For investors betting on a future of clean energy, few stocks have burned brighter in 2025 than Oklo (OKLO 7.46%).

As of writing, the advanced nuclear company has soared more than 525% on the year. Much of the rally has been stirred by data center needs and White House policy, which wants to quadruple U.S. nuclear energy capacity by 2050. That puts Oklo, as the purveyor of advanced nuclear technology, in a sweet spot to fuel future energy demands.

However, this is a pre-revenue company we're talking about. It has a big idea (or, rather, a compacted one -- small nuclear reactors), but no commercial profits to show for it.

Much of its future has been baked into its $20 billion market valuation, which begs the question: Is Oklo still a buy in 2025, or should investors wait for this stock to cool off?

What's working in favor of Oklo

The business case for Oklo is pretty clear. The world needs more power, less carbon, and a faster deployment of clean energy.

NYSE: OKLO

Key Data Points

All three are an apt description of its Aurora powerhouse, a compact fast reactor that uses liquid sodium as a coolant instead of water. This allows it to operate at higher temperatures without that sprawling cooling tower of a conventional reactor, which, in turn, could make assembly faster. Each unit can hypothetically run for a decade or longer without refueling.

Image source: Oklo.

Oklo also plans on running its reactors with recycled fuel, an approach that could reduce both waste and dependency on uranium enrichment. In theory, that could help improve its operating margin (and energy security) down the road.

Although Oklo has not built an Aurora powerhouse commercially, it's getting close to assembling one. This year alone it was selected for three pilot projects headed by the Department of Energy (DoE). In September, it broke ground on its first powerhouse at Idaho National Laboratory. It now expects to turn on its first reactor in mid-2026.

Meanwhile, the company has built up an impressive list of supporters. In addition to the DoE, Oklo has letters of intent to supply power to Diamondback Energy (FANG +0.54%) and Equinix (EQIX 0.62%). In mid-October, it also signed a $2 billion investment agreement with the European company newcleo.

Why you might want to wait this one out

Oklo has potential, but here's the rub: The company has no revenue and is unprofitable. Its still pre-commercial, and it needs to gain approval from the Nuclear Regulatory Commission (NRC) to operate reactors on a commercial scale.

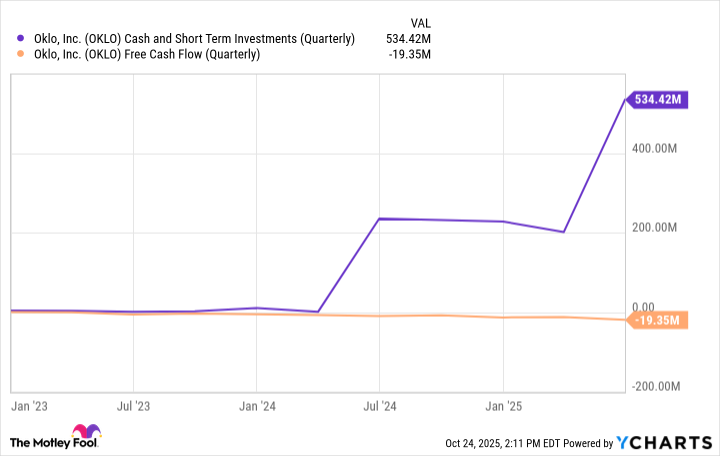

What's more, the timeline to profitability is long and uncertain. Commercial operations are targeted for 2027 or later, which means it will burn cash for many years.

OKLO Cash and Short-Term Investments (Quarterly) data by YCharts.

Cash burn isn't for a start-up, and as the chart above shows, Oklo has enough cash to keep its plans afloat for the next few years. But what's more concerning is the company's valuation. With a market cap of $20 billion and little to anchor its valuation, the risk of disappointment looms large.

So, buy now or hold off?

With Oklo's current valuation, I lean toward waiting a bit before buying full steam. The stock has taken off this year on speculation and hype, and there appears to be a disconnect between its fundamentals and market valuation.

Even if the future will be dotted with Aurora powerhouses, it's not a future we'll see next year, nor even by the end of this decade. That makes me cautious about buying while so much expectation is already baked in.

That said, the pieces do appear to be coming together for Oklo. As such, opening a small speculative spot for this nuclear stock could see generous returns over a long period, especially if you can stomach the volatility.

Otherwise, the prudent move might be to keep this one on your watchlist and wait for revenue -- or least one reactor -- to go live.