So far, nine American companies have achieved a market capitalization of $1 trillion or more, but only four have graduated into the $3 trillion club:

- Nvidia (NVDA +1.10%): $5 trillion.

- Microsoft (MSFT +2.19%): $4 trillion.

- Apple (AAPL +1.12%): $3.9 trillion.

- Alphabet (GOOG +0.42%) (GOOGL +0.39%): $3.4 trillion.

I think Meta Platforms (META +0.09%) could join them over the next few years. Artificial intelligence (AI) is fueling an acceleration in the company's revenue growth by boosting engagement on its Facebook and Instagram social networks, which could create significant value for investors from here.

Meta's market capitalization is $1.7 trillion as I write this, so investors who buy its stock today could earn a strong return of 76% if it does join the $3 trillion club. Read on.

Image source: Getty Images.

AI is transforming Meta's core advertising business

More than 3.5 billion people use at least one of Meta's social media apps every single day, which is approaching half the population of the entire world. It will be increasingly difficult for the company to continue attracting new sign-ups, so it's focusing on engagement instead. The longer users are online each day, the more ads they see, and the more money Meta makes.

The company has embedded AI into its recommendation algorithms on Facebook and Instagram to learn what type of content each user likes, so it can give the individual more of it. This strategy resulted in a 5% increase in the average amount of time each user spent on Facebook during the third quarter of 2025 (ended Sept. 30), and a 10% increase on Threads, which is Meta's X (formerly Twitter) competitor.

NASDAQ: META

Key Data Points

On Instagram, AI-powered recommendations drove a 30% increase in the amount of time users spent watching videos, which bodes well for the platform in the battle against its fierce rival TikTok.

The company is also using AI to create entirely new features across its social networks, like the Meta AI chatbot. It already has over 1 billion monthly active users after launching it just two years ago, so it has become another key tool in the quest to boost engagement. It runs on the company's Llama large language models (LLMs), which are among the most advanced open-source AI models in the world.

Meta's revenue growth is accelerating

Meta generated $51.2 billion in revenue during the third quarter, which was up 26% year over year. It was the second consecutive quarter in which revenue growth accelerated, highlighting its significant momentum led partly by AI.

Meta's earnings, on the other hand, plunged by 83% to $1.05 per share on the basis of generally accepted accounting principles (GAAP). It was due to a one-off tax charge worth $15.9 billion, and if we disregard it, the company's adjusted earnings actually came in at $7.25 per share, topping Wall Street's forecast of $6.69.

The bottom line is something investors are watching closely, because the company is rapidly increasing its capital expenditures (capex) to build more AI data center capacity, so it can improve its Llama foundation models. The company is on track to spend between $70 billion and $72 billion on AI infrastructure in 2025, which would be significantly higher than the $39.2 billion it spent in 2024.

During the third-quarter conference call with investors, chief financial officer Susan Li also said capex could increase at an even higher rate in dollar terms during 2026. Therefore, Meta's AI infrastructure spending might top $100 billion next year.

The increase in capex could be a headwind for profits in the short term, but the company wouldn't be spending this much money unless it expected a return. Subsequently, it could be a sign that management thinks AI will create significantly more value than initially anticipated, which could help Meta achieve a $3 trillion valuation.

Meta's (mathematical) path to the $3 trillion club

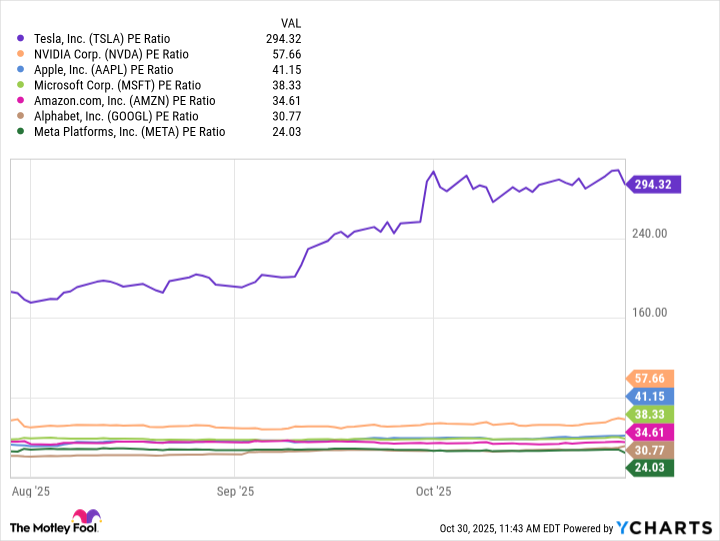

Based on Meta's trailing-12-month GAAP earnings of $22.64 per share, its stock trades at a price-to-earnings ratio (P/E) of 29.2 as I write this. It's the cheapest name in the prestigious Magnificent Seven, a group of trillion-dollar giants leading the AI revolution, listed in the chart below.

TSLA PE Ratio, data by YCharts.

Based on its third-quarter results, Meta is currently growing its revenue faster than every single one of the other Magnificent Seven except Nvidia. Its earnings growth has also outpaced that of most of those companies in recent quarters, with the exception of the third quarter because of the one-off tax charge I mentioned earlier.

Therefore, I think Meta stock is far too cheap. It would have to climb 32% just for its P/E to match the median P/E of the Magnificent Seven, and I don't think that's an unreasonable target given the momentum in its business. That alone would catapult its market capitalization to $2.24 trillion.

But according to Yahoo! Finance, Wall Street thinks Meta's earnings will grow to $29.88 per share in 2026, placing its stock at a forward P/E of 22.1. If we apply the same calculation as above, its stock would have to soar 74% by the end of 2026 just to match the median P/E of the Magnificent Seven. That would place its market cap at $2.95 trillion, a stone's throw from the $3 trillion milestone.

In theory, that means as long as Meta generates some earnings growth in 2027, it could join the exclusive club. Of course, I've made some assumptions here, and whether investors are willing to pay a much higher P/E for the stock could depend on its progress in the AI space. Based on what we know right now, the company appears to be well on track.