Over the next couple of weeks, many of America's largest technology companies will report their operating results for the recent quarter, which ended on June 30. They will update investors on their financial performance, and also their progress in the artificial intelligence (AI) space, which is creating an incredible amount of value at the moment.

For Microsoft (MSFT +0.77%), June 30 marked the end of its fiscal 2025 fourth quarter and full year, and it's scheduled to report those results on July 30. Investors can look forward to some fresh information on the company's Copilot AI assistant, and its growing portfolio of AI cloud services.

But Microsoft stock has already rose by 20% this year, and it's starting to look expensive. Should that stop investors from buying it ahead of the upcoming July 30 report? It depends.

Image source: Getty Images.

Copilot adoption will be front and center

Using a combination of its own AI models and those developed by its key partner, OpenAI, Microsoft created a powerful virtual assistant called Copilot. It isn't just a stand-alone chatbot like many others in the industry, because it's designed to enhance Microsoft's vast portfolio of software products. Copilot is integrated into Windows, Edge, and Bing where users can access it for free, but it's also available as a paid add-on for other products like the 365 productivity suite.

Organizations around the world pay for over 400 million Microsoft 365 licenses to give their employees access to applications like Word, Excel, PowerPoint, and Outlook. Those enterprises can significantly increase their employees' productivity by adding Copilot for an additional monthly fee, because it can instantly generate text and images on command, summarize lengthy emails, and even write computer code.

If every enterprise 365 customer added Copilot, it would translate to billions of dollars in additional recurring revenue for Microsoft each month. Mass adoption will take time, but during the fiscal 2025 third quarter (ended March 31), CEO Satya Nadella said the number of organizations using Copilot for 365 tripled compared to the year-ago period.

Nadella also said deal size continued to grow because a record number of customers returned to buy more licenses. In other words, organizations seem to be testing Copilot with some of their employees, discovering its value, and then rolling it out more broadly. Investors will be looking for a fresh update on adoption when Microsoft releases its fourth-quarter results on July 30.

The company will likely also share an update on other Copilot products. Copilot Studio allows businesses to create custom AI agents capable of handling customer service queries and automating repetitive tasks. It had a record 230,000 enterprise customers at the end of the third quarter. Then there is the Dragon Copilot healthcare solution, which is designed to help doctors track their patients' records more efficiently, saving them time and money.

NASDAQ: MSFT

Key Data Points

This might be the most important number to watch on July 30

The Azure cloud computing platform is often the fastest-growing part of Microsoft's entire organization, so it's a key point of focus for investors each quarter. AI is playing an increasing role in that growth thanks to an expanding portfolio of new services.

Azure AI offers access to the two main ingredients developers need to create AI software: state-of-the-art data center infrastructure, which delivers the required computing capacity, and ready-made large language models (LLMs) from leading third-party developers like OpenAI, which developers can use to speed up their AI software projects.

During the fiscal 2025 third quarter, the Azure cloud platform generated year-over-year revenue growth of 33%, of which Azure AI accounted for 16 points. Azure AI's contribution is steadily increasing, and it's on the cusp of becoming the primary growth driver behind the cloud platform:

The fourth quarter might be the first time Azure AI contributed more revenue growth than the rest of Azure's cloud services. In my opinion, this is the most important thing for investors to look for on July 30, because it will validate Microsoft's substantial investments in AI. The company's capital expenditures (capex) related to AI data center infrastructure and chips came in at over $60 billion for the first three quarters of fiscal 2025, placing it on track to have spent over $80 billion for the full year.

That's a big number, but CFO Amy Hood says Microsoft has a staggering $315 billion order backlog from customers who are waiting for more data centers to come online. On July 30, the company might tell investors it plans to increase its capex spending yet again in fiscal 2026 to serve that demand.

Should you buy Microsoft stock before July 30?

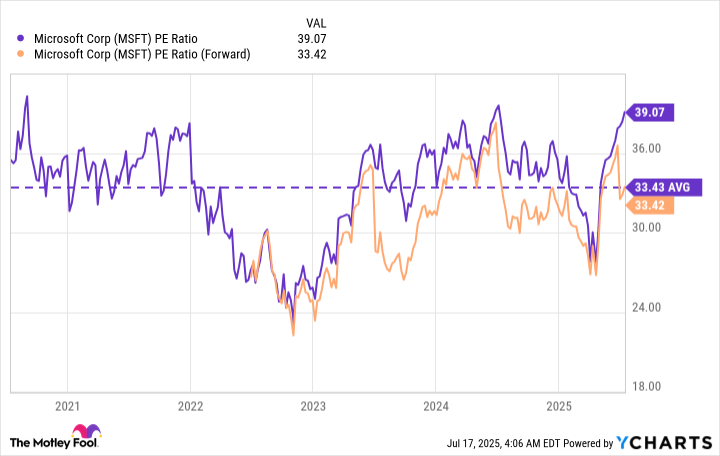

Microsoft stock isn't cheap right now. On the back of its 20% gain this calendar year, it's now trading at a price-to-earnings (P/E) ratio to 39.1, which is a premium to its five-year average of 33.4.

With that said, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Microsoft's earnings per share could jump by 13% in fiscal 2026, placing the stock at a forward P/E ratio of 33.4. That doesn't necessarily make it cheap, but it means investors who are willing to hold the stock for at least the next two years (but preferably five years or more) have reasonable odds of earning a positive return, assuming the company's earnings continue to grow.

MSFT PE Ratio data by YCharts

So, should investors buy Microsoft stock before July 30? One quarterly result isn't going to change the company's long-term trajectory, so the answer might come down to investors' time horizon. Those who are expecting a short-term gain within the next 12 months might be left disappointed because of the stock's high valuation, which could limit its upside. But as I just mentioned, those who are willing to hold it for the next few years will probably do just fine.