After years of stagnation, nuclear power is regaining favor due to its efficiency, reliability, and zero emissions. The U.S. is focused on recommissioning old plants, building new ones, and developing new technologies, such as small modular reactors (SMRs), which could help overcome some of the limitations of large, traditional reactors.

Two companies in the space garnering a lot of attention are Oklo (OKLO 5.53%) and Centrus Energy (LEU 4.57%). The two companies have benefited from positive news surrounding nuclear energy and regulatory tailwinds. Over the past year, Oklo has surged 365%, while Centrus has gained 252% -- trouncing the S&P 500's 13% return over that same period.

Oklo and Centrus are both nuclear operators, but have businesses at different points in the nuclear value chain. Here's what you should know if you're weighing an investment between these two nuclear stocks.

Image source: Getty Images.

Oklo and Centrus Energy share these similarities

Oklo and Centrus Energy benefit from the shift in sentiment around nuclear energy, which is poised for significant growth over the next several decades. A couple of years ago, numerous countries endorsed the Declaration to Triple Nuclear Energy Capacity by 2050, a commitment to expand their nuclear energy capacity to meet growing demand while embracing it as a zero-emissions source.

In the U.S., the Department of Energy estimates that the country will need 200 gigawatts (GW) of new nuclear capacity to meet future power demands and net-zero emission goals. To do so, the country plans to add 35 GW of capacity by 2035, and 15 GW per year through 2040 to get on track. This level of buildout will require significant time and investment, which should bode well for Oklo and Centrus long-term.

Exploring key differences

While these companies have things in common, there are important distinctions between the two. Let's take a closer look at these differences.

Oklo

Founded in 2013, Oklo is an early-stage company developing advanced fission power plants that use metal-fueled fast-reactor technology. Its core product line is the Aurora powerhouse, a modern, small-scale, scalable reactor. These powerhouses produce electricity in compact sizes and will initially target 15 MWe and 75 MWe, with the potential to expand to 100 MWe and higher.

Its Aurora powerhouses utilize metal-fueled fast-reactor technology based on the Experimental Breeder Reactor-II, which operated for 30 years at the Argonne National Laboratory until its shutdown in 1994.

NYSE: OKLO

Key Data Points

Oklo is working toward getting approvals for its reactor technology, which could take several years. The company is focused on a repeatable path for getting licenses, which could accelerate the development of subsequent plans. To do so, operators would be licensed on the Aurora powerhouse technology itself, allowing them to monitor multiple plants from a central location and move between sites as needed.

The company has not yet built any operational Aurora powerhouses or secured binding customer agreements for power. It aims to have its first Aurora powerhouse operational by late 2027 or early 2028.

Centrus Energy

Centrus Energy has been in operation since 1998, but it underwent restructuring and adopted its current name in 2014. The company provides nuclear fuel components, along with enrichment and technical services, to customers.

Most of its revenue comes from selling low-enriched uranium (LEU), the fissile component of most nuclear fuels, to utilities operating commercial nuclear power plants. The company sources uranium and related products from a range of global suppliers.

NYSE: LEU

Key Data Points

Centrus currently relies on outside sources for LEU, including one agreement with Russian entity TENEX. It currently has a Department of Energy waiver that allows it to import LEU for committed deliveries to U.S. customers in 2026 and 2027. However, a Russian LEU import ban is expected to be fully phased in as of 2028, creating an urgent need to replace about 25% of the enriched uranium currently imported from Russia.

Long-term, Centrus aims to produce LEU and high-assay, low-enriched uranium (HALEU) in-house using its advanced centrifuge technology. There are no commercially active HALEU reactors today, only test reactors that could be operational in the late 2020s or early 2030s. Companies developing HALEU or HALEU-capable reactor designs include TerraPower, Westinghouse Electric, and Oklo.

Centrus Energy is uniquely positioned as the only producer of HALEU for both commercial and national security applications that is licensed by the Nuclear Regulatory Commission (NRC).

To begin production, it will need to expand the uranium enrichment capacity at its Piketon, Ohio, plant. Doing so hinges on funding from the Department of Energy, private investment, and long-term customer commitments. This transition is vital for Centrus to grow from a reseller to a producer of key nuclear fuels.

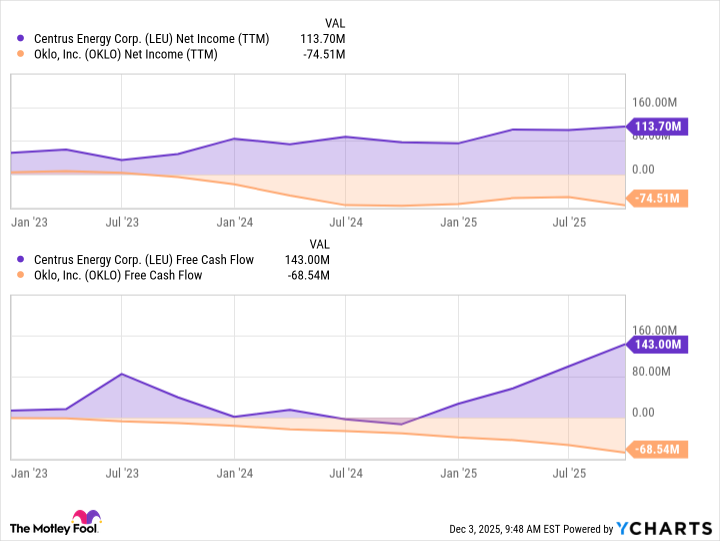

LEU Net Income (TTM) data by YCharts

Which is a better buy?

Oklo and Centrus Energy are two nuclear energy companies that are expected to benefit from favorable tailwinds over the coming decades.

With that said, Oklo is still without a commercial product, and it will still be two to three years before its reactor comes online. Centrus Energy, on the other hand, is established as a provider of the key component used in nuclear plants and generates revenue and income right now, which is why I'd give Centrus Energy the edge today.