SoundHound AI (SOUN 5.23%) has witnessed a roller-coaster 2025 so far. The stock started the year on a negative note and dipped substantially in the first four months of 2025 before staging a stunning comeback in recent months.

As it turns out, SoundHound AI stock has shot up a stunning 143% in the past six months. It is now trading close to its 52-week highs, which is why investors may be wondering if it is a good idea to buy shares of this artificial intelligence (AI) company in anticipation of more upside in 2026.

Let's take a closer look at SoundHound's prospects and check if this pure-play AI company can deliver more upside next year.

Image source: Getty Images.

Analysts aren't very confident about SoundHound AI's performance in 2026

According to the 10 analysts covering SoundHound AI, the stock has a one-year median price target of $16. This price target indicates that the stock may have gotten ahead of itself following its recent rally as it points toward a potential drop of 16% from current levels.

NASDAQ: SOUN

Key Data Points

It is easy to see why the majority of the analysts aren't expecting any more upside in SoundHound AI stock. It is trading at a whopping 53 times sales right now. The U.S. technology sector, for comparison, averages 9 times sales. Clearly, SoundHound's expensive valuation is expected to weigh on the stock in the coming year, according to analysts.

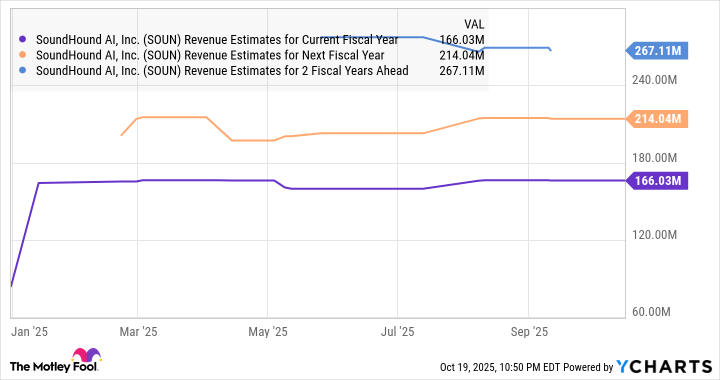

Another reason why analysts may not be very enthusiastic about SoundHound's performance going forward is that they are forecasting a slowdown in its growth in 2026 and 2027. The midpoint of the company's 2025 guidance range suggests that its top line is on track to double this year to $169 million from last year. The following chart tells us that analysts don't expect it to repeat such a terrific performance.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts

However, SoundHound has the potential to do better than analysts' expectations.

Here's why the stock can continue soaring next year

SoundHound's conversational AI platform is in solid demand from customers looking to integrate AI-powered voice solutions into their operations and offerings. This is evident from the recent partnerships that the company has announced.

Seafood restaurant chain Red Lobster, for instance, is rolling out AI-equipped phone ordering agents powered by SoundHound's technology across all of its locations. The restaurant reportedly has more than 500 locations globally. Integrating SoundHound's voice AI solutions into its ordering system will allow the company to handle large call volumes and help customers place orders seamlessly.

This is just one of the many examples of the recent partnerships that SoundHound has struck across diverse industries. From healthcare to the automotive to the hospitality industry, the company's generative AI voice solutions have been gaining impressive traction. In fact, SoundHound has been ranked as a leading vendor of conversational AI platforms globally by market research firm IDC.

The market research firm rates SoundHound's Amelia agentic voice AI platform highly, pointing out its "accurate intent recognition, even for complex requests, combined with superior voice channel capabilities." Not surprisingly, Amelia has already been adopted by nearly 30 customers for developing agentic voice AI offerings, which is impressive considering that it was launched just over five months ago.

According to one estimate, the voice AI agents market could grow by 20x between 2024 and 2034, generating over $47 billion in annual revenue at the end of the forecast period. So, this market could ensure outstanding growth for SoundHound AI in the long run considering the healthy adoption of the Amelia platform.

Moreover, SoundHound has the ability to easily outperform Wall Street's expectations in 2026 since it had a tremendous revenue backlog of $1.2 billion at the end of last year. That's big enough for the company to easily eclipse consensus estimates in 2026 and beyond. Assuming SoundHound can grow its revenue by even 50% next year to just over $253 million (which is conservative considering the jump it is expected to deliver in 2025), it will easily coast past consensus expectations.

That may be enough for the company to maintain its premium valuation. But even if it trades at a discounted 40 times sales next year, which is lower than consensus forecasts as seen below, its market cap could go just past $10 billion.

That points toward a potential jump of 30% from current levels, which would send SoundHound AI's stock price to almost $25. But don't be surprised to see bigger gains than that as this AI stock has the ability to clock stronger growth than what's assumed above, which should be enough for it to break past the $25 mark.