Buying artificial intelligence (AI) stocks that are both profitable and undervalued may seem like a long shot right now. That's because many companies that are capitalizing on the AI boom are either too expensive or have yet to make a profit because of their heavy investments into this space, or both.

That's why Micron Technology (MU +0.93%) looks like an outlier in the universe of AI stocks. Shares of the chipmaker have shot up a remarkable 140% in 2025 as of this writing. Even then, it trades at a substantial discount when compared to other technology and AI stocks. Micron's attractive valuation along with its ability to sustain the impressive growth in its revenue and profits is likely to pave the way for more upside in this semiconductor stock.

Let's see why that's the case.

Image source: Micron Technology.

Micron is set to win big from secular growth in memory chip demand

Micron is coming off a solid fiscal performance that explains its red-hot rally in 2025. The company's revenue in the recently concluded fiscal 2025 (which ended on Aug. 28) was up by 49% from the previous year to $37.4 billion. Meanwhile, the improving pricing environment in the memory chip industry led to a sharp improvement in Micron's bottom line.

NASDAQ: MU

Key Data Points

Its non-GAAP (adjusted) earnings per share increased to $8.29 per share in fiscal 2025 from $1.30 per share in the prior year. Micron's operating income margin jumped by almost 4x last fiscal year as the tight supply and healthy demand for high-bandwidth memory (HBM) chips deployed in AI servers boosted prices. However, a recent development may lead investors to wonder if the favorable memory pricing environment can continue.

A Reuters exclusive report says that Micron is planning to stop selling its AI server memory chips to Chinese customers. The chipmaker was banned by Beijing in 2023 from selling memory products that power crucial infrastructure in the country, which explains its eventual exit from conducting data center business in that country.

Micron generated just $2.6 billion in revenue from mainland China in the previous fiscal year, which was 7% of its top line. It is worth noting that it will continue to sell its data center memory chips to Chinese customers who have established their operations outside the country, including Lenovo. Micron will also sell memory chips deployed in automotive, smartphone, and personal computer (PC) applications in China.

Meanwhile, the company plans to direct the data center memory capacity that will be freed up after shutting its data center business in China toward other markets. Investors will do well to note that Micron management pointed out on its previous earnings conference call that it expects "to conclude agreements to sell out the remainder of our total HBM calendar 2026 supply in the coming months."

It shouldn't be difficult for Micron to find customers for its HBM chips. That's because this type of memory is being increasingly deployed in both graphics processing units (GPUs) and custom AI processors to handle AI workloads in the cloud. Goldman Sachs is predicting a 23% increase in GPU-related HBM demand next year, along with a much bigger increase of 82% from custom AI processors.

Micron's cloud memory business unit (CMBU), which accounts for sales of HBM, saw a 3.5x jump in revenue in the previous fiscal year to $13.5 billion. Given that the demand for HBM is growing at a faster pace than supply, Micron is looking to expand its manufacturing capacity. In all, it shouldn't be too difficult for the company to overcome the minor setback in China.

Investors should note that HBM is likely to remain in robust demand in the long run as well considering that a whopping $4 trillion could be spent on AI infrastructure by the end of the decade. Companies such as Nvidia, Broadcom, and AMD have been receiving sizable orders to deploy their chips in AI data centers, and all of them rely on Micron for HBM.

Micron management says that it now has six customers for HBM chips. So, there is a good chance that it supplies this type of memory to all the leading AI chipmakers. That's likely to ensure that the impressive growth in Micron's earnings continues.

Micron's earnings growth potential and valuation point toward more upside

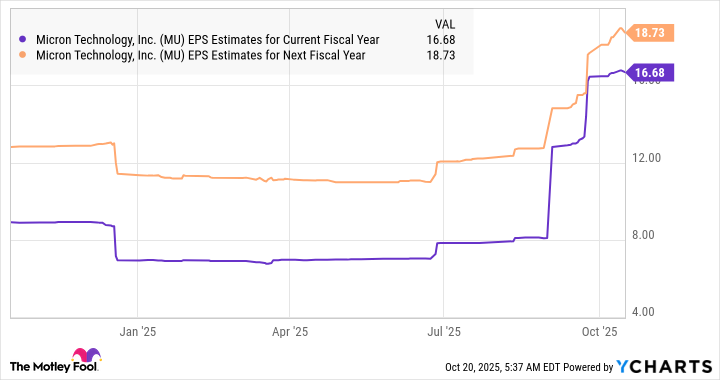

We have already seen that Micron's earnings grew at a blistering pace last year. The good part is that analysts are expecting its outstanding growth to continue in the current fiscal year as well, followed by another double-digit jump in the next one.

MU EPS Estimates for Current Fiscal Year data by YCharts

The chart above tells us that Micron's bottom line could double in fiscal 2026. Given that Micron is trading at just 24 times trailing earnings right now, investors can get their hands on this AI stock at an attractive valuation. After all, Micron is cheaper than the tech-laden Nasdaq-100 index's trailing earnings multiple of 33 (using the index as a proxy for tech stocks).

It won't be surprising to see Micron enjoying a premium valuation after a year on account of its remarkable earnings growth. Assuming that the stock trades in line with the index after a year and indeed hits $16.68 per share in earnings, its price could hit $550. That would translate into potential gains of 170% from current levels, giving investors a solid reason to buy it before it skyrockets further.