Intel (INTC +2.41%) has suddenly become one of the hottest stocks to own of 2025. Its year-to-date return was a staggering 77% as of the end of last week. Investors have been seeing plenty of reasons to take a chance on the stock despite its lackluster financials.

The U.S. government took a 10% stake in the business and leading chipmaker Nvidia (NVDA 3.73%) has also announced it will invest $5 billion into the company. Is this a clear sign that Intel is a safe stock to own again, and that it could be due for an even greater rally?

Image source: Getty Images.

How important is the Nvidia investment?

The timing of the Nvidia investment is intriguing, since the news comes after the government recently announced it was taking a 10% stake in Intel. Nvidia's CEO Jensen Huang has been fairly close with the U.S. government as the two sides brokered a deal where the chipmaker would be able to sell its chips to China in exchange for a 15% cut going to the government. This recent move may have been as part of a way for Nvidia to win more favor from the government, which has been pushing hard for more chip production in the U.S.

For Intel, getting an influx of cash is important as the company's free cash flow over the trailing 12 months has been negative, totaling a loss of $10.9 billion. While the companies will work together, a key detail that's noteworthy is that Intel's foundry will not be making chips for Nvidia. And it's Intel's foundry business that has been struggling mightily to show that it can win over big customers and be a major growth driver for Intel in the future. Huang says he's still evaluating the foundry and the lack of firm commitment may be the most telling piece of this investment.

Although a $5 billion investment may be significant, for a company of Nvidia's size, which has generated $87 billion in profit over the past 12 months, it's by no means an investment that will make or break its operations.

NASDAQ: NVDA

Key Data Points

Investors shouldn't ignore Intel's worrisome fundamentals

Obtaining an investment from Nvidia may sound great at first glance, but without a commitment to its foundry, there are still some significant doubts about Intel's long-term success. Consider just how unimpressive the company's results have been in recent years.

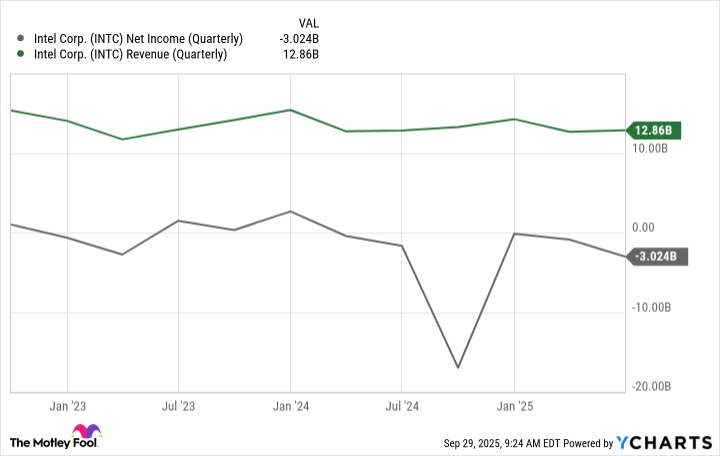

INTC Net Income (Quarterly) data by YCharts

There has been limited growth for Intel and its bottom line has frequently been in the red or just barely above breaking even. The big overarching question is whether Intel's foundry business can truly be successful and make quality, high-performing chips in the U.S. and be able to compete effectively against Taiwan Semiconductor Manufacturing, which utilizes a labor market where wages are far lower than in the U.S.

For now, Intel still has a lot to prove.

NASDAQ: INTC

Key Data Points

Why Intel's rally may not last

The market has a way of overreacting to news in the short term. And over a longer period, things usually calm down. That's what I think may end up happening with Intel's stock. News of the U.S. government and Nvidia investing in the business may sound promising at first, but that doesn't mean that Intel is suddenly on a path to profitability or that it has become a less risky buy overnight.

At the end of the day, what matters is how the business is actually performing, not who has invested in it. A company like Nvidia can afford to make a $5 billion investment into Intel and not lose sleep over it because its profits are so massive. But for the average investor, even putting a few thousand dollars into this tech stock may not be a great idea given the significant uncertainty around Intel's operations. Given all the question marks around Intel's future, a wait-and-see approach may be the best one to take with the stock right now.