The healthy spending on artificial intelligence (AI) infrastructure is set to continue in 2026, as evident from the recent quarterly results released by major hyperscalers and the announcements made by key AI companies such as OpenAI.

According to a third-party estimate, the capital expenditure of the top five U.S. hyperscalers alone is expected to hit $602 billion in 2026, a projected increase of 36% from current levels. As such, companies such as Nvidia and Broadcom that design AI chips could deliver another stellar performance next year. But both of these semiconductor stocks are trading at expensive valuations, and that may weigh on their potential returns next year.

However, there is one AI chip stock that's not just cheap but is growing at an incredible pace as well. It won't be surprising to see this stock double in 2026. Let's see why this name could outpace its more popular peers and make investors richer next year.

Image source: Getty Images.

Marvell's phenomenal growth should set the stock up for outstanding gains

Marvell Technology (MRVL 1.02%) may not be as big or as famous as Nvidia and Broadcom, but it is quickly making a name for itself in the AI chip market. Marvell designs application-specific integrated circuits (ASICs). These are custom processors that can be designed to perform specific workloads, such as running AI inference applications.

The specific nature of custom AI chips allows them to perform the assigned tasks quickly and efficiently, which is why they are considered to be better than graphics processing units (GPUs) while running certain AI workloads. This explains why there is robust demand for Marvell's custom AI processors, leading to remarkable growth in its data center business.

Marvell's data center revenue grew 69% year over year in the second quarter of fiscal 2026 (ended on Aug. 2) to $1.5 billion. As this business accounts for three-fourths of the company's top line, it was easy to see why Marvell's overall revenue jumped by 58% from the year-ago period.

Marvell plays second fiddle to Broadcom in the custom AI chip market. Specifically, Marvell aims to corner 20% of this space by the end of 2028, which means that it will have room to make more progress in custom AI chips going forward. What's worth noting here is that Marvell is more of a pure-play custom AI chip company when compared to Broadcom, which also has a presence in the infrastructure software market.

NASDAQ: MRVL

Key Data Points

The pure-play nature of Marvell is the reason why it is growing at a significantly faster pace than Broadcom, which reported a 22% year-over-year revenue increase to $16 billion in its fiscal 2025's third quarter (ended Aug. 3). What's more, Marvell's remarkable growth is filtering down to its bottom line as well, with its adjusted earnings jumping by 123% in the last reported quarter. That was way faster than the 36% increase in Broadcom's non-GAAP earnings during the same quarter.

Even better, Marvell's earnings are growing at a significantly faster rate than those of Nvidia, which reported a 60% year-over-year jump in its bottom line last quarter. So, Marvell's smaller size should allow the company to sustain remarkable growth levels in the long run. That's why it looks like a much better buy than both Nvidia and Broadcom right now when their valuations are taken into account.

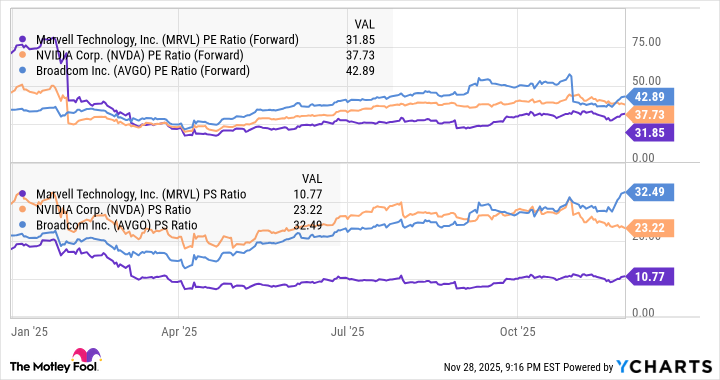

MRVL PE Ratio (Forward) data by YCharts

Marvell has a significantly lower price-to-sales ratio than its peers. It is also cheaper as far as the forward earnings multiple is concerned. Given that Marvell's fast-expanding AI revenue pipeline and customer base are likely to help it maintain its remarkable momentum in 2026, it won't be surprising to see it being rewarded with a richer valuation.

That's precisely why this AI stock is likely to double next year.

Here's how the stock may double

We have already seen that Marvell's earnings grew at an incredible pace last quarter. Analysts are expecting the company to finish the current fiscal year with a 78% spike in earnings to $2.80 per share. That's expected to be followed by a 20% increase in the next fiscal year to $3.38 per share.

However, Marvell can easily outpace analysts' expectations next year. That's because the company now has more than 50 custom AI chip opportunities across more than 10 customers. It has already been supplying its custom AI processors and networking chips for 18 sockets to four major hyperscalers, along with six emerging hyperscalers.

So, the pipeline of more than 50 opportunities suggests that it is likely to witness a terrific increase in its revenue and earnings next year, as well as in the long run since Marvell expects a potential lifetime revenue opportunity of $75 billion from its AI opportunity pipeline. That's over 10 times the trailing-12-month revenue of $7.2 billion generated by the company.

As such, it is easy to see why Marvell has the ability to generate stronger-than-expected earnings growth next year. Assuming it can replicate its fiscal 2026 earnings growth rate next year, its bottom line could hit $4.98 per share (based on the fiscal 2026 bottom-line forecast of $2.80 per share). Such strong earnings growth is likely to be rewarded with a higher earnings multiple than the current reading.

Let's say Marvell is trading at even 35 times earnings after a year, a slight premium to its forward earnings multiple. Its stock price could hit $174. That's almost double where this AI stock is trading right now, which is why investors may want to buy Marvell before it steps on the gas and potentially delivers stunning gains in 2026.