Quantum computing stocks jumped on Thursday on some surprising news. The Trump administration is in talks to take a stake in several quantum computing companies, according to reporting from The Wall Street Journal.

Among the companies that the government is interested in are IonQ (IONQ 5.48%), Rigetti Computing (RGTI 9.81%), and D-Wave Quantum (QBTS 7.01%). All three of those stocks jumped on the news, and related companies, like Quantum Computing Inc. (QUBT 8.54%), also surged, and it is also considering competing for funding.

The companies involved are discussing minimum investments of $10 million each.

The talks continue a pattern of the Trump administration making investments in U.S. companies, a change in the federal government's approach to working with American businesses. In recent months, the government took a nearly 10% stake in Intel, the ailing semiconductor company, and it also made a deal to take a 15% stake in the country's largest rare earth miner, MP Materials, in a bid to push back on China's dominance of the valuable minerals.

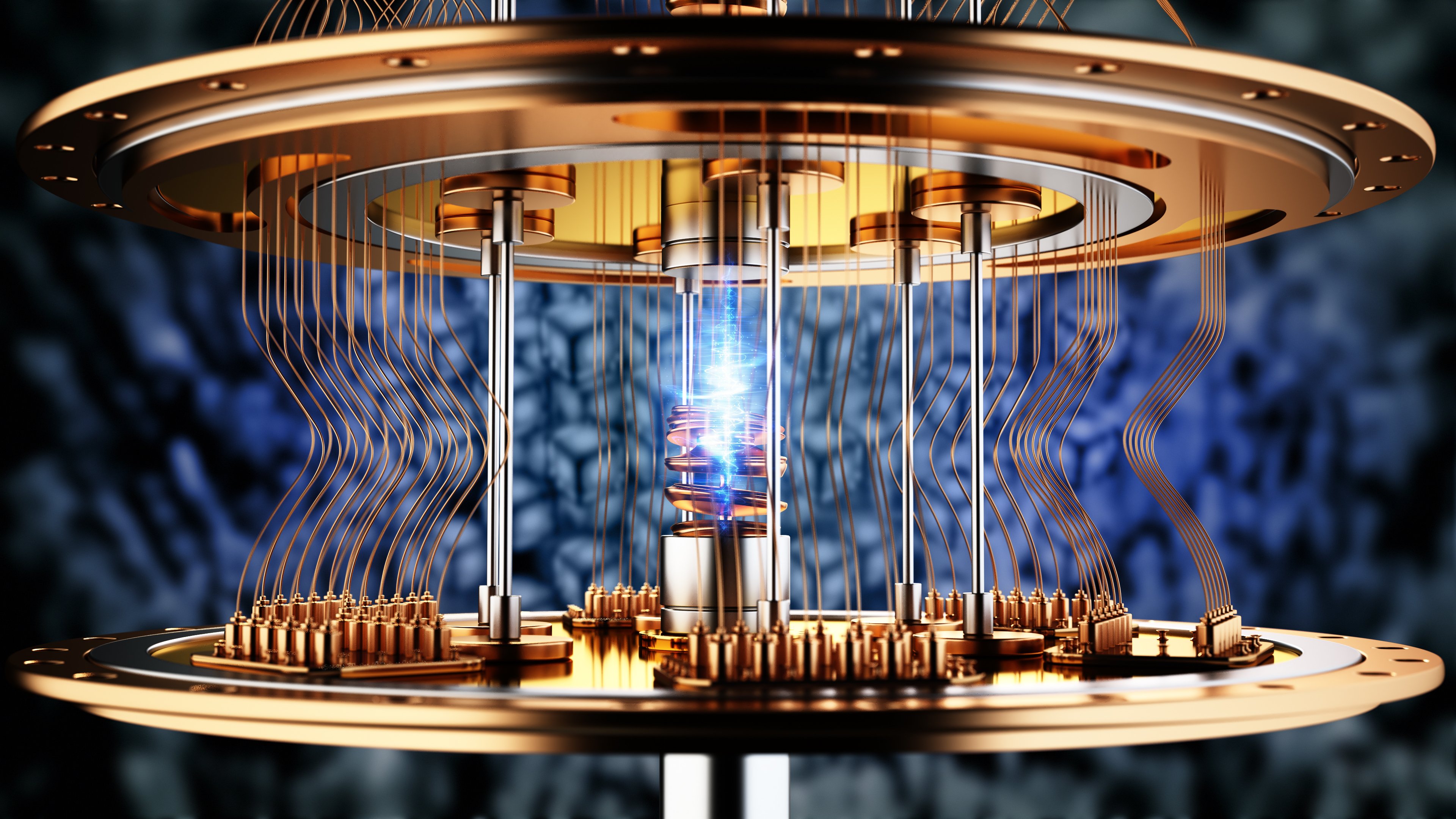

Image source: Getty Images.

Why is the Trump administration investing in quantum computing companies?

The Wall Street Journal story didn't cite any government official explaining the investment, but the most likely reasoning behind its investment in the quantum computing industry is that it sees it as a strategic priority, following in the vein of its investment in Intel and MP Materials.

The CHIPS Act under the Biden administration enabled billions of dollars in funding in grants and loans for companies that manufacture semiconductors, and Intel was a major target of the program as the company is the biggest integrated device manufacturer in the U.S., meaning it both designs and manufactures chips.

The Trump administration has taken that thinking one step further, investing $8.9 billion in Intel stock. Like the CHIPS Act, that move came out of the government's assessment that semiconductors and artificial intelligence are a strategic priority for the government. Commerce Secretary Howard Lutnick said, "This administration remains committed to reinforcing our country's dominance in artificial intelligence while strengthening our national security."

The deal with MP Materials seemed guided by the same logic. Rare earth minerals, which are used in a variety of high-tech applications, have also become a strategic priority.

Quantum computing is seen by some as the next frontier in technology following the AI boom, and Alphabet's Google said Wednesday that its Willow quantum chip achieved another milestone, running a verifiable algorithm that surpasses what supercomputers can do for the first time.

NYSE: IONQ

Key Data Points

Is the move good for investors?

A potential investment in quantum computing stocks would be much different than the Trump administration's investment in Intel for at least one key reason. Intel is a large, established company and it's struggled in the AI era. The investment from the government, therefore, helped prop up a struggling but strategically necessary company, and one that plays a vital role in the U.S. semiconductor supply chain.

Quantum computing stocks, on the other hand, are mostly speculative at this point. Stocks like IonQ and its peers trade at sky-high multiples, and have little revenue to show for their efforts thus far, though they are forging deals and partnerships to step up research and work to solve problems with quantum computing.

Quantum computing is still not developed enough to work on large-scale applications that observers hope it can one day solve.

Unlike the Intel investment of nearly $9 billion, investing $10 million in quantum computing companies is unlikely to be material for their future. Additionally, the move helped pump up these stocks, front-running investors who may have been interested but cannot get as good a price now.

Of course, current shareholders are pleased, but the government's investment may not be able to stop a drawdown should one come.

Overall, the Wall Street Journal report is a positive sign for the quantum computing sector, but investors shouldn't mistake it for a stamp of approval. These are still speculative investments.