Netflix (NFLX 1.45%) operates the world's largest streaming platform for television shows and movies, and it's cementing its dominance by consistently outspending the competition when it comes to creating and licensing content.

The company released its operating results for the third quarter of 2025 (ended Sept. 30) last week, and its earnings missed Wall Street's expectations due to an unforeseen, one-off tax issue. The report triggered a sell-off in Netflix stock, and it's now trading 18% below its record high from earlier this year. Could this be the ultimate opportunity for investors to buy a slice of the streaming giant ahead of 2026, or is there more downside on the horizon?

Image source: Netflix.

Netflix just delivered the fastest revenue growth in four years

Netflix no longer reports its subscriber numbers, but with more than 300 million members at the end of 2024, it remains comfortably ahead of its largest streaming competitors like Amazon Prime and Disney's Disney+. But keeping the top spot isn't a guarantee, so Netflix continues to experiment with innovative ways to attract new members.

The company's advertising subscription tier is one of its most successful growth initiatives to date. It's priced at just $7.99 per month, so it's much cheaper than the Standard ($17.99 per month) and Premium ($24.99 per month) tiers. The difference is made up by selling advertising slots to businesses. In previous quarters, management has said the ad-supported tier routinely accounts for more than half of all new signups in countries where it's available.

Plus, each member becomes more valuable over time, because Netflix can charge more for ads as the subscriber base grows. In fact, the company's advertising revenue doubled in 2024, and it's on track to more than double again in 2025.

Therefore, it has been a key driver of Netflix's strong financial results over the last couple of years. On that note, the company generated a record $11.5 billion in revenue during the third quarter of 2025, which was up 17.2% from the year-ago period. It was the fastest growth rate in four years (since the second quarter of 2021).

However, Netflix disappointed Wall Street at the bottom line. The company generated earnings of $5.87 per share during the quarter, but analysts were looking for $6.97. Management attributed the miss to a one-off, unexpected tax dispute with the Brazilian government, so it wasn't due to its streaming business underperforming.

NASDAQ: NFLX

Key Data Points

Netflix is betting big on live content

Despite Netflix's disappointing result at the bottom line in the third quarter, it remains one of the few pure-play streaming providers generating consistent profits. The company has generated a whopping $10.4 billion in net income over the last four quarters alone, which enables it to spend more than its competitors on content, thus solidifying its advantage.

According to management's guidance, Netflix could spend around $18 billion on new shows and movies this year, and live events account for a growing portion of that investment. Live sports in particular are a huge draw for new members, and the company's ventures in areas like boxing and the National Football League (NFL) have been very successful so far.

In September, Netflix exclusively live-streamed the Canelo Álvarez vs. Terence Crawford boxing match, which became the most-watched fight of the century, with 41 million viewers. The platform will look to build on that momentum in mid-November, when it streams the Jake Paul vs. Gervonta Davis bout.

Then, in December, Netflix will exclusively show both Christmas Day NFL games. It also had the rights to these games last year, and each drew over 30 million viewers to become the most-streamed matches in the sport's history at the time.

Should you buy, sell, or hold Netflix stock?

Now to address the big question: What should investors do with Netflix stock from here?

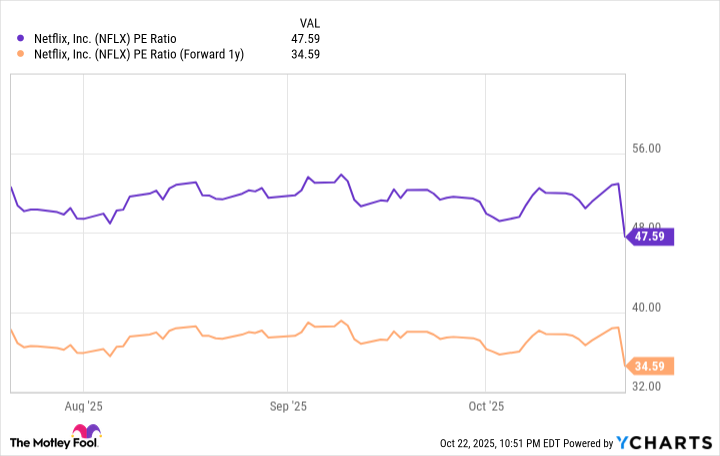

The answer might depend on each individual's time horizon. Based on the company's trailing-12-month earnings of $23.94 per share, its stock is trading at a price-to-earnings (P/E) ratio of around 47. The Nasdaq-100 technology index trades at a P/E ratio of 33.1, so Netflix is considerably more expensive than the rest of the market.

Therefore, investors hoping for blistering gains in the short term might be left disappointed. But there could be a great opportunity here for investors with a longer-term time horizon. Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Netflix could grow its earnings to $32.35 per share in 2026, placing its stock at a more reasonable forward P/E ratio of around 34:

Data by YCharts.

That would bring Netflix roughly in line with the Nasdaq-100 in terms of valuation, so as long as the company continues to grow its bottom line, its stock will look increasingly attractive as the new year progresses.

Simply put, investors who buy the stock today and intend to hold it for three to five years have an opportunity to do extremely well from here.