Shares of quantum computing company Rigetti Computing (RGTI +2.53%) soared more than 10% in early trading Tuesday -- then gave almost all of it back. By 11:15 a.m. ET, Rigetti stock was up only about 0.5%.

This morning's Rigetti roller-coaster ride comes to you courtesy of the friendly analysts at Benchmark.

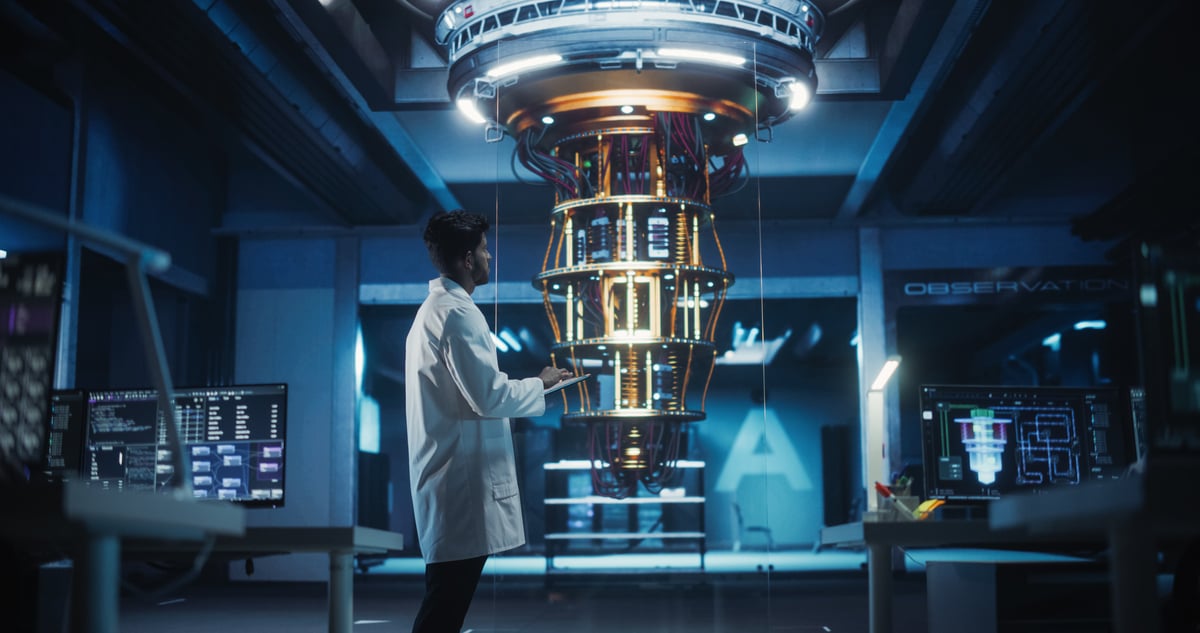

Image source: Getty Images.

What is Rigetti Computing?

Rigetti calls itself "a pioneer in full-stack quantum computing ... selling on-premises quantum computing systems with qubit counts between 24 and 84 qubits, supporting national laboratories and quantum computing centers." This technology may be new, it may sound a bit out there, but it is winning adoption and scaling up rapidly.

As analyst David Williams explains in a note covered on TheFly.com, Rigetti boasts "substantial capital inflows, an expanding ecosystem, and growing validation from 'established technology leaders.'" In demonstration of this, Rigetti last week announced $5.7 million in sales for two 9-qubit Novera quantum computing systems, an amount equal to about 72% of the sales the company made in all of last year -- secured in a single day.

Impressed by the sale, and impressed by Rigetti's prospects, Williams went on to more than double his price target on Rigetti stock -- to $50 a share.

NASDAQ: RGTI

Key Data Points

Is Rigetti stock a buy?

Commenting on last week's sale, Rigetti CEO Dr. Subodh Kulkarni confirms he's seeing "increased demand for on-premises quantum computing systems as the industry matures." That said, investors chasing the Rigetti momentum need to be aware they're investing primarily in far-off hopes and dreams.

Rigetti is priced at more than 1,100 times sales already, with no profits, and no analysts currently predict Rigetti turning profitable ever. This stock could still pay off big for investors in time, but until we see some profits, Rigetti remains a risky gamble.