With so many great investments to choose from on the stock market, why would anyone ever double up on a dividend stock?

Dividends provide a boost to long-term investor returns in a couple of ways. First, investors can use a dividend reinvestment plan (DRIP) to slowly and surely buy a bigger stake in the company, which in turn leads to bigger dividend payouts. Second, companies often increase their dividends per share voluntarily.

A 2% payout might not seem like much at first. But for investors using a DRIP plan to invest in dividend-growth companies, things steadily compound and boost overall returns.

Image source: Getty Images.

Granted, doubling up on a dividend stock isn't always a good idea -- the health of the business should never be overlooked. So it's still important to be choosy here. And that's why I'm choosing Target (TGT 0.38%), Dollar General (DG 0.40%), and PepsiCo (PEP 0.24%) as three dividend stocks to double up on now.

1. Target

I don't expect much top-line growth from Target right now -- in fact, management believes sales will modestly dip in 2025 compared to 2024. Moreover, when it comes to dividend growth, Target may not impress. After all, the company raised its dividend by less than 2% in June.

NYSE: TGT

Key Data Points

Investors need to zoom out further for Target stock. The dividend yield is over 4% and has reached its highest-ever point earlier in 2025. This suggests that investors believe the dividend is unsafe. But raising its dividend -- even a small raise -- demonstrates that management is committed to it.

One should expect Target to raise its dividend, considering that's what it's done every year for over 50 years as a Dividend King.

Target's management may have ongoing confidence to raise its dividend because of an underappreciated growth component in the business. By diving deeper in advertising, allowing third-party sellers on its e-commerce platform, and launching subscription service Target Circle 360, it's building digital businesses that have better profit margins.

Other retailers have boosted profitability by doing what Target is doing right now. The sales outlook for 2025 may be uninspiring. But long term, the company has a path to grow profits and keep raising its dividend, which is why this is a dividend stock to double up on while its yield is still over 4%.

2. Dollar General

Dollar General stock resembles Target stock in that both businesses are low-growth. But investors might also be anxious about profits for this discount-retail chain. Earnings per share (EPS) plunged more than 30% in 2024. And for dividend stocks, it's never good when profits plunge.

NYSE: DG

Key Data Points

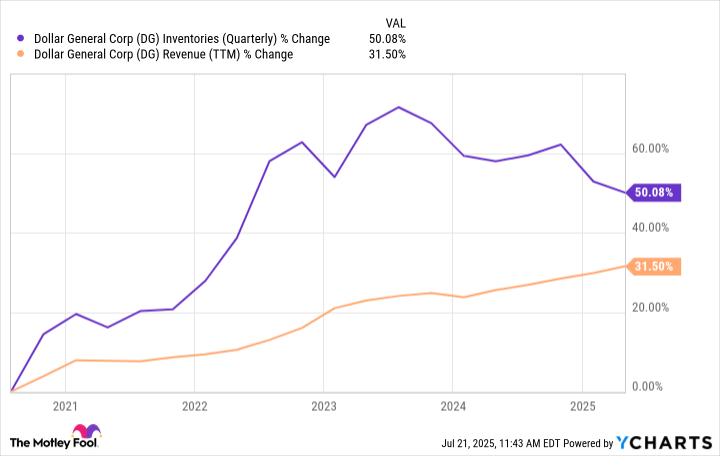

To put it simply, Dollar General's profits plunged in recent years because it had too much stuff. The chart shows that inventories increased much faster than revenue before peaking in 2023. Management has worked hard to bring it back down to better levels. But the inventory reduction came at the expense of profitability.

DG Inventories (Quarterly) data by YCharts

After a couple of rough years, Dollar General is getting back on track. For the first quarter of 2025, EPS jumped 8% year over year, and management thinks that full-year EPS could jump by double digits. And this relative improvement still has a long ways to go before the company is approaching previous levels of profitability.

Dollar General's dividend yield is above 2%, which is rare for this company. And with its earnings expected to keep rising in coming years as management works through past mistakes, there will be plenty of room for growing the dividend. That's why Dollar General is another dividend stock to double up on today.

3. PepsiCo

Finally, PepsiCo might be the safest dividend stock to double up on of these three. The stock is down about 30% from its 2023 high, and investors assume it's because consumer habits are changing. But I don't believe this prognosis is supported by the numbers.

NASDAQ: PEP

Key Data Points

Pepsi has a large portfolio of carbonated beverages, snacks, and foods. In the first half of its fiscal 2025, sales volume for beverages was flat year over year. Convenience food sales volumes was down a mere 2%. This doesn't sound like a business that's quickly going out of style -- sales volume is within spitting distance of all-time highs.

Even if consumer tastes were changing, Pepsi is an adaptable business. In carbonated beverages, it's staying in front of the trends with its recent acquisition of prebiotic soda company Poppi for $2 billion. In foods, Pepsi is also diversifying away from well-known brands such as Doritos with acquisitions such as its $1.2 billion deal for Mexican-American food company Siete Foods.

In short, being one of the biggest consumer goods companies in the world has its perks -- if tastes shift, it just buys out smaller players to ride the new trend.

Data from YCharts goes back about 35 years. Over this time, the dividend yield for Pepsi has never been over 4%. It's been over 4% in 2025 and is close to that right now. In other words, for investors who believe that this business will be resilient for years to come (as I do), then doubling up on this dividend stock while the yield is high could be a great long-term move.