Ferrari (RACE +0.29%) and Tesla (TSLA 0.04%) have been two of the most popular automotive stocks over the past decade, with each of them carving out a unique niche in the auto space.

Tesla benefited for years as an electric vehicle leader and is looking ahead to a future built on automation and robotics -- both of which could be significant opportunities. Meanwhile, Ferrari has built its brand on decades of successful racing heritage, selling expensive supercars to an exclusive clientele.

If we judge these two companies solely on their share price gains, they've both been massively successful. Tesla's stock is up an astonishing 3,100% over the past decade, and Ferrari has gained 663% -- compared to the S&P 500's 234% increase. But which stock looks like the better automotive stock right now? Let's take a look.

Image source: Ferrari.

What's happening with Tesla and Ferrari right now

Ferrari recently made headlines when it announced its third-quarter results, in which management lowered its five-year outlook. Management now believes adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will have an annual growth rate of about 6%, reaching about 3.6 billion euros by 2030 -- lower than the 10% EBITDA growth the company previously guided for three years ago.

What's more, management said that 2030 sales would be about 9 billion euros in 2030, lower than Wall Street's consensus estimate of 10 billion euros. Investors panicked on the news, leading to Ferrari's worst trading day since it went public in 2015.

NYSE: RACE

Key Data Points

Tesla recently reported its third-quarter results, which were slightly better compared to the previous two quarters, but still not great. Revenue was $28.1 billion in the quarter, a 12% increase from the year-ago quarter, but that growth likely came as buyers rushed out to take advantage of EV tax credits before they expired at the end of September.

More troubling was the fact that Tesla's GAAP net income fell 37% to about $1.4 billion, and the company's operating expenses soared 50% to $3.4 billion. In short, Tesla is generating far less income and at a time when its costs are substantially rising.

NASDAQ: TSLA

Key Data Points

Ferrari has two advantages over Tesla

Tesla CEO Elon Musk has said that the future of his company will be focused on robots and automation. These are massive opportunities. The humanoid robotics market could be worth an estimated $5 trillion by 2050 and the autonomous mobility-as-a-service market could reach an estimated $10 trillion by the early 2030s.

While these are promising markets, they're going to take a massive amount of investment to potentially pay off. That's a problem for Tesla because its operating margin was just 5.8% in Q3 -- down by nearly half from the year-ago quarter -- and net income is tumbling. Tesla is facing increased global EV competition and headwinds in the electric vehicle industry, including higher costs, tariff uncertainty, and the loss of EV tax credits.

In contrast, Ferrari's vehicles are in high demand, and the company's operating margins are the envy of the auto industry. Morningstar research shows that the company's total production has increased 88% over the past 10 years, thanks to new models -- and yet it still produces about 1,000 vehicles per model, ensuring each one stays in high demand.

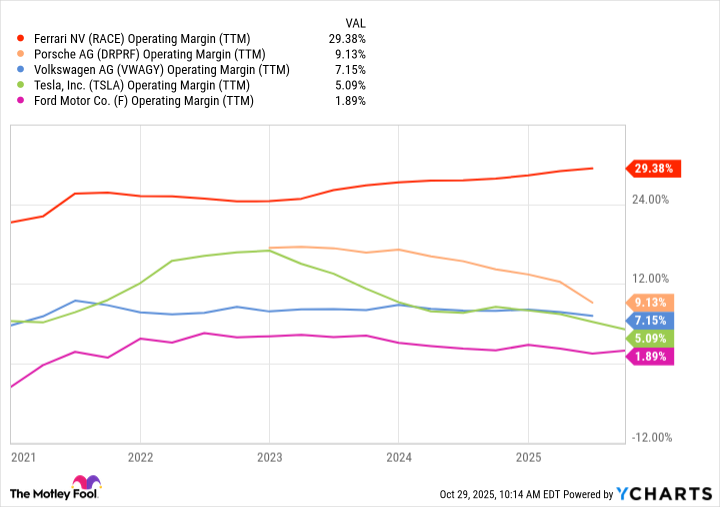

That's one key advantage Ferrari has over Tesla. The other is that Ferrari's operating margins of 29% far outpace all of its competitors and make it the envy of the auto industry. Here's how it compares to other automakers:

Data source: YCharts; TTM = trailing 12 months.

The good news for investors is that Ferrari's management anticipates that its high margins will continue, saying that operating margin will be "at least 30%" continuing through 2030 because of the company's vehicle personalizations, product mix, and limited-edition models.

Ferrari is the better stock

If it isn't already obvious, Ferrari is the better automotive stock for investors. The company's supercars are in high demand, its operating margins are through the roof, and the company has successfully expanded its lineup over the years without diminishing its brand. In contrast, Tesla's expenses are rising and its operating margins are plunging at the same time as it's increasing spending. If you're looking for an autos stock to hold on to for years, Ferrari is the far better bet right now.