One of the hotter market segments to invest in this year -- besides artificial intelligence (AI), of course -- has been cryptocurrency. As of the closing bell on July 28, both Bitcoin and Ethereum boasted higher returns this year compared to the S&P 500 (^GSPC +0.64%) and Nasdaq Composite (^IXIC +0.52%).

One player that has trounced Bitcoin, Ethereum, and the broader stock market is none other than Ripple's XRP (XRP 1.61%), which is designed be cheaper and faster than existing technology used in cross-border financial transactions. As of this writing (July 28), XRP boasts a 35% return so far this year.

But with the token trading for less than $5, could more upside be in store? Read on to find out.

CRYPTO: XRP

Key Data Points

XRP has a lot going for it

I think there are a few factors fueling XRP's gain this year.

First, XRP's issuer, Ripple, had been tied up in a messy lawsuit with the Securities and Exchange Commission (SEC) for years. However, recent court rulings have gone in favor of Ripple and, in turn, removed much of the uncertainty that depressed XRP's price.

In addition, Capitol Hill has introduced a number of crypto bills in hopes of paving the way for a more standardized regulatory framework. I think this legislation has been welcomed by crypto enthusiasts who expect that it will help pave the way for clearer structure in an otherwise volatile industry.

Lastly, I think the market is speculating that the introduction of spot XRP exchange-traded funds (ETFs) could be another catalyst sparking interest in the token -- much in the way that spot Bitcoin ETFs spurred new interest from institutional investors.

Image source: Getty Images.

So why is it so "cheap"?

XRP might look like an outright bargain at just $3.13. But smart investors understand that an asset cannot be valued solely through the lens of its share price or price per token. To get a more accurate sense of XRP's value, consider that its market capitalization currently hovers around $186 billion.

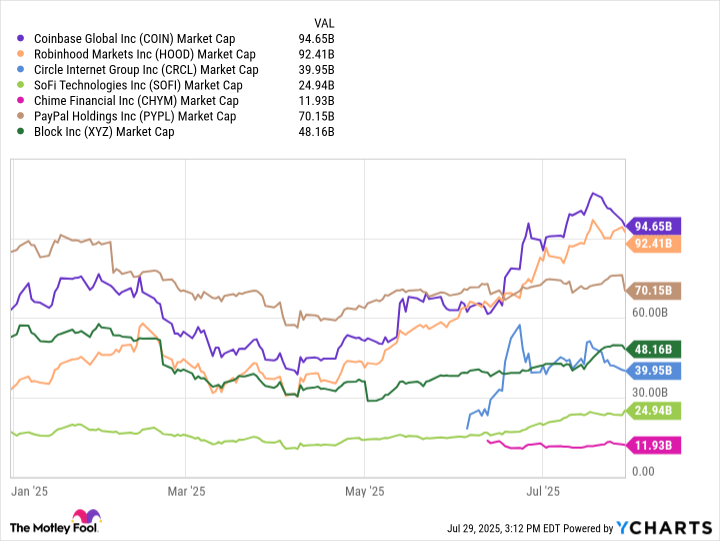

COIN Market Cap data by YCharts.

Looked at another way, XRP's market value is about double that of Coinbase and Robinhood Markets. Moreover, it's several times larger than established fintech darlings such as SoFi Technologies, Chime, PayPal, and Block.

The important nuance to call out here is that XRP might appear cheap given its $3.13 price tag, but the company's underlying valuation suggests otherwise.

Is XRP a buy right now?

I think the discrepancy between XRP's valuation and those of the fintech stocks above boils down to how investors perceive the competitive landscape.

For example, PayPal and Block are more mature businesses compared to their cohorts. For this reason, growth investors may see these companies as less innovative and discount these stocks due to their perceived upside relative to other players in the space.

Meanwhile, Coinbase and Robinhood are competing fiercely when it comes to trading, brokerage services, and cryptocurrency investing. Neobanks such as SoFi and Chime are essentially fighting for the same customer demographics in the digital banking arena.

These views have led to a perception that many fintech and crypto stocks offer commoditized services and are less attractive compared to other disruptive opportunities such as XRP. I think this view is misguided, though.

XRP also faces competition from the likes of Stellar and, of course, the existing financial industry payments networks. Furthermore, it's important for investors to understand that wider adoption of Ripple's payments infrastructure does not necessarily correlate to broader usage of the XRP token.

In my eyes, a lot of the good news surrounding Ripple -- and by extension, XRP -- is already priced in. From a risk-reward perspective, I think buying XRP at its current price point carries limited upside for the time being. I would pass on XRP at its current valuation, as I continue to view the cryptocurrency as a speculative opportunity relative to other players in the payments infrastructure market.