Tuesday was a banner day to be in the silver business, so it was hardly surprising that investors piled into the stock of Pan American Silver (PAAS 1.22%). The company's share price zoomed more than 11% higher as a result, crushing the essentially flat performance of the benchmark S&P 500 index.

Outpacing both gold and platinum

Silver is on a tear these days, with its price zooming to all-time highs (at over $61 per troy ounce, as of this writing). It has more than doubled this year, surpassing the growth rates of the No. 1 precious metal, gold, and platinum.

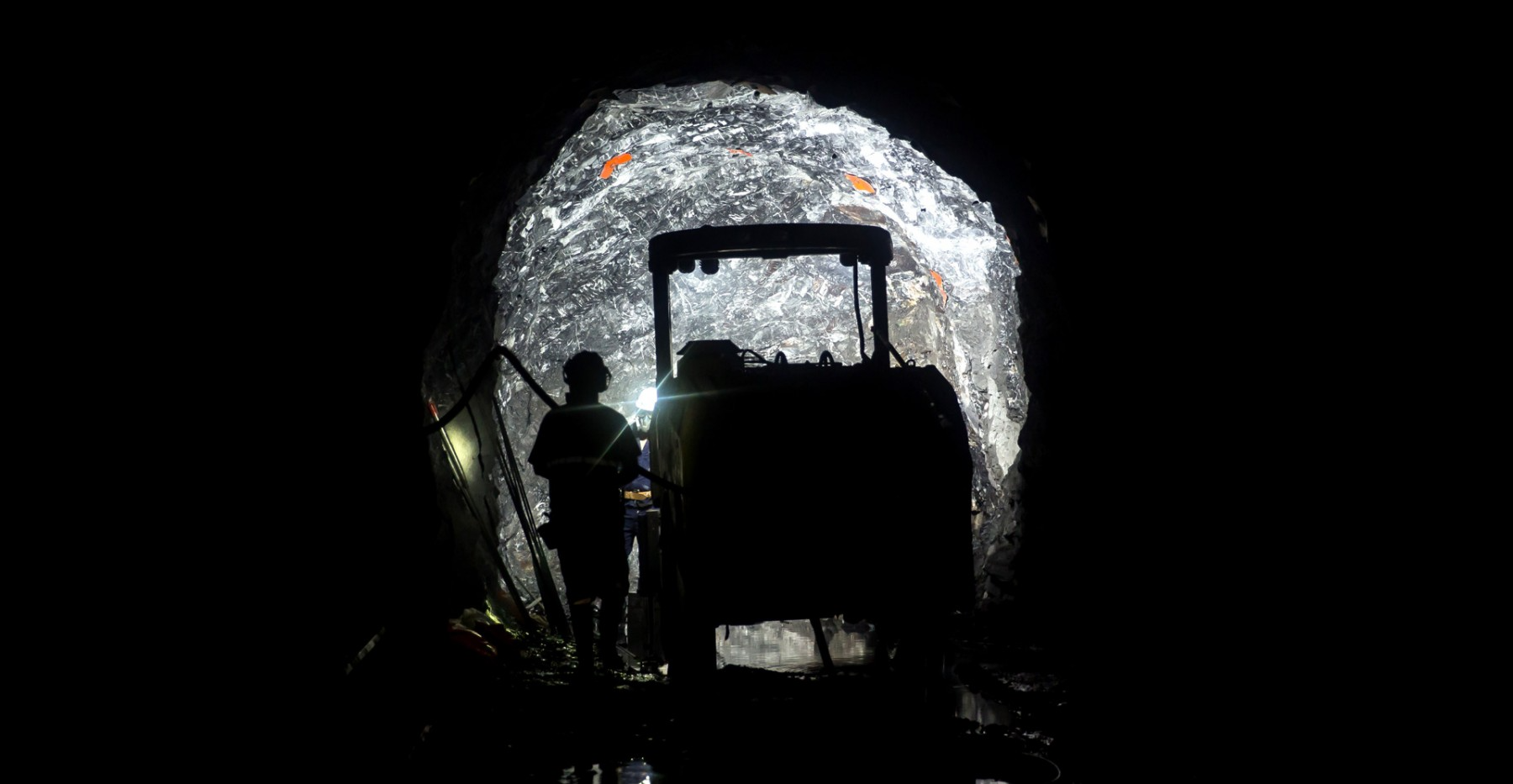

Image source: Getty Images.

Two major factors are driving the silver price north. The first is the widespread anticipation that the Federal Reserve's (Fed) Open Market Committee will announce a fresh interest rate cut when it concludes its regular meeting on Wednesday. Generally speaking, economists and analysts expect a 25-basis-point reduction from the Fed.

Precious metals become more attractive to many investors following rate cuts because they make assets that don't pay interest (like bonds) more attractive. Additionally, skinnier rates tend to weaken a currency, making dollar-denominated assets more appealing to overseas investors.

NYSE: PAAS

Key Data Points

Eggs in different baskets

Despite its name, Pan American Silver also has considerable gold assets, thanks in no small part to its 2023 acquisition of Yamana Gold. So, it's not only doing well on the run-up in silver prices, it's also benefiting from gold's glow.

As ever with precious metals stocks, though, how bullish you are on their future depends on your view of the underlying metals. For those who believe this bullish rally in silver and gold is sustainable, Pan American Silver appears to be a compelling buy, even after Tuesday's price surge.