Semiconductors (chips) are the unsung heroes of the tech world, powering everything from smartphones to computers to TVs to car infotainment systems, and much more. Most of the time, these semiconductors are smaller than a grain of rice, yet they are to many electronics what a brain is to the human body.

When it comes to bringing chips to life, no company does it better than Taiwan Semiconductor Manufacturing (TSM 0.21%) (also known as TSMC). Top companies will design the chips they need for specific products, but most rely on TSMC to manufacture them into high-performing hardware. The tech world's reliance on TSMC is why I continue to load up on the stock with no intention of selling.

Image source: TSMC.

Good luck catching up

There are several other big-name semiconductor companies, but none compare to TSMC in terms of precision, consistency, scale, and yield (the percentage of chips that work as intended). That's why it has long been the go-to for some of the world's top tech companies, like Apple, Nvidia, Tesla, AMD, Qualcomm, and dozens of others.

Since semiconductor manufacturing requires so much state-of-the-art equipment, capital, and specialized engineering expertise, the barrier to entry -- or to catch up to TSMC's manufacturing power -- is huge. It would take billions and many years to get to where TSMC is now, and by the time a company does, it's safe to assume TSMC would have been progressing accordingly, keeping it ahead of the pack.

NYSE: TSM

Key Data Points

Riding the AI wave all the way to the bank

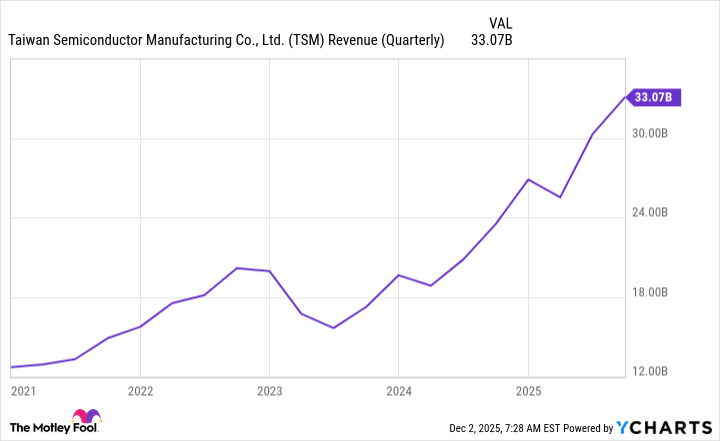

For a while, smartphone chips accounted for most of TSMC's sales. Now, with artificial intelligence (AI) advancements, its high-performance computing (HPC) segment -- which includes advanced AI chips -- is the bulk of its sales. In the third quarter, HPC accounted for 57% of TSMC's $33.1 billion in revenue.

TSM Revenue (Quarterly) data by YCharts

Although TSMC manufactures the bulk of semiconductors for today's electronics, it manufactures virtually all advanced AI chips used in today's data centers (an important piece in training, deploying, and scaling AI). With spending on AI infrastructure set to explode in the coming years, TSMC will be a natural beneficiary as money flows to the chip designers, and then to TSMC.

TSMC is in a good position, because if AI advances as many people expect and companies continue to pour money into the infrastructure, its business will keep growing with demand. However, if companies spending on AI infrastructure begin to think they were overly ambitious with their spending plans and cut back, TSMC still remains the go-to for electronics that aren't AI-related.

Its long-term business will benefit from AI, but it is far from depending on it. That's why I feel comfortable holding onto the stock for the long haul.