Intel (INTC 2.81%) stock's fortunes have turned around impressively over the past six months. Shares of the company have shot up a remarkable 106% during this period, as investors have been buying the stock hand over fist in anticipation that its deal with Nvidia (NVDA 0.29%) will help it make a dent in the artificial intelligence (AI) chip market.

That's not surprising, as Nvidia is the biggest player in AI chips. So, when Nvidia announced in September that it would be investing $5 billion in Intel and jointly developing custom data center and personal computer (PC) chips with the latter, investor confidence in the stock shot up. However, it does seem that Intel stock may have gotten ahead of itself.

After all, the company's financial performance is yet to pick up, and it has become quite costly from a valuation perspective. Will these factors weigh on Intel stock in 2026? Let's try to find out and check where Chipzilla could be trading after a year.

Image source: Intel.

Analysts aren't expecting any gains from Intel in the coming year

Intel is now trading at a whopping 690 times trailing earnings. The forward earnings multiple of 56 isn't cheap either, compared to the tech-laden Nasdaq-100 index's average forward earnings multiple of 26. Of course, Chipzilla is expected to clock a massive improvement in its bottom line this year, reaching $0.34 per share, compared to a loss of $0.13 per share in 2024, but its cost-cutting efforts mainly drive that.

NASDAQ: INTC

Key Data Points

Intel said last year that it planned to save $10 billion in 2025 by cutting 15,000 jobs, or 15% of its workforce. However, it is actually on track to slash 25,000 jobs this year.

The fact that Intel's revenue remained almost stagnant in the first nine months of 2025, as compared to the year-ago period, suggests that it is yet to make the most of the massive revenue opportunity in semiconductors. The cost optimization efforts are expected to drive a 75% increase in Intel's bottom line next year, but that doesn't make it worth buying, according to analysts.

Out of 47 analysts who cover Intel, only 11% rate it as a buy. The majority, at 70%, rate Intel as a hold, while the remaining suggest that it is time to sell this semiconductor stock. The 12-month median price target of $39 suggests a potential 6% decline from current levels.

However, there are a few catalysts that could help Intel sustain its rally in 2026.

Here's why the stock may head higher despite the valuation

The good news for Intel is that the demand for its advanced chips is outpacing supply in both the PC and the data center markets. The company's client computing group (CCG) revenue was up by 8% quarter over quarter in Q3. Intel benefited from healthy PC demand during the quarter, a trend that could continue in 2026 thanks to AI-capable PCs.

Intel management sees 2026 as another strong year for the PC market. That won't be surprising as AI PC sales are expected to jump by 83% next year. On the other hand, Intel points out that some of its "data center customers are beginning to ask about longer-term strategic supply agreements to support their business goals due to the rapid expansion of AI infrastructure."

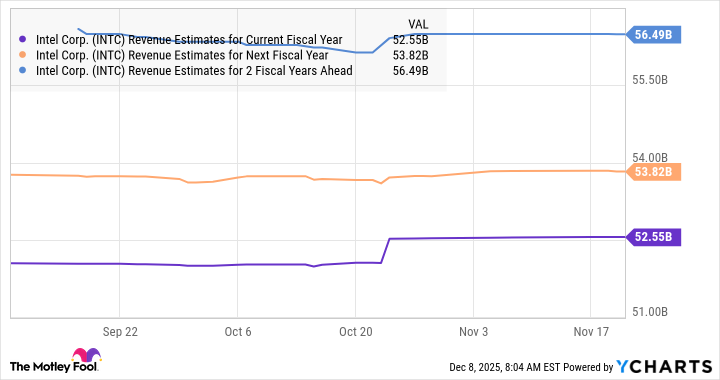

Given that Intel's Arizona fab, which produces chips based on the advanced Intel 18A process, is now fully operational, there is a chance that it may be able to overcome the supply constraints and clock stronger-than-expected growth in 2026. Analysts seem to be anticipating something similar, as they have raised their expectations for Intel.

INTC Revenue Estimates for Current Fiscal Year data by YCharts

The chart above tells us that Intel's growth is expected to pick up slightly next year, followed by a bigger jump in 2027. But there is a possibility that it could outpace analysts' expectations thanks to its partnership with Nvidia, which can open up new avenues for Intel in the PC and data center markets. That's why the market could continue to reward Intel with a premium valuation, paving the way for potential upside in 2026.

For instance, even if Intel manages to clock a slightly stronger increase of 5% in its top line in 2026 to $55.2 billion, which would be a nice improvement over this year's estimated drop of 1%, its market cap could hit $304 billion after a year (assuming a sales multiple of 5.5, in line with the Nasdaq Composite index's average sales multiple).

However, investors should remember that Intel will have to continue demonstrating that its business is turning around, or else the stock will lose momentum in 2026.