The adoption of artificial intelligence (AI) is progressing rapidly as companies and governments across the globe are ramping up their spending on the technology. While improving productivity and efficiency, AI is also speeding up decision-making processes by analyzing data in real time.

Not surprisingly, the demand for AI software has been increasing at an exponential pace to unlock the potential of this technology. ABI Research estimates that the AI software market could clock an annual growth rate of 25% through 2030, generating $467 billion in annual revenue at the end of the decade. Palantir Technologies (PLTR +0.34%) is a company that can help investors capitalize on this lucrative opportunity.

The software specialist has seen a nice uptick in its growth on account of the healthy demand for its AI offerings. Palantir stock has jumped just over 5x in the past year thanks to AI, bringing its market cap to $335 billion. Of course, the stock is quite expensive right now following its astronomical jump. However, it wouldn't be surprising to see Palantir stock jump another 3x in the next five years and hit a $1 trillion market cap. Let's see why that may be the case.

Image source: Getty Images.

Palantir's growth rate is set to accelerate remarkably in the next three years

The proliferation of AI has unlocked a terrific growth opportunity, and importantly, Palantir has been capitalizing on it in the past couple of years with its Artificial Intelligence Platform (AIP). Palantir launched AIP in April 2023, and it has been a huge hit among both government and commercial customers since it enables them to integrate AI into their business operations and processes.

NASDAQ: PLTR

Key Data Points

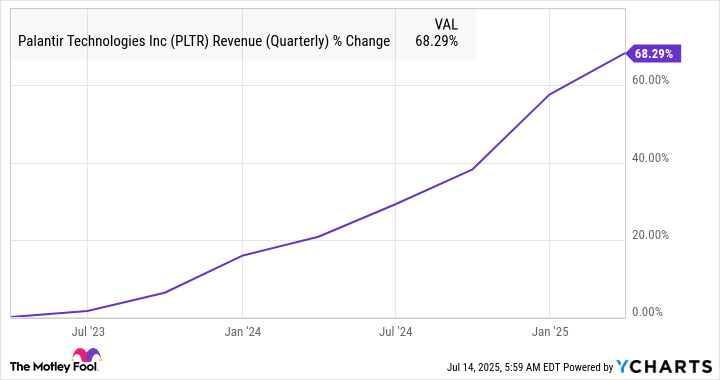

From automating operational processes to building AI tools and workflows, AIP is being used by major names across multiple industries. Its adoption has gained steam since its launch, and this is evident from the solid acceleration in Palantir's revenue in the past two years.

PLTR Revenue (Quarterly) data by YCharts

This is just the beginning. The AI software market is on track to grow at a healthy pace over the next five years, and Palantir is growing at an even faster pace. Its first-quarter 2025 revenue increased by 39% year over year to $884 million, and as the chart above indicates, this growth rate has been improving with each passing quarter.

AIP is the key reason behind the acceleration in Palantir's growth, as it is not just attracting new customers toward its platform but is also helping it win more business from existing ones. As a result, the company is now signing bigger deals with customers and has managed to build a revenue pipeline worth $6 billion by the end of the first quarter. This figure refers to Palantir's remaining deal value (RDV) at the end of Q1, which is the total value of all contracts that are to be fulfilled at the end of a period.

The important thing to note here is that Palantir's RDV improved by 45% from the year-ago period and was better than the improvement in its top line. So, the company's growth is already better than the annual rate at which the AI software market is expected to grow through the end of the decade. Also, Palantir's RDV is almost double the revenue it has generated in the past 12 months, indicating that it could sustain the acceleration in its top-line growth rate and win a bigger share of the lucrative AI software market.

The path to a $1 trillion valuation

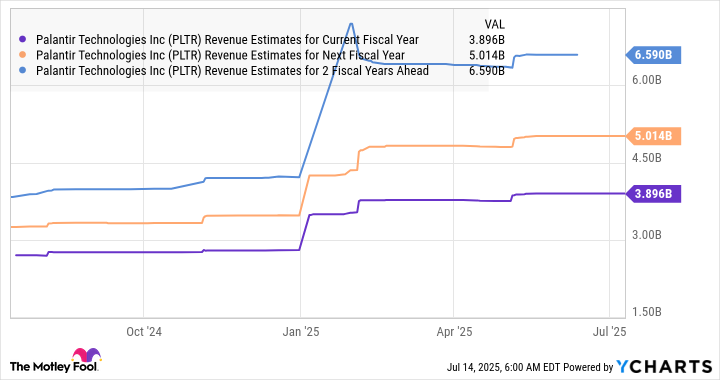

The following chart makes it clear that analysts are indeed expecting Palantir's revenue growth rate to improve.

PLTR Revenue Estimates for Current Fiscal Year data by YCharts

However, the rapid growth of the AI software space could very well help Palantir zoom past these estimates. Consensus estimates are projecting a 36% increase in Palantir's revenue in 2025 to $3.9 billion, in line with its guidance. The fast-improving pipeline on account of its rapidly growing customer base and its ability to land bigger contracts from existing customers could help Palantir do better.

Assuming it can increase its top line by 40% this year to $4 billion and maintain this growth rate for the next five years, Palantir's revenue could hit $28 billion in 2030. Palantir is trading at a whopping 113 times sales right now as the market is putting a huge premium on the stock on account of its leading position in the AI software market, the robust demand for its offerings, and the long-term opportunity on offer.

But even if it trades at a third of its current sales multiple after five years, which would be a big discount from current levels, its market cap could exceed $1 trillion in five years. Palantir is likely to command a premium valuation after five years because it has the potential to grow at a faster pace than the AI software market.

So, growth-oriented investors can consider looking past Palantir's valuation. The company's potential growth drivers are strong enough to help it generate elevated levels of growth for a long time and lead to more upside on the market.