Investors in the nuclear power company Oklo (OKLO 6.38%) have made significant gains, as the market bets that nuclear power can prove to be a reliable and clean source of energy that helps meet the substantial demand expected from artificial intelligence (AI).

Oklo currently has three sites where it is developing nuclear reactors: Oklo Aurora at the Idaho National Laboratory and two sites in southern Ohio. However, the company has only recently broken ground on the Aurora site, where it is building a 75-megawatt electrical (MWe), liquid metal-cooled fast reactor.

Image source: Getty Images.

The company initially expected to have this site operational in late 2027 or early 2028. However, the project has been fast-tracked by the U.S. Department of Energy, which may accelerate this timeline.

Still, Oklo has no revenue, while trading at a roughly $13 billion market cap. The company also recently announced a $1.5 billion capital raise that will dilute shareholders, and many questions remain about the ultimate energy needs of AI.

If you'd invested $10,000 in Oklo's IPO

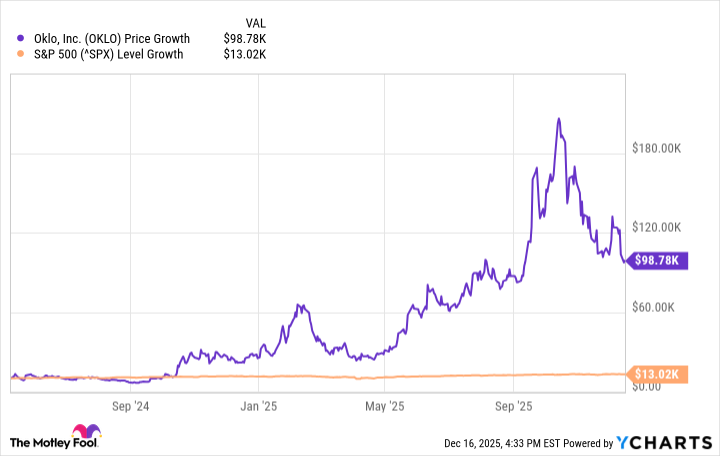

Oklo went public through a special purpose acquisition company (SPAC), but began trading publicly on May 10. Since then, the stock has skyrocketed higher and is now up over 730%. At one point, just a few months ago, the stock traded at nearly double its current price, making it a volatile investment.

As you can see above, $10,000 invested in Oklo's IPO is now worth close to $99,000. Meanwhile, the same $10,000 invested in the broader benchmark S&P 500 index would only be worth slightly over $13,000, which is by no means a bad return over roughly a year and a half.