Duolingo (DUOL +4.75%) runs the world's most popular digital language education platform, and its stock was up by as much as 65% earlier this year as investors rewarded the company's spectacular revenue and earnings growth.

However, the stock reached a very expensive valuation that wasn't sustainable, so it has since declined by 42% from its May peak of around $540. But this might be the buying opportunity investors have been waiting for, because Duolingo's education platform looks set to continue delivering strong growth with the help of an expanding portfolio of artificial intelligence (AI)-powered features.

The company is scheduled to release its operating results for the third quarter of 2025 (ended Sept. 30) on Nov. 5. Here's why investors might want to buy the stock ahead of the report.

Image source: Getty Images.

AI is transforming the learning experience

Duolingo is popular for its interactive and gamified learning experience, which it primarily delivers through its mobile application. The platform takes education out of the formal classroom setting and places it at the fingertips of anyone with a smartphone, enabling it to reach a much wider audience.

Duolingo had 128 million monthly active users in the second quarter of 2025 (ended June 30), which was up 24% from the year-ago period. The company makes money by showing ads to its free users, but it also offers paid subscriptions to users who want to accelerate their learning with additional features. The platform had 10.9 million paying subscribers in the second quarter, which was up 37% year over year.

Duolingo Max is the platform's most expensive subscription tier. Its main selling point is its expanding list of AI features, like Roleplay, which uses a chatbot interface to help users practice their conversational skills in a language of their choice, and Explain My Answer, which offers personalized feedback after each lesson. Last year, Duolingo also launched a new tool called Video Call, which uses an AI-powered digital avatar named Lily to help Max subscribers practice their speaking skills.

The Max subscription tier brings Duolingo one step closer to its long-term goal of creating a digital learning experience that rivals a human tutor. Max subscribers represented 8% of the platform's total subscriber base at the end of the second quarter, but that figure is growing, and it's something investors should watch when the company releases its third-quarter report on Nov. 5.

NASDAQ: DUOL

Key Data Points

Duolingo is generating rapid growth at the top and bottom line

Duolingo's revenue came in at $252.3 million during the second quarter. It grew by 41% from the year-ago period, which marked an acceleration from the 38% growth the company delivered in the first quarter just three months earlier.

The high-end of management's guidance suggests revenue grew by around 35.5% to $261 million in the third quarter, but Duolingo has a habit of beating its own expectations. In the second quarter, for example, its revenue cleared the top end of management's forecasted range by almost $11 million.

In fact, the strong Q2 result prompted management to raise its 2025 revenue guidance for the second time this year, to over $1 billion. It would be the first time in Duolingo's history that its annual revenue crosses the billion-dollar milestone.

Turning to the bottom line, Duolingo generated $44.8 million in net income on a generally accepted accounting principles (GAAP) basis during Q2, which was up by an eye-popping 84%. This figure could influence the direction of Duolingo stock (more on this in a moment), so another blistering result on Nov. 5 would be very bullish.

Duolingo's valuation has declined to a more reasonable level

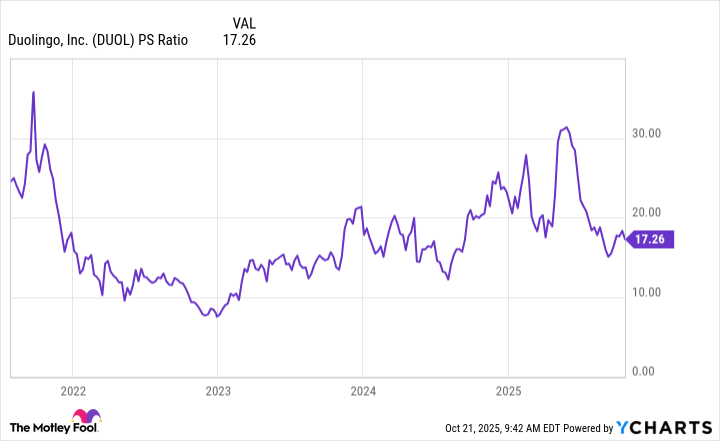

Duolingo's price-to-sales (P/S) ratio soared to above 30 back in May, which was simply unsustainable. But the 42% decline in its stock since then has pushed its P/S ratio down to 17.1, which isn't necessarily cheap, but it's far more reasonable considering the company's rapid revenue growth.

DUOL PS Ratio data by YCharts

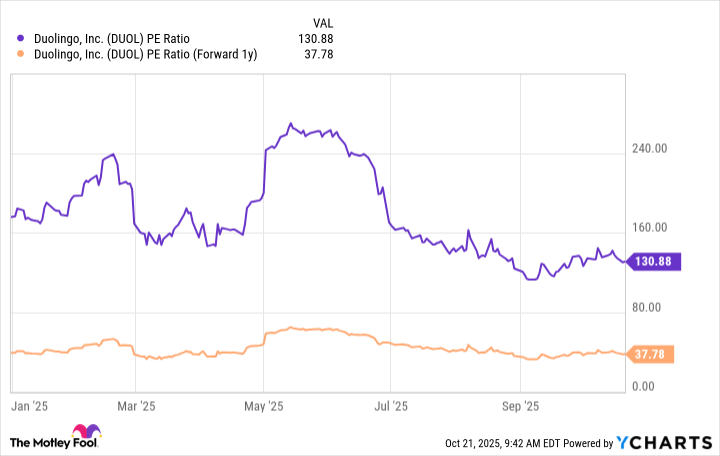

A similar trend is unfolding if we measure Duolingo's valuation using its earnings (profits). Its price-to-earnings (P/E) ratio was over 250 a few months ago, making the stock 10 times more expensive than the S&P 500, which trades at a P/E ratio of around 25. It remains quite high at 130 as I write this, but the company's profits are growing so fast that its valuation is actually attractive when we look just one year into the future.

Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Duolingo's earnings per share (EPS) will grow to $8.34 in 2026, placing the stock at a forward P/E ratio of just 37.

DUOL PE Ratio data by YCharts

As a result, investors who have been waiting to buy this growth stock might have a great opportunity now that it's down 42% from its record high.