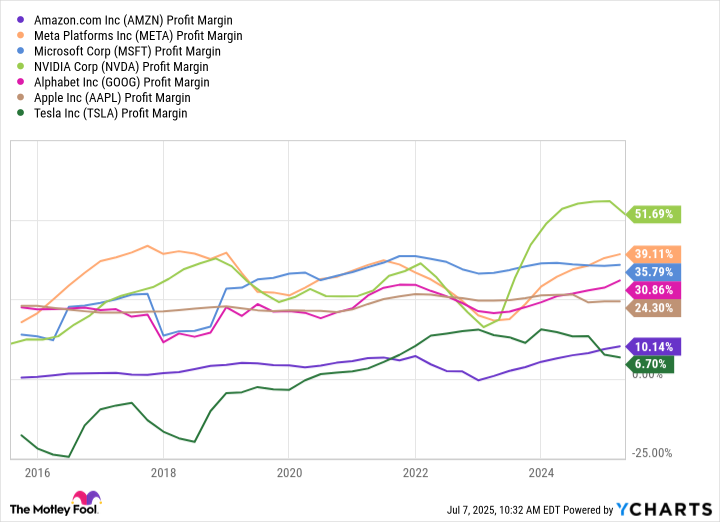

Meta generates an incredible amount of income from its revenue. In 2024, the company made $62 billion in net income on $165 billion of revenue. That works out to a net profit margin of about 39%, which is quite efficient and ranks second among the "Magnificent Seven" stocks (Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla).

AMZN Profit Margin data by YCharts.

Meta's efficient business model and its global reach make it a stock that many investors should consider owning if they want to get -- and keep -- their retirement plans on track.