When OpenAI released ChatGPT to the masses at the end of November 2022, Palantir Technologies (PLTR 11.62%) had a $12.5 billion market capitalization. Today, the data-mining darling is worth more than $400 billion -- larger than the software companies Salesforce and Adobe combined.

With gains of this magnitude, Palantir has clearly been a major winner in the artificial intelligence (AI) revolution. Enterprise software is not the only industry benefiting from AI, though.

Perhaps the most lucrative pocket of the AI realm is hardware, particularly semiconductor stocks. While Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing are the three largest players in AI chips, investors should not turn their backs on Advanced Micro Devices (AMD 17.31%).

Let's break down where shares of both Palantir and AMD could be headed next year and explore why I think the Nvidia rival is set to overtake the data analytics specialist in 2026.

Palantir could be headed for a valuation reset in 2026

Since the AI revolution kicked off about three years ago, shares of Palantir have soared by more than 2,000%. There have been some minor pullbacks here and there, but it's been pretty difficult losing money in Palantir stock over the last few years.

The company's software suite -- comprised of platforms Foundry, Gotham, and Apollo -- has witnessed unprecedented demand as corporations and government agencies race to build more comprehensive data-driven workflows.

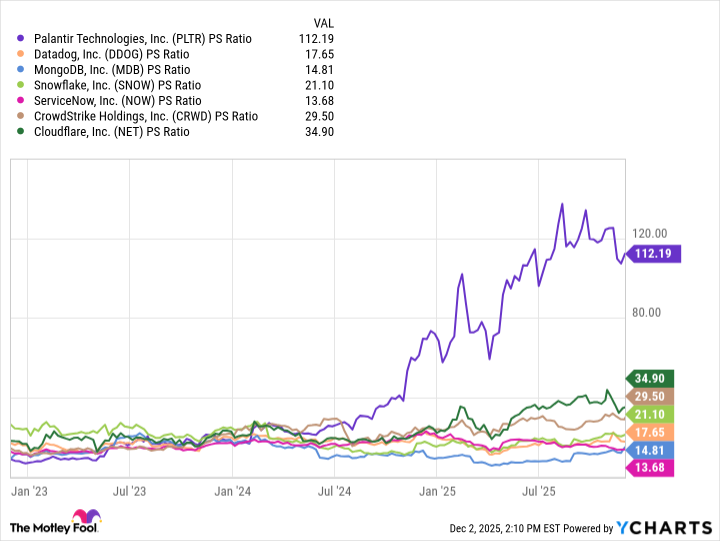

While revenue and profit have accelerated in a meaningful way, so too has the company's valuation. Palantir's price-to-sales (P/S) multiple of 112 is meaningfully higher than a number of comparable high-growth software stocks.

PLTR PS Ratio data by YCharts.

The clear valuation expansion that Palantir has experienced throughout the AI boom echoes what investors saw during the dot-com bubble in the late 1990s. As history shows, many companies from the early days of the internet were not able to sustain their premium valuations in the long run.

Against this backdrop, I think expectations are going to become increasingly high for Palantir. While I do not see AI-driven tailwinds necessarily slowing down, I think Wall Street and retail investors alike are going to demand levels of growth that the company may not be able to achieve.

Should this occur, its valuation could be headed for a meaningful de-rating as investors digest how overbought the stock has truly become.

Image source: Getty Images.

Why AMD stock could skyrocket next year

Shares of AMD are up 79% on the year. Maintaining this level of momentum is difficult, but I think AMD's trajectory remains strong.

For most of the AI revolution, the company was seen as playing second fiddle to Nvidia -- unable to out-innovate its larger competitor. Nvidia had a first-mover advantage in the data center GPU industry, which helped give the company a lead in winning over AI hyperscalers.

Nevertheless, AMD's MI300 and MI400 chip series have proved to be a hit among large AI developers. In particular, the company has won over Microsoft and Meta Platforms, each of which are complementing their existing Nvidia infrastructure with clusters of AMD's chips.

The company also recently inked a deal with Oracle's cloud services division to sell 50,000 MI450 chips and is partnering with OpenAI on building a 6-gigawatt data center.

At a more macro level, Goldman Sachs estimates that the hyperscalers will have roughly $500 billion in capital expenditures next year. As investment in AI infrastructure continues to accelerate, AMD is beginning to demonstrate its ability to win incremental business despite an intensive rivalry with Nvidia.

Given these dynamics, I think AMD is positioned to continue riding the secular tailwinds of the AI infrastructure era, leading to further stock price appreciation.

Image source: Getty Images.

What will it take for AMD to overtake Palantir?

As is stands today, AMD stock would need to rise by about 16% in order to reach the same market cap as Palantir (assuming the latter didn't move from its current valuation).

NASDAQ: AMD

Key Data Points

Palantir and AMD both compete in fierce markets, but I think the chipmaker's current momentum is the start of a more prolonged breakout. By contrast, shares of Palantir have continued to soar almost exclusively in an upward direction for three years.

Smart investors understand that stocks do not increase in value in a linear fashion forever. It's impossible to predict the exact price point for a stock, but I think the broader idea explored here is that AMD has more-direct exposure to benefit from big tech doubling down on AI infrastructure compared to Palantir.

For these reasons, I think shares of AMD will continue to soar in 2026 relative to Palantir -- ultimately propelling the chip designer past a $400 billion market value.