You might not automatically think of the words "bargain" or "dirt cheap" when considering "Magnificent Seven" stocks. That's because these are the seven tech giants that have soared in recent years, leading the S&P 500 higher in this bull market. So, you wouldn't necessarily expect these players to be inexpensive.

But two of these stocks, well-established technology giants delivering billions of dollars in earnings annually, actually are pretty cheap right now -- and they also offer bright prospects in the high-growth space of artificial intelligence (AI) today and in the years to come. I'm talking about Alphabet (GOOG 2.16%) (GOOGL 1.89%) and Meta Platforms (META 3.28%), companies well positioned to win in the AI race.

If you only could buy one of these bargain Magnificent Seven stocks right now, though, which one should you choose?

Image source: Alphabet.

The case for Alphabet

Alphabet is best known for its ownership of the Google platform, with advertising across it bringing in the lion's share of the company's revenue. This is because Google is and has been for years the dominant internet search engine, holding about 90% share of the worldwide market.

But Alphabet also has become a major player in the AI space, using its AI tools -- such as its own large language model (LLM), Gemini -- to improve its search performance and to make advertising easier and more fruitful for advertisers. This is key as it may keep these customers spending more and more on ads here and driving Alphabet's revenue higher.

NASDAQ: GOOGL

Key Data Points

Meanwhile, Alphabet is winning big in AI thanks to its Google Cloud unit, which offers a wide variety of AI products and services to customers -- and this has resulted in double-digit revenue growth for the business quarter after quarter.

Finally, one of Alphabet's biggest risks has faded, as a federal judge in a U.S. antitrust case against the company recently ruled out the worst-case scenario, a breakup of Google, offering investors one more reason to be optimistic about this tech giant.

The case for Meta Platforms

Meta Platforms, like Alphabet, probably isn't a company that automatically brings AI to mind. Instead, when you think of Meta, you may think of social media as the company owns the world's most popular apps -- from Facebook to Instagram.

And, like Alphabet, Meta generates most of its revenue through advertising -- in Meta's case, companies place ads across its social media apps to catch us where they know they'll find us. In the recent quarter, that resulted in $46 billion in revenue for Meta, so this is a big business.

NASDAQ: META

Key Data Points

But Meta isn't just a social media giant. This company has a major ambition, and that's to become an AI leader. It may be well on the way as it's invested billions of dollars in the technology, has developed its own LLM, called Llama, and aims to use AI as a tool to supercharge revenue over time.

Meta already is using AI to keep people on its apps longer through features like its AI assistant and at the same time, Meta's AI tools are improving the ad experience for advertisers. If ads are more efficient, advertisers may go all-in on advertising across Meta's apps. Finally, Meta's investment in AI research also may lead to other products and services in the future.

Better buy: Alphabet or Meta?

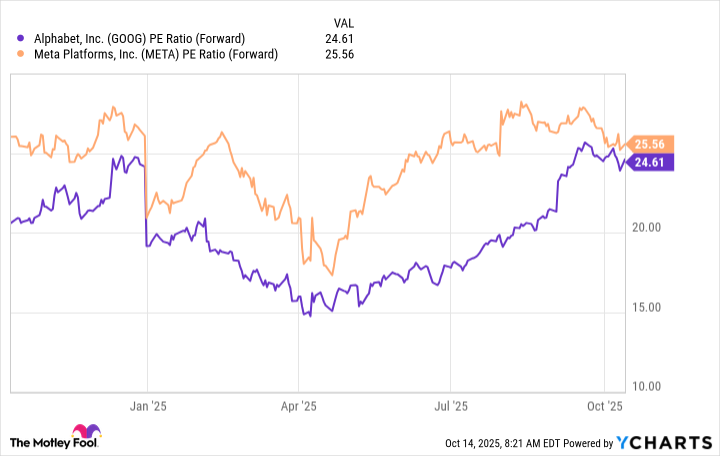

Both of these companies look like strong AI winners, so to make the choice a bit easier, let's look at valuation. Here, too, each player is reasonably priced -- we even can use the word "cheap" to describe these stocks. And their valuations, using forward P/E ratios, are almost identical.

GOOG PE Ratio (Forward) data by YCharts

So, which stock makes the better bargain Magnificent Seven buy if you only could scoop up one today? Though they both are fantastic buys, I would go for Alphabet for the following reason. Right now, one of the greatest needs of AI customers is capacity for workloads, and they are finding this at Google Cloud. I expect this unit to continue to see strong growth in the coming years as customers rush to cloud providers for various AI tasks -- from training and inferencing to the development of AI agents.

All of this means right now is a great time to get in on Alphabet, at this bargain price, and benefit from this key phase of the AI story.