Roughly 30 years ago, the advent and mainstream proliferation of the internet began charting a new course for corporate America. It opened new doors for businesses to sell and market their products and services, while also breaking down information barriers that had previously existed on Wall Street between professional and retail investors.

For decades, investors have been waiting (sometimes impatiently) for the next game-changing technology that would provide a decisive boost to America's long-term growth potential. Artificial intelligence (AI) looks to be this long-awaited innovation.

Although graphics processing unit (GPU) company Nvidia is commonly viewed as the face of the AI revolution -- GPUs act as the brains that facilitate split-second decision-making in AI-accelerated data centers -- a strong argument can be made that data-mining specialist Palantir Technologies (PLTR 1.90%) has supplanted it. Shares of Palantir have skyrocketed more than 2,500% since the end of 2022.

Image source: Getty Images.

While Palantir possesses a well-defined moat and clearly has an enthusiastic investor base, history offers a very big (and potentially worrisome) clue as to where the company's shares may head in 2026.

Palantir's ascent to Wall Street's eighth most valuable tech stock didn't happen by accident

As of the closing bell on Nov. 28, Palantir had a market cap of more than $401 billion, which places it 23rd in the pecking order of the largest U.S.-listed companies, and eighth overall within the tech sector. Its ascent from a company of fringe importance to one of the stock market's most valuable tech businesses didn't occur by accident.

Above all else, investors value Palantir's sustainable moat. Its two core operating segments -- Gotham and Foundry -- have no true one-for-one replacements at scale, which all but ensures predictable operating cash flow and transparent double-digit sales growth.

NASDAQ: PLTR

Key Data Points

Gotham is the company's AI- and machine learning-inspired platform used by the U.S. government and its allies to plan and oversee military missions, as well as collect and analyze copious amounts of data. Government contracts typically span four to five years in length, leading to the predictability of Palantir's sales and cash flow.

Meanwhile, Foundry is an AI-driven subscription service that helps businesses understand their data to improve all aspects of their operating efficiency. This is a relatively newer segment that's generating eye-popping sales growth.

Investors have also come to appreciate Palantir's ability to hurdle Wall Street's sales and profit expectations. Gotham has been the primary profit driver, allowing CEO Alex Karp and his team to raise full-year sales guidance on several occasions this year.

Although Wall Street handsomely rewards profitable businesses with sustainable moats, historical precedent is a headwind that Palantir may struggle to overcome in the new year.

Image source: Getty Images.

History hasn't been kind to next-big-thing technologies early in their expansion

To preface this discussion, no previous event or data point can guarantee what will happen with a specific stock, trend, or the broader market. Nevertheless, certain correlated events throughout history have demonstrated a phenomenal track record of predicting the future. This is especially true when it comes to Wall Street's next-big-thing trends, which include AI.

There's no question that the internet was a massive leap forward for businesses. But while it was immediately embraced, corporate America didn't figure out how to optimize the internet from a sales and marketing perspective for years. The dot-com bubble is evidence that investor expectations were too lofty.

Following the proliferation of the internet, we've witnessed investors overestimate the adoption rate, utility, and/or early optimization of several next-big-thing technologies, including genome decoding, nanotechnology, 3D printing, blockchain technology, and the metaverse. Investors consistently overlook the fact that new technologies need ample time to mature. In other words, there's the real potential for an AI bubble to form and burst in 2026.

If there's a bit of a silver lining for Palantir, it's that AI hardware stocks, such as Nvidia, would be among the hardest hit if an AI bubble forms and bursts. Palantir's multiyear government contracts and subscriptions would ensure that sales don't fall off a cliff. Nonetheless, investor sentiment would still be expected to weigh heavily on Palantir's shares if such an event were to occur.

The other historical headwind for Palantir Technologies is its valuation.

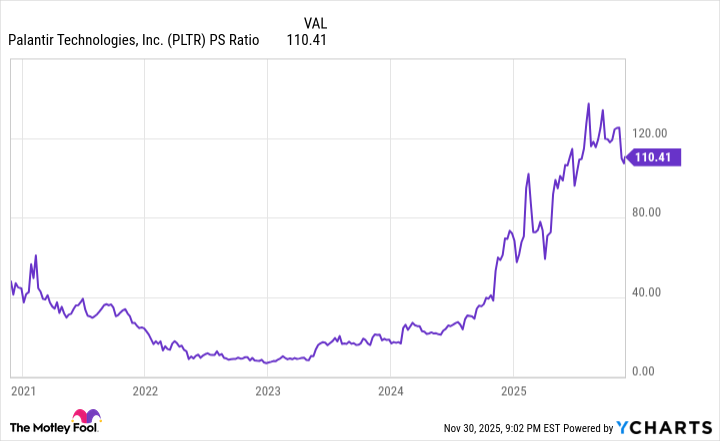

PLTR PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

Although it's an arbitrary line in the sand, history shows that trailing-12-month (TTM) price-to-sales (P/S) ratios above 30 for businesses on the leading edge of next-big-thing trends are unsustainable over an extended period. Internet stocks frequently bogged down at peak TTM P/S ratios ranging from 31 to 43 before the dot-com bubble burst.

In Palantir's case, it closed out the previous week with a P/S ratio of (drum roll) 110! We've never witnessed a TTM P/S ratio of 30 be sustainable, let alone one that's nearly four times this bubble-marking level.

Companies that have previously met these criteria -- market leaders of next-big-thing trends with P/S ratios of 30 or higher -- have all seen their shares plunge by well over 50%. When the metaverse bubble popped, Meta Platforms shares fell 80% from their peak. Meanwhile, Amazon and Cisco Systems each tumbled by around 90% when the dot-com bubble burst.

In Palantir's case, a 50% decline in its shares still wouldn't come close to removing it from clear bubble territory, based on its P/S ratio.

Although it's impossible to accurately predict when the music will stop for hyped early stage technologies and innovations, history offers undeniable clues that point to significant downside for Palantir stock in 2026.