In the artificial intelligence (AI) industry's infancy -- when AI data centers were few in number and didn't need to be particularly efficient -- it was easy for giants like Amazon and Alphabet to take control of the cloud computing piece of the artificial intelligence business. After all, these companies were already major non-AI cloud computing service providers. Adding AI offerings to their menu of services was relatively easy.

With the AI industry continuing to refine its own technology, however, challenges linked to sheer scale and performance expectations are surfacing. As it turns out, the cloud computing industry's familiar stalwarts aren't necessarily best positioned to meet the industry's newest needs.

Specialists are stepping up, translating into opportunity for investors. And one of the most promising AI cloud specialists is a relatively small company called Vertiv (VRT +2.46%). Let's see why.

The rise of AI data centers is creating unexpected challenges

It's not a household name. In fact, with a market capitalization of less than $100 billion, it doesn't turn many heads in the investing world either.

Within the artificial intelligence computing community, though, Vertiv is a name you're hearing more and more often. And for good reason. See, this company solves the problems that institutions didn't exactly anticipate when mapping out their AI ambitions. That's cost-effective electricity, data center cooling, and a means of managing these two surprisingly complicated aspects of the business.

An outlook from Deloitte puts things partially in perspective. The consultancy suggests that electricity consumption from AI data centers alone is poised to grow by a factor of more than 30 between last year and 2035. Even if alternatives like nuclear power and the continued proliferation of on-site solar are able keep energy costs in check, it's still in companies' best interest to make cost-effective use of the electricity they're going to be consuming.

NYSE: VRT

Key Data Points

Then there's cooling. All data center hardware generates heat. Too much heat, however, can damage computer hardware. If the world is going to be using AI even more in the future, it's going to need to find a way of dealing with all the additional heat that's going to be created as a result. That's why Precedence Research believes the global data center cooling market is poised to grow at an average annualized pace of 12% between now and 2034 when it will be worth more than $200 billion per year.

Vertiv has what the industry needs

So where does Vertiv fit into the picture? In simplest terms, the company provides the solutions most data center owners/operators didn't fully realize they would need at this point in time.

Take its PowerDirect In-Rack systems as an example. This equipment is 97.5% efficient, which means it not only maximizes the delivery of electricity to a rack with as little power-input as needed, but also generates as little heat as is feasibly possible, dialing back the burden on a data center's cooling system.

Image source: Getty Images.

Vertiv's technology is also optimized for the unique power needs of artificial intelligence data centers, which can dramatically change from one minute to the next. Not only does such fluctuation often cause inefficiency, but it can strain power supplies and even pose a danger to a data center's hardware as well.Vertiv has answers, though, in the form of automatic static transfer switches paired with battery-based storage systems that can deliver off-grid power.

The company is even adapting its tech to meet the needs of an industry that can't quite predict what it will need in the future. For instance, its SmartRun infrastructure system incorporates power distribution, cooling, and networking into a single modular platform that can be easily added to or subtracted from an existing data center with no fuss.

And its menu of cooling solutions is just as impressive, and flexible. Liquid cooling, conventional cooling, and evaporative cooling are all in its wheelhouse, with each option also offering superior efficiency to its customers.

The best all-around bet of a growing bunch

No, Vertiv isn't the only specialist in the AI cloud computing space. Although it's more focused on the computing part of the AI data center business, you'll also likely be hearing the name CoreWeave mentioned more often in the future.

Nebius and Iren are two other names inching their way deeper into this market. Iren is leveraging its experience as a Bitcoin miner to build data centers powered completely by renewable energy, while Nebius makes it easier for customers to do machine learning work, and inference learning in particular. In its words, it's the "ultimate cloud for AI innovators," and seemingly aimed at newcomers.

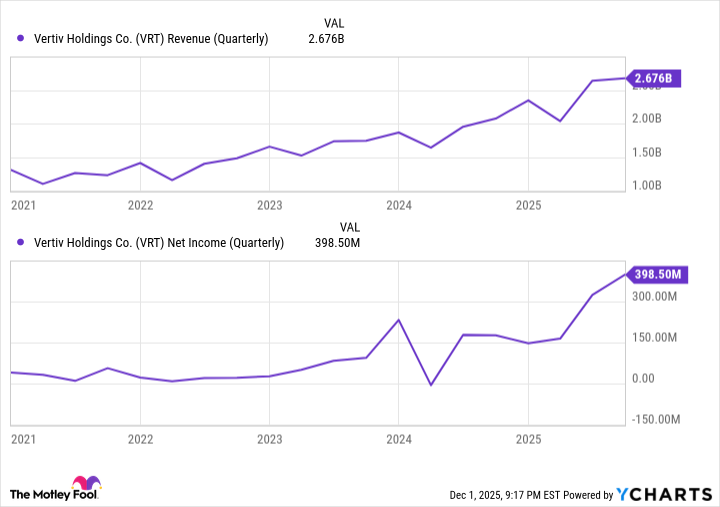

If there's only room for one such name in your portfolio right now, however, it's arguably Vertiv for two related reasons. First, it's already consistently profitable, and second, its top and bottom lines are growing like crazy. Last quarter's net revenue grew 29% year over year to nearly $2.7 billion. Almost $400 billion of that top line (15%) was turned into net income too, more than doubling the year-earlier comparison.

VRT Revenue (Quarterly) data by YCharts

This growth is likely to continue growing like crazy for a long time too. Remember, Precedence Research expects the global data center cooling industry alone to grow 12% per year through 2034, while the AI data center business itself is projected to grow at an average annualized pace of more than 28% for the same timeframe. The vast majority of data center capital expenditures expected in the meantime should be investments in infrastructure like Vertiv offers, according to IoT Analytics.

A specialist that's not only already in the business but also already profitable -- which means it's not facing any immediate liquidity concerns or threatening to dilute existing shareholders or on the verge of blowing up its balance sheet -- inherently brings a better risk-versus-reward scenario to the table for any investor looking to plug into this tailwind.