BigBear.ai (BBAI 9.29%) is a fairly popular AI investment pick, as it's one of the few options available in the market that sells an application of AI. It's also a relatively small business with a market cap of less than $3 billion. This gives it massive growth potential if its offerings become mainstream.

Is BigBear.ai a winning artificial intelligence pick? Or are there better options out there? Let's find out.

Image source: Getty Images.

BigBear.ai is focused on government business

BigBear.ai's primary business is focused on government business or government-adjacent clients. Its biggest contract is with the U.S. Army to build its Global Force Information Management-Objective Environment system. This AI-powered application ensures that the U.S. Army is "properly manned, equipped, trained, and resourced" for whatever mission is at hand.

While this is a critical software for the military, the number of clients that could use this software is relatively slim. This makes BigBear.ai seem more like a consulting agency that can build AI applications, rather than a platform used for many purposes. Building a general-use platform is far more lucrative over the long term, as the clients are responsible for building on the platform, rather than BigBear.ai doing everything for the client.

NYSE: BBAI

Key Data Points

Another area where BigBear.ai's software is used is at airports to speed up processing for international travelers. This is another specialized software, and can really only be used in other facial recognition applications. While those exist, they aren't as prevalent as some other AI opportunities.

With BigBear.ai developing fairly custom software, it's starting to look like a business that isn't an attractive investment. However, its latest acquisition looks like a pivot in the right direction.

During the third quarter, BigBear.ai acquired Ask Sage, which is a generative AI platform intended for defense and national security. That's a far more attractive business, as it's a platform that can be used in multiple applications. Ask Sage is also growing rapidly, with revenue increasing six times on a year-over-year basis. It's still a fairly small business, with 2025 annual recurring revenue totaling $25 million, but that's a huge improvement over BigBear.ai's existing business.

BigBear.ai needed to make a big change

During Q3, BigBear.ai's revenue decreased 20% year over year to $33.1 million. That's a huge problem, as there has never been a better time to be an AI company. AI should be able to sell itself, and with BigBear.ai's revenue shrinking due to lower volume on U.S. Army contracts, it's incredibly concerning. The Ask Sage acquisition will certainly help, but it may be too little, too late.

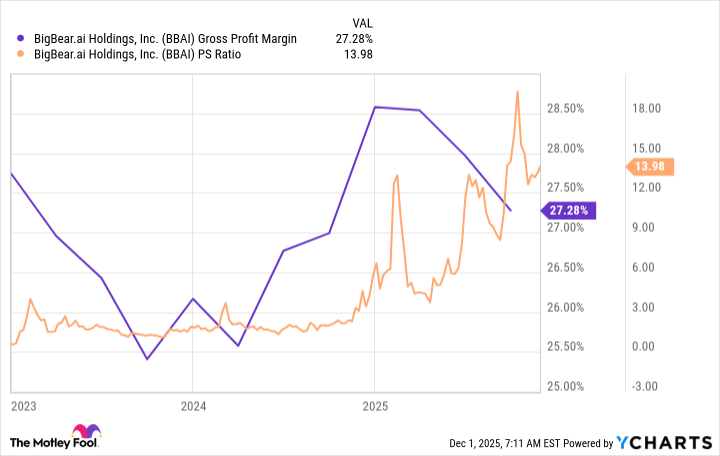

Alongside my concerns about BigBear.ai's profitability is its gross margin. Most software companies have gross margins between 70% and 90%, which allows them to trade for 10 to 20 times sales. They receive this premium because the market expects them to generate a 30% profit margin sometime down the road. However, BigBear.ai's gross margin is far lower than that threshold, which makes its valuation quite expensive.

BBAI Gross Profit Margin data by YCharts. PS = price-to-sales.

At 14 times sales, it's already an expensive software stock. However, because of its low gross margin, it's actually far more expensive than it appears, as it doesn't have the same profit potential as its peers.

These are all huge red flags for me, and I think BigBear.ai is a stock to stay away from. The market has the wrong expectations for BigBear.ai as a software company, and it won't work out over the long term. There are far too many great AI stocks to invest in right now, and all of those represent far greater investment opportunities than BigBear.ai.