Over the past three years, Nvidia has evolved from a niche chip designer into the most valuable company in the world, propelled by the unprecedented boom in artificial intelligence (AI).

Its graphics processing units (GPUs), once used largely to improve the rendering of visuals in video games, now provide key computing power in applications ranging from data center training clusters to humanoid robotics to autonomous vehicles. With demand for its chips still far exceeding supply, Nvidia's dominance in the AI chip space shows little sign of slowing.

Yet, the next five years could usher in a new wave of AI computing infrastructure leaders. I predict that one company in particular -- Broadcom (AVGO +0.91%) -- could surpass the combined market value of Amazon (AMZN +0.54%) and Palantir Technologies (PLTR 0.80%) by 2030, fueled by surging demand for the networking, connectivity, and custom silicon that help underpin the AI revolution.

NASDAQ: AVGO

Key Data Points

Amazon and Palantir could plateau despite AI tailwinds

Both Amazon and Palantir are poised to benefit from the continued rise of AI. However, each faces meaningful hurdles when it comes to further valuation expansion in the medium term.

Amazon's clearest exposure the AI trend lies within Amazon Web Services (AWS) -- its crown jewel and primary profit engine. Yet AWS faces fierce competition on the enterprise side from Microsoft Azure and Google Cloud, both of which are deploying AI-powered tools at a faster clip. Meanwhile, Amazon's consumer-facing AI initiatives -- spanning robotics, logistics automation, and retail personalization -- are just getting started. It could be years before they materially boost its operating income.

In short, while Amazon's AI efforts are broad, they are unlikely to generate explosive upside anytime soon for a company that's already valued at roughly $2.3 trillion.

Palantir, on the other hand, has become synonymous with AI-driven data analytics and intelligence software. Its Artificial Intelligence Platform (AIP) -- built around its Foundry, Gotham, and Apollo operating systems -- has captured enormous attention, fueling accelerating revenue growth and sustained profitability.

However, Palantir's valuation tells a different story. Trading at a price-to-sales (P/S) multiple approaching 180, the stock carries a premium that leaves it little room for error. Investors have already priced in years of expected future success, meaning any slowdown in contract wins or government spending could lead to significant multiple compression. Between now and 2030, it seems more likely that Palantir's valuation will normalize than that it will skyrocket further.

Image source: Getty Images.

Why Broadcom could become the next AI infrastructure giant

Broadcom isn't the first name most investors associate with AI -- and that's exactly what makes it so compelling. The company sits at the intersection of the AI hardware supply chain, producing data center networking gear, custom application-specific integrated circuits (ASICs), and connectivity solutions that make hyperscale AI clusters possible.

In recent years, Broadcom has become a critical supplier to tech titans such as Amazon, Alphabet, Microsoft, Oracle, and IBM. Earlier this year, CEO Hock Tan indicated that just three of its hyperscale customers could contribute $60 billion to $90 billion in revenue by fiscal 2027 -- providing remarkable visibility into its business outlook and backlog strength. More recently, management disclosed that Broadcom had secured a new $10 billion chip contract -- though it did not disclose the customer's identity.

Together, these developments highlight a broader trend: As AI workloads evolve, demand for specialized processors beyond Nvidia's GPUs is rapidly accelerating.

At the same time, Broadcom's diversified business model provides a stabilizing counterweight. Its software division, bolstered by its 2023 acquisition of VMware, generates steady recurring revenue from enterprise cloud customers. Meanwhile, its semiconductor operations span 5G networking, broadband, Wi-Fi, and storage connectivity, giving the company multiple profit engines that are not connected to the AI trend.

This balance puts Broadcom in a position to maintain its resilience across economic cycles even as it capitalizes on the AI infrastructure boom. It should benefit enormously from the secular AI tailwinds without being overexposed to their volatility.

Valuation expansion could drive Broadcom to record highs

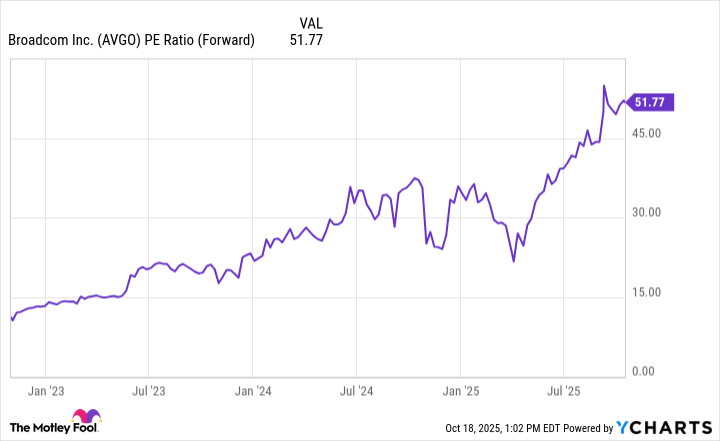

Over the past three years, Broadcom stock has delivered a staggering 700% return, handily outperforming both the S&P 500 and Nasdaq Composite. The AI revolution has been the driving force behind this ascent, propelling Broadcom into the trillion-dollar club. While its forward price-to-earnings (P/E) ratio of 51 is far from cheap, the company's growth prospects remain firmly intact.

AVGO PE Ratio (Forward) data by YCharts.

According to Wall Street estimates, AI infrastructure spending could surpass $7 trillion in the years ahead. As hyperscalers continue investing heavily into data center buildouts and custom silicon, Broadcom should benefit from both earnings growth and multiple expansion through the end of the decade.

For investors seeking AI stocks that can produce compounding gains, it may be time to look beyond the usual suspects. Broadcom might not enjoy the level of hype generated by Nvidia or the brand power of Amazon and Palantir, but it does occupy a deeply entrenched role in the AI supply chain that keeps the digital world running.