Shares of C3.ai (AI 2.27%) have witnessed a big sell-off this year, losing more than 55% of their value, as of this writing. This decline isn't surprising, as the company has fallen upon tough times lately, losing its way in the fast-growing generative artificial intelligence (AI) software market.

The stock nosedived in August of this year after the company revealed it would miss its guidance by a significant margin. Former CEO Thomas Siebel had to step aside due to health issues, which created a crisis of confidence among investors, as he played a key role in C3.ai winning new business. The company also withdrew its fiscal 2026 guidance on account of near-term uncertainty.

However, it appears that C3.ai's latest results have instilled some confidence in the stock. The company released its fiscal 2026 Q2 report (for the three months ended Oct. 31) on Dec. 3. Shares of the company were up by more than 4%, following the release.

Below, I'll examine why that was the case and determine whether this AI stock is now a worthwhile investment.

Image source: Getty Images.

C3.ai finally has some revenue visibility

The reorganization of C3.ai's sales force and leadership churn has disrupted the company's momentum. The pure-play enterprise AI software company delivered a decent increase of 25% in revenue in fiscal 2025 to $389 million. It also guided for a 20% increase in revenue in the current fiscal year to a midpoint of $466 million.

However, it took the company less than three months to withdraw its guidance. Its revenue in the first six months of fiscal 2026 has dropped by 20% to $145 million. The positive takeaway from its latest earnings report is that it now expects to generate nearly $300 million in revenue for the current year.

While this suggests a slight acceleration in growth in the second half of the fiscal year, the new guidance is still well below C3.ai's original target. Also, C3.ai's top line is on track to shrink by 23% this year, as per its guidance.

However, it wasn't all doom and gloom for investors, as there were several silver linings in C3.ai's quarterly report. The company pointed out that it witnessed a solid quarter-over-quarter jump of 49% in its bookings during the quarter. It closed a total of 46 agreements during the quarter, including expanded agreements with existing customers.

NYSE: AI

Key Data Points

These agreements are likely to have boosted the company's revenue pipeline. That's because it closed 17 agreements valued at over $1 million, while six agreements were worth $5 million or more. Another point worth noting is that C3.ai's federal business was in solid shape last quarter, registering 89% year-over-year growth in bookings.

Therefore, there's a chance that C3.ai will get back on track if it manages to sustain the deal momentum in the future. But does that make the stock a buy in anticipation of a potential turnaround?

What should investors do?

The generative AI software market that C3.ai caters to is poised for rapid growth, driven by the productivity and efficiency gains that this technology can deliver. According to one estimate, the AI software platforms market can clock an annual growth rate of 29% through 2034, generating annual revenue of $237 billion at the end of the forecast period.

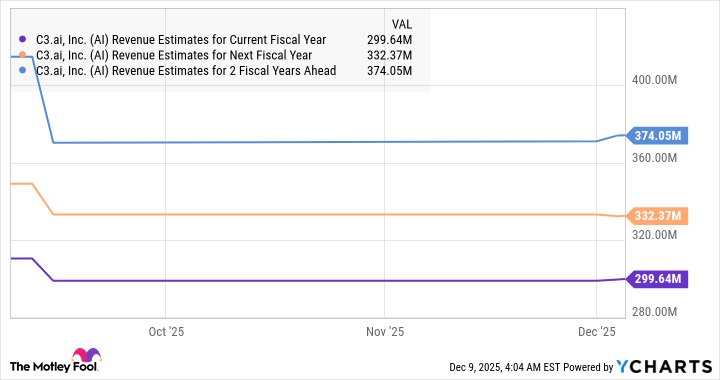

Therefore, there's ample opportunity for C3.ai to regain its mojo and start growing once again. This is precisely what analysts are projecting for the next couple of years.

AI Revenue Estimates for Current Fiscal Year data by YCharts.

Also, C3.ai is not as expensive as some of its peers. It has a price-to-sales ratio (P/S) of 5.3, a discount to the tech sector's average of 9. There's a reason why this generative AI company is cheap right now, but if it manages to turn its fortunes around, it may not be available at such a valuation in the future. That's why opportunistic investors may consider opening a small position in C3.ai.

However, if you're cautious, add it to your watchlist so that you don't miss out on any concrete signs of a turnaround in this business.