Self-driving cars are quickly becoming a reality thanks to companies like Tesla and Alphabet's Waymo, but those pioneers might not be the biggest winners during the autonomous revolution.

Uber Technologies (UBER 0.46%) operates the world's largest ride-hailing network, in addition to highly successful food delivery and commercial freight platforms. It relies on 8.5 million human drivers to fulfill demand from its customers, which is its largest cost by far. Autonomous vehicles could slash that cost, which would completely transform the company's economics.

Uber is scheduled to release its operating results for the second quarter of 2025 (ended June 30) on Aug. 6. Wall Street's estimates point to strong revenue and earnings growth, but investors might be more interested in an update on the company's rapidly growing list of partnerships with autonomous vehicle providers. Is it a good idea to buy Uber stock ahead of the report?

Image source: Getty Images.

Autonomous driving could transform Uber's business

Uber reported $42.8 billion in gross bookings during the first quarter of 2025 (ended March 31), which represented the total dollar value of every ride, food order, and commercial delivery that the company facilitated for its customers. A whopping $18.6 billion of that went to the drivers operating in Uber's network, which was the company's largest cost by a country mile.

A further $12.9 billion was paid out to restaurants and other merchants for food and products customers bought through Uber, which left the company with $11.5 billion in revenue. After deducting operating costs like research and development and marketing, Uber's generally accepted accounting principles (GAAP) net profit came in at $1.7 billion.

That's right, after taking in a whopping $42.8 billion from its customers, Uber generated $11.5 billion in revenue and turned a profit of just $1.7 billion. This is why autonomous vehicles could be the greatest financial opportunity in the company's history.

In theory, if Uber eliminated human drivers completely while charging the same amount for its services, it would have earned an extra $18.6 billion in revenue during the first quarter of 2025 -- and a lot of that money would have flowed to the bottom line as profit.

That scenario isn't entirely realistic, because the company would have to pay a percentage of each trip to its partners that deploy their autonomous vehicles in its network. Plus, self-driving cars will probably lead to lower prices, which will reduce the amount of revenue Uber generates per ride. However, autonomous vehicles can also operate around the clock, so there is an opportunity to service a much bigger market by offering 24/7 availability.

Look for an update on Uber's autonomous business on Aug. 6

According to Uber's guidance, its gross bookings came in somewhere between $45.7 billion and $47.2 billion during the second quarter of 2025, which would represent year-over-year growth of 18% at the midpoint of the range. Wall Street's consensus estimate (provided by Yahoo! Finance) suggests that translated to $12.5 billion in revenue, representing 16.4% growth.

The Street is also looking for another profitable quarter, with Uber's earnings expected to soar by 34% year over year to $0.63 per share. In other words, Uber's upcoming report on Aug. 6 is likely to reveal another great set of results.

However, investors might be more eager for an update on the company's autonomous driving business. In his prepared remarks to shareholders for the first quarter, CEO Dara Khosrowshahi said Uber had partnerships with 18 different providers of self-driving vehicles, which was up from 14 just six months earlier. Providers want access to the largest pool of potential customers, and since Uber's ride-hailing platform is the biggest in the world with 170 million monthly active users, it's their preferred destination.

Waymo is one of Uber's top partners. It's already completing over 250,000 paid autonomous ride-hailing trips every week across five U.S. cities. It uses a combination of its own ride-hailing network and Uber's network, except in Austin and Atlanta, where its autonomous service is available exclusively through Uber.

Uber also has a budding partnership with Serve Robotics, which is in the process of deploying 2,000 of its new autonomous sidewalk robots to deliver food orders to customers through Uber Eats.

As of the first quarter, Khosrowshahi said Uber's network was completing 1.5 million annualized autonomous trips and deliveries. Investors should look for an updated number on Aug. 6, and they should also keep an eye out for any new partnerships in this space.

Should you buy Uber stock before Aug. 6?

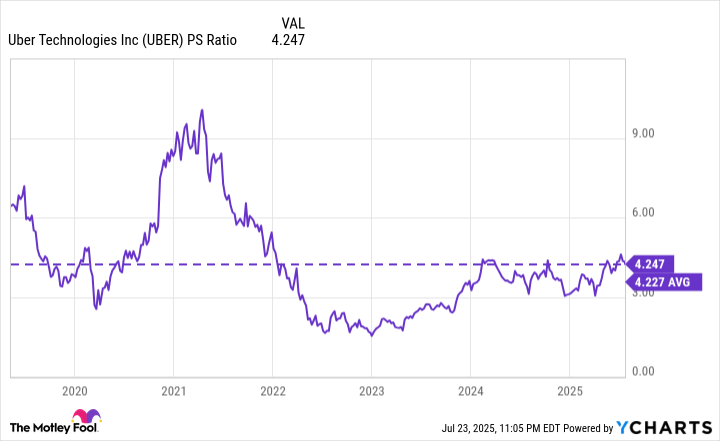

Uber stock has soared by 42% this year already, and it's currently trading near a record high. Nevertheless, its price-to-sales (P/S) ratio is just 4.2, which is in line with its 10-year average, so the stock isn't expensive. It's basically sitting at fair value.

UBER PS Ratio data by YCharts

Everybody loves a bargain, but based on Uber's potential to deliver accelerating revenue growth in the future thanks to autonomous vehicles, I would argue there's nothing wrong with paying fair value for its stock right now.

One single quarter probably won't change the company's positive long-term trajectory, but there is a chance its stock will rally if management delivers an exciting update on the autonomous business. Therefore, buying it ahead of Aug. 6 might be a good idea, especially for investors who are willing to hold onto it for the next few years while this next phase of Uber's growth story unfolds.