Over the past three years, nothing has garnered more attention on Wall Street than the rise of artificial intelligence (AI). Empowering software and systems with AI to make split-second decisions without the need for human oversight is a multitrillion-dollar global opportunity.

While a long list of companies has benefited from the evolution of AI, Nvidia (NVDA +7.59%) currently finds itself atop the pedestal. It's added $4 trillion in market value since the end of 2022, with its graphics processing units (GPUs) acting as the "brains" powering decision-making in AI-accelerated data centers.

Image source: Nvidia.

Perhaps nothing is more important to Wall Street and investors than being able to dive into Nvidia's quarterly operating results, which are due after the closing bell today, Aug. 27.

Although Wall Street's largest publicly traded company has made it a habit of handily outpacing consensus revenue and earnings per share (EPS) estimates from analysts, there's a less-talked-about metric that'll ultimately determine if Nvidia's fiscal second-quarter operating results are incredible or terrible news.

The stage is set for Nvidia to shine

When Nvidia lifts the proverbial hood just hours from now, Wall Street will be looking for the company to have generated $46 billion in second-quarter sales for fiscal 2026 (its fiscal year ends in late January), and deliver $1.01 per share in EPS. Nvidia has surpassed consensus EPS projections by $0.04 to $0.06 in each of the previous four quarters.

Beyond these headline numbers, there are other figures and timelines investors will be focusing on.

For example, the Donald Trump administration somewhat recently gave Nvidia the green light to export its H20 chip to China, the world's No. 2 economy by gross domestic product. During the final two years and change of the Joe Biden administration, and Trump's first six months in office for his second term, the export of high-powered AI-GPUs and related equipment to China was restricted. With these exports now back on the table, investors will be keen to see how this impacts the company's full-year sales guidance.

NASDAQ: NVDA

Key Data Points

Additionally, CEO Jensen Huang's innovation timeline is bound to come into focus. Huang has stated his intent to bring a new AI-advanced chip to market on an annual basis. Investors should expect updates on the ramp up of Blackwell Ultra shipments in the latter-half of 2025, as well as development projections for Vera Rubin and Vera Rubin Ultra, which are believed to be coming to market by 2026 and 2027, respectively. Both will be operating on the all-new Vera processor.

Huang's conference call commentary is also known for highlighting newly developed partnerships and collaborations, as well as those currently in the works. For instance, Huang has built a close-knit relationship with the world's largest chip fabrication company Taiwan Semiconductor Manufacturing (commonly known as "TSMC"), whose packaging technology of high-bandwidth memory is a necessity for AI-accelerated data centers. Nvidia would love to increase production of new/existing AI chips to China, and working closely with TSMC can make that happen.

While the stage would appear to be set for Nvidia to thrive, there's another metric that stands head-and-shoulders above Blackwell Ultra updates, recent partnerships, and even fiscal 2026 full-year sales guidance.

Image source: Getty Images.

It's time to shine a light on gross margin

The one metric that has the potential to make or break Nvidia is its generally accepted accounting principles (GAAP) gross margin guidance.

Nvidia's GAAP gross margin has soared thanks to the AI revolution. After hovering in the low-to-mid 60% range, its gross margin catapulted to a peak of 78.4% during the first quarter of fiscal 2025. This spike is a direct reflection of demand for its Hopper chip handily outstripping supply, which allowed Nvidia to charge a hearty premium of 100% to 300% per chip, relative to its peers.

This premium pricing power is probably one of the main reasons Jensen Huang wants to bring a new AI-GPU to market on an annual basis. Being able to maintain his company's compute edge should, on paper, afford Nvidia a reason to charge a premium for its hardware.

But a solid argument can be made that AI-GPU scarcity has been the primary driver of Nvidia's soaring gross margin. A lack of available product has potentially mattered much more than Nvidia boasting superior data-center GPUs.

What puts the company's gross margin forecast squarely in the spotlight is the undeniable ramp in external and internal competition Nvidia is now contending with.

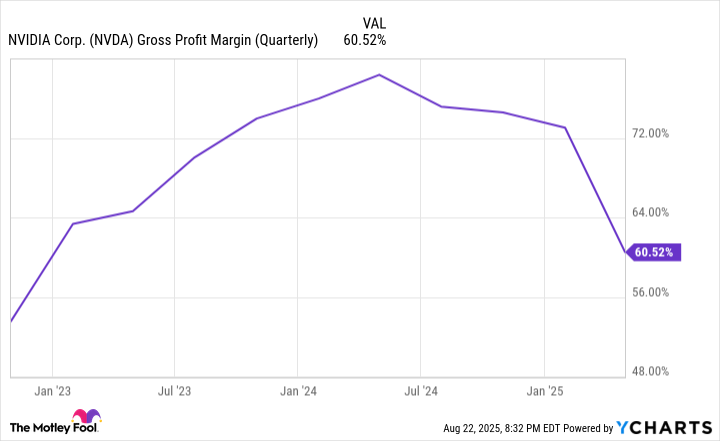

Nvidia's GAAP gross margin has declined for four consecutive quarters. NVDA Gross Profit Margin (Quarterly) data by YCharts.

Most investors are closely following the development and production ramp of Advanced Micro Devices Instinct series AI-accelerating chips, as well as the rollout of China-based Huawei's AI solutions. However, the greatest threat to Nvidia's gross margin possibly comes from within.

Many of Nvidia's top customers by net sales are members of the "Magnificent Seven." Industry-leading businesses with boatloads of cash flow and mammoth data center needs are spending big bucks on Hopper and Blackwell chips. The problem is these same businesses are also internally developing AI-GPUs for use in their data centers. Though they're not an external threat to Hopper or Blackwell, they're less costly, more readily available, and poised to take up valuable data center real estate.

There's also the unknown of whether Huang's aggressive innovation cycle will ultimately end up hurting his company. Bringing advanced chips to market every 12 months threatens to rapidly depreciate the value of prior-generation AI-GPUs, such as Hopper. This could encourage businesses to delay upgrade cycles and/or opt for less costly but still very effective prior-generation AI-GPUs. Both decisions would be detrimental to Nvidia's GAAP gross margin.

All of these fears may be playing out before our very eyes. Excluding the steep drop-off in gross margin during the previous quarter, which was related to a charge on H20 chips for China, the company's GAAP gross margin has fallen for four consecutive quarters.

Nvidia's GAAP gross margin will clue Wall Street and investors into whether AI-GPU scarcity still persists, and if the company has maintained, or expects to retain, its premium pricing power. It's the premier operating metric to home in on after the closing bell.