Nvidia (NVDA 3.18%) stock has soared by 1,100% since the beginning of 2023, which is when the artificial intelligence (AI) revolution really started to gather momentum. It's now the largest company in the entire world thanks to its market capitalization of $4.3 trillion, but I think its stock still has room for upside.

Nvidia supplies the world's most powerful graphics processing units (GPUs) for data centers, which have become the gold standard for AI development. Tech giants like Alphabet and Meta Platforms recently told shareholders they plan to spend more on AI data center infrastructure this year than originally anticipated, and they are among the chipmaker's largest customers.

Nvidia is scheduled to release its financial results for its fiscal 2026 second quarter (ended July 30) on Aug. 27. Here's why I think the report could be a catalyst for more upside in its stock.

Image source: Nvidia.

AI infrastructure spending continues to climb

Nvidia's H100 GPU was the hottest data center chip for AI training and AI inference workloads in 2023, when large language models (LLMs) started going mainstream. Those LLMs were great at delivering one-shot responses, which created a fast and convenient way for users to find information, but they were sometimes inaccurate.

The latest generation of AI models focuses on "reasoning," which means they spend more time operating in the background to weed out errors before rendering responses. According to Nvidia CEO Jensen Huang, these models consume up to 1,000 times more tokens (words, symbols, and punctuation) than the old one-shot LLMs, so they require substantially more computing capacity.

Nvidia developed the Blackwell and Blackwell Ultra GPU architectures to deliver that capacity. Blackwell Ultra GPUs like the GB300 offer up to 50 times more performance than the H100 in certain configurations, and these chips were forecast to start shipping in the second half of calendar year 2025. Since Nvidia's fiscal Q2 2026 included July, investors should expect a sales update in the company's upcoming earnings report on Aug. 27.

All signs point to astronomical demand, because many of Nvidia's largest customers continue to ramp up their data center infrastructure spending. Alphabet, for instance, just raised its 2025 capital expenditures (capex) forecast from $75 billion to $85 billion. Meta Platforms also increased the low end of its capex guidance from $64 billion to $66 billion, but the company says it could spend up to $72 billion.

Amazon, on the other hand, allocated $55.7 billion to capex during the first two quarters of 2025, and its guidance suggests that its full-year spending could top a whopping $118 billion. Most of that will go toward AI data center infrastructure and chips.

NASDAQ: NVDA

Key Data Points

Nvidia's upcoming report could be another blockbuster

Nvidia's guidance suggests that its total revenue came in at around $45 billion in Q2 of fiscal 2026, which would be a 50% increase from the year-ago period. If previous quarters are any indication, the data center segment likely represented around 90% of total revenue, led by GPU sales.

Wall Street's consensus estimate (provided by Yahoo! Finance) suggests that the company also delivered earnings of around $1 per share during the quarter, which would be a 47% jump year over year. This number can influence Nvidia's valuation, and hence the direction of its stock, so it's an important one for investors to watch.

Wall Street will also focus on management's forecast for the upcoming fiscal 2026 third quarter, because it's likely to reflect demand for the new Blackwell Ultra GPUs. Analysts will be looking for revenue guidance of around $52 billion, so any number above that could be very bullish for Nvidia stock.

Nvidia stock could soar after Aug. 27

Nvidia reported its financial results for the first quarter of fiscal 2026 on May 28, and its stock is up 33% since then. I think the Q2 report on Aug. 27 will be another upside catalyst, as long as the company's results don't fall short of expectations.

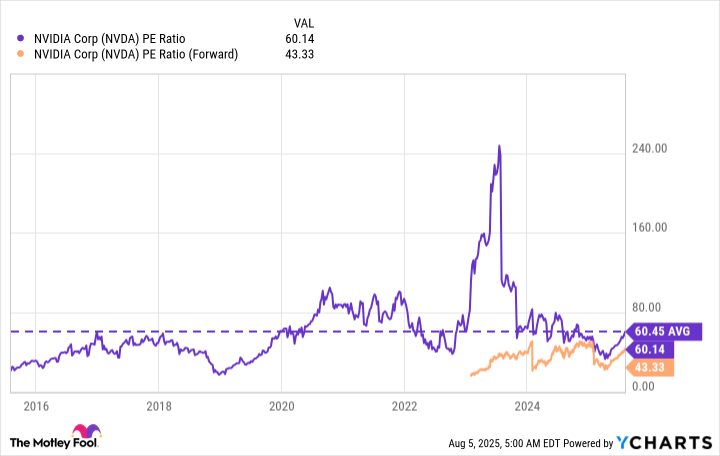

Nvidia stock is trading at a price-to-earnings (P/E) ratio of 60.1 as of this writing. That's right in line with its 10-year average, suggesting it's at fair value. However, the picture looks very different if we value the stock based on the company's future potential earnings.

Wall Street predicts that Nvidia will deliver earnings of $4.30 per share during fiscal 2026 overall, which places its stock at a forward P/E ratio of just 43. In other words, the stock would have to climb by 40% over the next six months just to maintain its current P/E ratio of 60.1.

NVDA PE Ratio data by YCharts.

Since so many of Nvidia's top customers have increased their capex forecasts for this year, I think the company will easily meet expectations on Aug. 27, and potentially even exceed them. Either of those scenarios will lay the groundwork for more upside in its stock from here.