One of the key pillars of investing has always been diversification. It's like the old saying: "Never put all your eggs in one basket." This is particularly true when it comes to investing because you don't want your returns (or lack thereof) to be dependent on just a few companies.

Luckily, exchange-traded funds (ETFs) make it easy to achieve a diversified, well-rounded portfolio. Instead of investing in dozens or hundreds of individual stocks, buying a few ETFs can do the trick.

If you're looking to achieve a diversified portfolio (which you should be), the following four Vanguard ETFs are a great way to do so. They cover a lot of ground and can be staples in your portfolio for the long haul.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

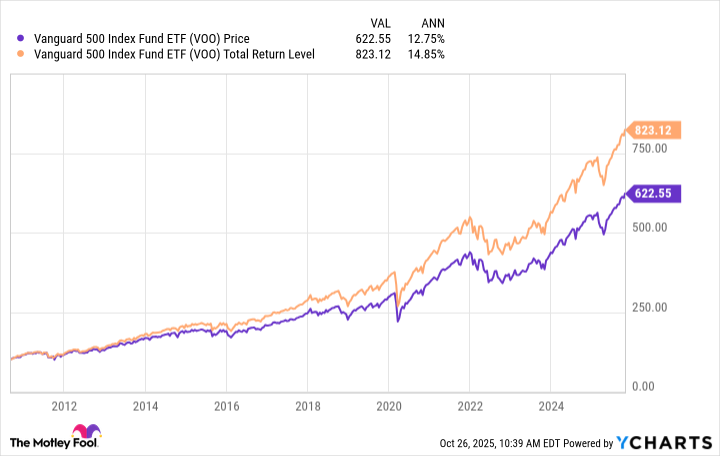

The Vanguard S&P 500 (VOO +0.50%) is arguably the best way to get exposure to the broader U.S. economy. It only contains large-cap stocks, but these roughly 500 companies are undoubtedly among the most influential in the world and have the greatest impact on the U.S. economy.

The S&P 500 has long been the benchmark that stocks and ETFs measure their performance against. Past performance doesn't guarantee future performance, but it's worth noting that the S&P 500 has generally averaged around 10% annual returns over the long term.

That might not be a jaw-dropping average, but it's definitely enough to build a nest egg over time. Since its inception, VOO's returns have been even more impressive.

They're not directly correlated, but investing in VOO is a great way to participate in the overall growth of the U.S. economy.

2. Vanguard Mid-Cap ETF

Mid-cap stocks seem to fly under the radar, but they can be good additions to a portfolio, particularly when the economy is in a steady growth phase. It's the sweet spot between the stability that typically comes with large-cap stocks and the growth opportunities that typically come with small-cap stocks.

The Vanguard Mid-Cap ETF (VO +0.29%) holds 290 mid-cap stocks, with the most represented sectors being industrials (19.1% of the ETF), consumer discretionary (15.5%), and financials (13.9%).

NYSEMKT: VO

Key Data Points

Sometimes investors confuse being a smaller company with being a "lesser" company, but that's far from the case. There are plenty of well-known mid-cap companies that have found their niche and continue to flourish in that space. Some notable names in VO are Robinhood Markets, DoorDash, Roblox, Coinbase Global, and Realty Income.

With a 0.04% expense ratio, VO is a cheap way to get exposure to mid-cap stocks. That works out to only around $0.40 annually per $1,000 invested.

3. Vanguard Russell 2000 ETF

The Russell 2000 is the primary index for small-cap stocks, similar to the S&P 500 for large-cap stocks. Adding the Vanguard Russell 2000 ETF (VTWO +1.07%) to your portfolio along with VOO and VO is a great way to make sure you cover all your bases when it comes to company sizes.

NASDAQ: VTWO

Key Data Points

Small-cap stocks tend to be more volatile than larger-cap stocks because they're more susceptible to broader economic conditions, but their smaller size also typically means there's more room for growth (and investor returns).

With roughly 2000 holdings, VTWO is less concentrated than VOO and VO, which is beneficial given the volatile nature of small-cap companies and the risks that come with them. Its top five represented sectors are industrials (18.9%), financials (17.5%), healthcare (16%), technology (13%), and consumer discretionary (11.7%).

VTWO has underperformed over the past decade, but small-cap stocks tend to outperform the broader market during times when economic growth is picking up and interest rates are falling (as is the case now).

4. Vanguard Total International Stock ETF

To really cap off a well-rounded portfolio, you should add non-U.S. companies. That's where the Vanguard Total International Stock ETF (VXUS +0.25%) comes into the picture. It contains companies from both developed and emerging markets.

NASDAQ: VXUS

Key Data Points

Developed markets are seen as more stable and established, while emerging markets are seen as faster-growing but more volatile and riskier. VXUS is divided as follows:

- Europe (37.9%)

- Emerging markets (27.6%)

- Pacific (25.4%)

- North America (7.9%)

- Middle East (0.7%)

- Other (0.5%)

The U.S. economy has consistently grown over the long term, but it definitely hits bumps in the road along the way. Investing outside the U.S. is a good way to hedge against domestic slumps and take advantage of global growth opportunities. There are plenty of international companies doing great things, and you'd be doing yourself a disservice to not have at least a small bit of exposure to them.

VXUS also offers an impressive dividend yield (2.7% at the time of writing), which is an added bonus that helps you avoid relying solely on stock price growth to get value from your investment.