Flying taxis sounds like a great business to invest in for long-term investors. And one company that could be an early leader in the electric vertical takeoff and landing (eVTOL) aircraft space is Archer Aviation (ACHR 2.96%). Its Midnight aircraft, which has room for a pilot and four passengers, may obtain approval and begin commercial operations in the United Arab Emirates by next year. The U.S. market could follow.

It can be an exciting time to invest in Archer, given the potential it possesses and it still being in its early growth days. But with a lot of hype, no revenue, and plenty of risk, is it too early to invest in the company?

Image source: Getty Images.

Archer's making progress, but its business model is still unproven

There's a lot of excitement around Archer's Midnight eVTOL and the potential for it to alleviate traffic in busy cities. Archer has partnered with United Airlines, as the two companies plan to launch air taxis services in New York City in the future. Archer is also the official air taxi provider of the Olympic Games in Los Angeles in 2028, where it'll be able to showcase its aircraft for the entire world to see.

There are clearly some intriguing opportunities for the business within the next few years. But until the company begins producing its aircraft at significant scale and generating revenue from them, it'll be difficult to determine what its margins will look like, how strong its prospects for profitability will be, and whether it will be generating positive cash flow anytime soon.

Those are all factors that are important for investors to consider, because without them, the stock can quickly become just another risky and speculative buy. If a business isn't sustainable and bringing in enough cash to fund its operations, frequent share offerings and dilution are a significant risk for investors.

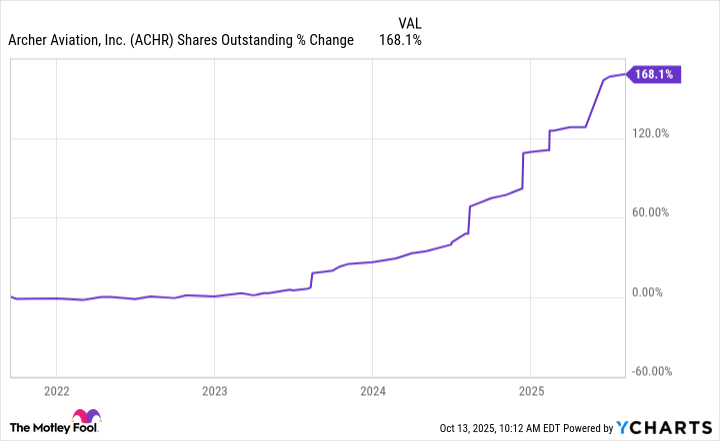

Archer's share count has risen dramatically in recent years, a trend that can very well continue in the years ahead, particularly as it ramps up production of its aircraft.

ACHR Shares Outstanding data by YCharts

Its valuation has already gotten out of hand

Another problem for investors who buy the eVTOL stock today is that its market cap is around $8 billion. That's significant when you consider that analysts at Grand View Research estimated the entire eVTOL market was worth just over $2 billion last year; Archer is around four times that size today.

The eVTOL market is growing, but the danger for Archer investors is that they are paying a premium for the stock based on where the business may be in five-plus years -- and that's under the assumptions that everything goes well in the industry and that Archer becomes a big player in it. Those are some rosy assumptions, and if they don't pan out, there's considerable downside risk for the stock.

If you're paying a high price for a stock that's dependent on ideal conditions, that can leave little-to-no margin of safety, putting your portfolio in a dangerous position.

NYSE: ACHR

Key Data Points

There's no rush to buy Archer's stock today

Archer is an intriguing stock to invest in, especially if you're bullish on the eVTOL market as a whole. And I can see why investors may be bullish on the stock right now, as its Midnight aircraft does look impressive. But you also want to be careful not to fall in love with a stock, particularly when its underlying business still has a lot to prove.

I don't see a reason to rush out and buy shares of Archer today due to its inflated valuation and the risk that comes with it. A wait-and-see approach looks to make the most sense at this stage. You may miss out on some gains if you wait, but you can also avoid incurring significant losses if its business doesn't pan out.