Investors fell in love with electric vehicle (EV) and electric battery companies in 2020 and 2021. One company that went public during that time was QuantumScape (QS 0.65%), which was trying to commercialize solid-state batteries, and hit a market cap of over $45 billion even though it had zero revenue.

Unsurprisingly, the last few years have been disappointing for QuantumScape shareholders. The stock fell over 95% from all-time highs, and is still down 88% from its peak, even though it has made a large recovery so far in 2025.

What is driving this stock price comeback? The company may finally be close to commercializing its potentially revolutionary solid-state batteries. Here's what investors need to know about QuantumScape stock today, and where the stock may end up 10 years from now.

NASDAQ: QS

Key Data Points

New battery technology

The world is slowly adopting EVs as a primary mode of transportation. One large roadblock to EV adoption is battery technology, with current batteries being expensive, heavy, range limiting, and not charging very fast, leading to customers to still adopt gasoline vehicles or hybrids instead of full battery technology.

QuantumScape aims to take the next technological leap in battery technology with solid-state batteries. Unlike lithium-ion batteries that are liquid based, a solid-state battery will be more compact, lighter, and charge faster, alleviating the pain points restricting EV adoption. This would not only create a better value proposition for customers to switch to EVs, but could create cheaper EV designs, since batteries are one of the largest input costs for vehicle manufacturers.

At least, that is what QuantumScape promises. The technology has been researched for years, but has failed to commercialize. However, in recent quarters, the company has made some potential breakthroughs on the way to commercialization.

In September, it actually made the first real-life demonstration of solid-state batteries on a Ducati motorcycle in conjunction with its partner Volkswagen Group. While the company has still not generated a lick of revenue, QuantumScape stock has more than doubled in the last month after this demonstration was made.

Image source: Getty Images.

Cash runway through 2029

Before looking at whether QuantumScape stock is a buy and what the share price could return over the next 10 years, we need to make sure this pre-revenue company will not go bankrupt. The good news for any shareholder is the company has a cash runway into 2029, which was recently extended with a new $130 million funding commitment from its partner Volkswagen. Last quarter, the company had $800 million in total liquidity on its balance sheet, which measures how much funds it can access to keep spending on research and manufacturing development.

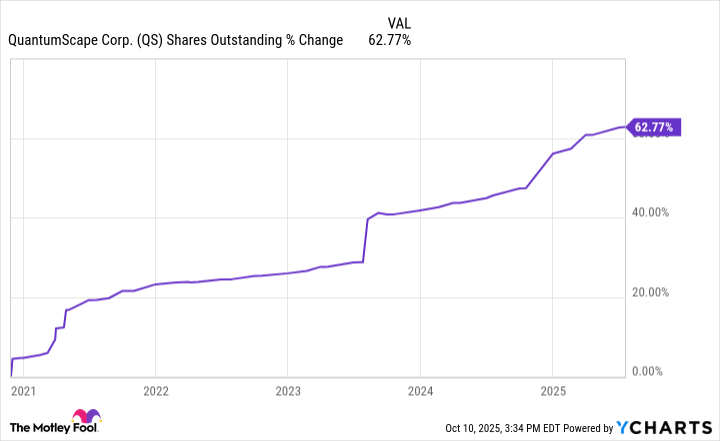

One downside of continued funding needs is shareholder dilution, which has held back QuantumScape stock and will be a further headwind in the years to come. QuantumScape's total shares outstanding are up 63% since going public. As shares outstanding go up, earnings per share (EPS) will go down, all else equal. This may not be noticeable for a company that doesn't yet generate revenue, let alone a profit, but is something long-term investors should track for QuantumScape, as it will help determine the share price performance.

QS Shares Outstanding data by YCharts

So where will QuantumScape stock be in 10 years?

When looking at a pre-revenue stock like QuantumScape, it has a wide range of potential outcomes. Today, the stock price is $14.67, and the market capitalization is approximately $8.5 billion.

If QuantumScape can become the first and only company to develop solid-state batteries, it may have a monopoly on EV manufacturing in the near future (not to mention other products that use electric batteries). Just in the United States alone, estimates say that annual spending on electric batteries will grow to $30 billion by 2032.

Globally, it is much larger, and would give QuantumScape a huge addressable market to go after. If the company can successfully commercialize the technology, it may see a stock price 10x higher than today 10 years from now.

Don't think this means QuantumScape is a slam dunk buy right now. The company is not generating any revenue, burning a lot of cash, and has not scaled up any manufacturing capabilities yet. There is a chance this stock is a zero over the next 10 years.

Taking both sides of the equation, if you want to buy QuantumScape stock, make it a small percentage of your portfolio due to the large downside risks present with this solid-state battery developer.