When you look at the stock market performance of the 11 major U.S. business sectors, there's tech, and then there's everyone else. The tech sector has considerably outperformed other sectors and has positioned itself as the go-to for investors seeking high-growth opportunities.

Twenty years ago, at the end of 2005, only one of the world's top 10 most valuable companies was a tech company (Microsoft). Today, nine of them are, each with a valuation of over $1 trillion (as of Dec. 4).

Considering the historical success, it makes sense that investors would want to continue pouring money into the sector. Rather than betting on individual stocks, investing in tech-focused exchange-traded funds (ETF)gives you broad exposure to the sector without taking on each company's individual risks.

Two popular tech ETFs are the Invesco QQQ ETF (QQQ +0.32%) and the Vanguard Information Technology ETF (VGT +0.10%). However, if you had to choose one of the two, which is the better option to go with heading into 2026? To me, the Invesco ETF stands out as the go-to. Here's why.

Image source: Getty Images.

Sector technicalities could mean missing out on key tech companies with Vanguard Information Technology ETF

The Invesco QQQ mirrors the Nasdaq-100, an index tracking the 100 largest nonfinancial companies on the Nasdaq exchange. This means QQQ isn't only tech stocks, but they do make up 64% of the ETF. On the other hand, the Vanguard ETF contains only companies from the information technology (tech) sector.

One knock on Vanguard Information Technology that makes me lean toward QQQ is how stock sectors are defined and how that affects what companies the Vanguard fund holds. The Vanguard fund is a pure-play tech ETF, but because of how the information technology sector is categorized, it's missing some key companies that I'd want exposure to if I were investing in a tech ETF.

For example, the ETF doesn't include Alphabet, Amazon, Meta, Tesla, or Netflix because the stock market categorizes those companies in different sectors. Alphabet, Meta, and Netflix fall into the communication services sector, and Amazon and Tesla fall into the consumer discretionary sector.

Although QQQ includes companies from other sectors, it also includes all the companies mentioned above, as well as those that technically fall into the tech sector.

NASDAQ: QQQ

Key Data Points

High concentration comes with more risk

The other reason I would prefer QQQ over Vanguard Information Technology ETF going into 2026 is that it's much less concentrated. Nvidia (NVDA +1.60%), Apple, and Microsoft are the top three holdings in each ETF, but in the Vanguard ETF, they account for over 45% of the fund.

| Company | Percentage of VGT | Percentage of QQQ |

|---|---|---|

| Nvidia | 18.18% | 9.16% |

| Apple | 14.29% | 8.85% |

| Microsoft | 12.93 | 7.47% |

Source: Vanguard and Invesco. Vanguard holdings as of Oct. 31. Invesco holdings as of Dec. 2.

Three companies comprising around 25% of QQQ doesn't necessarily scream diversification, but having three companies account for over 45% of a 314-stock ETF is a high-risk, high-reward game. It has worked out in Vanguard Information Technology ETF's favor in the past few years because of Nvidia's beyond-impressive performance (up 987% in three years), but the cause of its gains can be the same cause of its vulnerability.

The high concentration in Nvidia, in particular, is cause for hesitation. It has benefited significantly from demand for its graphics processing units (GPUs), artificial intelligence (AI) chips, and other data center hardware. But at over 18% of the Vanguard fund, you'd be banking on that demand continuing and Nvidia's earnings growth remaining near its current rate at a time when it's facing increased competition from companies like Alphabet, Amazon, and AMD.

AI demand is still strong, but I would prefer exposure to QQQ in the coming year because it also holds companies that deal with AI on the application side (Alphabet, Amazon, and Meta), which seems more promising than relying solely on the hardware side of the ecosystem.

Comparing their performances

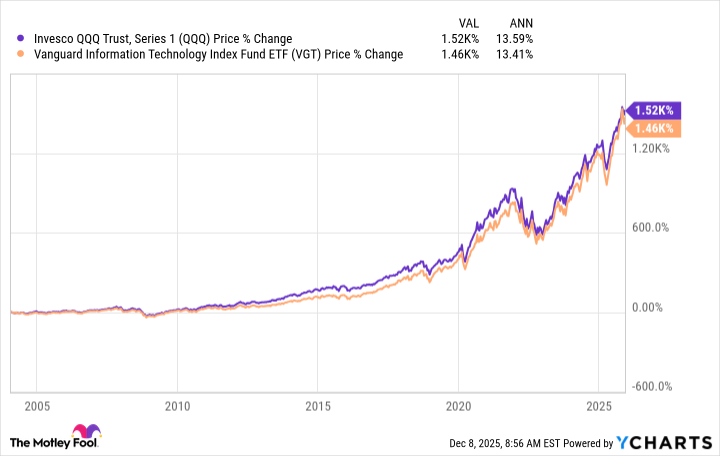

Over the past decade, both QQQ and the Vanguard Information Technology ETF have performed impressively, but the Vanguard fund has outperformed QQQ, mainly due to the growth of its top holdings, such as Nvidia. However, when you zoom out, QQQ has narrowly outperformed Vanguard since the latter debuted in January 2004.

Past performance doesn't guarantee future performance, and there's no way to predict how each will perform going forward. That said, I like how QQQ is better positioned for the long run. It has all the tech giants you would want, while having a piece of other sectors to help hedge against any tech-related downturns.