BigBear.ai (BBAI +8.15%) recently reported its earnings numbers, and the results may have left investors feeling a bit puzzled. After all, the company didn't show progress on the top line, but its bottom line improved -- significantly. That's normally not what you see for a growth-focused company, which usually generates a ton of revenue growth but whose bottom line is often the troubling part.

The company, which focuses on artificial intelligence (AI) and data analytics, is seen by some investors as the next Palantir Technologies, and has at times been a hot buy this year. But depending on whether you bought near its low ($1.70) or its peak ($10.36) over the past year, your returns could look vastly different as it now trades at around $6. This has been an incredibly volatile investment to own.

Do BigBear's recent results suggest the company is going in the right direction?

Image source: Getty Images.

What was behind BigBear's big bottom-line improvement?

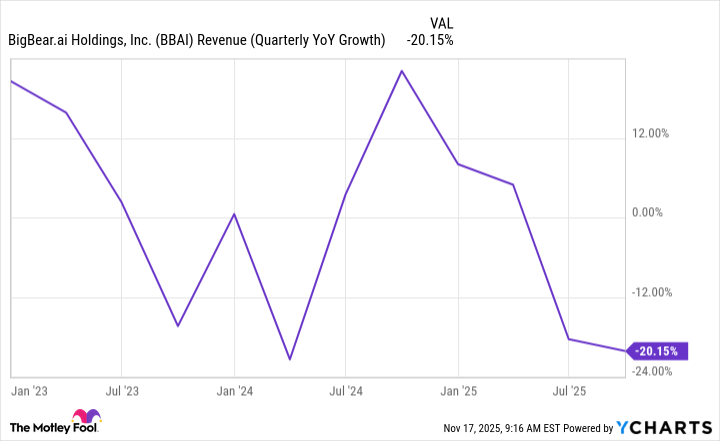

Last week, BigBear posted its third-quarter numbers covering the period ending Sept. 30. Revenue totaled $33.1 million -- a 20% drop from the $41.5 million it posted in the same period last year. The decline was mainly due to a drop in demand related to Army programs, which was the same reasoning it gave in the previous period when its sales were down.

Yet, despite the drop in sales, the company posted a positive net income figure of $2.5 million, versus a loss of $15.1 million in the same period a year ago. The reason for the improvement in the bottom line was due to a $26.1 million decrease in the fair value of derivatives, which included the revaluation of warrants. This is a non-operating item that investors should monitor closely each quarter, as it can significantly impact the company's bottom line. In the previous quarter, BigBear reported an increase in the fair value of its derivatives to the tune of $135.8 million, which had the reverse effect and led to its net loss totaling $228.6 million -- more than double the size of its $90.3 million operating loss.

For investors, a good idea is to stop at the operating income line to gauge how the business is performing. As long as the company experiences these wild swings in its derivatives, they can make its financials appear significantly worse or better than they really are.

NYSE: BBAI

Key Data Points

The big concern for BigBear still relates to its growth

BigBear is a risky tech company to invest in, as it continues to post operating losses and burn through cash -- using up $9.6 million over the course of its day-to-day operating activities last quarter. For investors who are comfortable with the risk, this can be potentially acceptable, but only if the company is generating at least some strong growth.

This is where I believe BigBear may have the toughest time convincing growth investors. Not only is it incurring losses, but without at least strong sales growth to demonstrate progress, there may be no reason for investors to remain committed. While there have been periods of growth in the past, the path has by no means been consistent for BigBear.

BBAI Revenue (Quarterly YoY Growth) data by YCharts

Should you buy BigBear stock today?

BigBear's stock is up around 36% this year (as of Nov. 14), and its modest market cap of $2.8 billion may have some investors still contemplating taking a chance on the AI stock, given the possible upside it may possess in the long run. But with many AI stocks to choose from and without the strong growth to provide proof that the business is the real deal, I think there's just too much risk with BigBear.ai right now.

Its business looks heavily dependent on government spending, and that isn't looking all that strong these days. BigBear is a stock you may want to keep on a watch list, as a wait-and-see approach looks to be most appropriate given the risk and uncertainty ahead.