It took computer memory company Micron Technology (MU 4.87%) 20 years to regain the highs it had achieved during the dot-com bubble at the turn of the century. But since finally hitting a new all-time high again in 2021, Micron's stock has continued to soar. It is up nearly 400% in just the last three years.

With the shares soaring to new highs, investors are clearly enthusiastic. But on Dec. 17, the company reported financial results for its fiscal first quarter of 2026. And it turns out that investors actually may not be enthusiastic enough.

Image source: Getty Images.

The business trends are so favorable for the company right now that investors may be underappreciating its potential over the next three to five years. And it's why Micron stock could still enjoy some more upside from here.

The big-picture trend

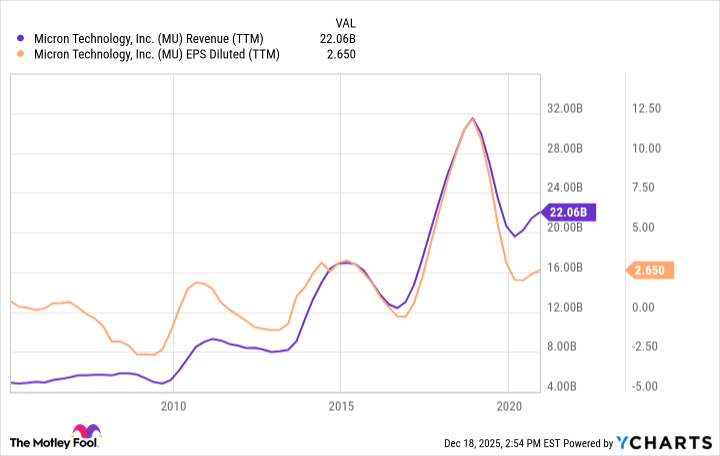

Investors tend to be cautious about buying Micron Technology stock because it's a historically cyclical business. The chart below illustrates the fluctuations from 2005 to 2020.

MU Revenue (TTM) data by YCharts; TTM = trailing 12 months.

If the boom-and-bust financials continue, then this entire discussion falls apart. However, a significant trend is currently underway that may finally help Micron's stock break free from its historical cyclicality.

The secular trend is artificial intelligence (AI), of course. Investors have heard plenty about it in recent years, but there is a lot of work still to be done to build out the AI infrastructure needed to achieve the goals laid out by tech giants.

NASDAQ: MU

Key Data Points

These major tech companies are building new data centers and filling them with graphics processing units (GPUs) from Nvidia. These GPUs supply the computing power needed to do useful things with AI. However, there is much more to the AI technology stack than just GPUs.

It has thus far centered on generative AI. In these applications, the models find generalities from large data sets and use them to create new things. But generative AI is starting to take a back seat to agentic AI. And this is fueling new hardware needs in data centers.

The shift to agentic AI -- where it is working on behalf of the user in a more active and personalized way -- requires more computer memory than before. And it's why computer memory businesses have more demand than they can handle right now.

Why Micron is suddenly a hot business

For the first quarter, Micron's revenue was up a stunning 57% year over year and more than 20% just from the previous quarter. And this isn't a one-off; it could be the new normal.

For the fiscal second quarter of 2026, management is guiding for revenue of $18.7 billion. If it hits this target, it would be a 132% year-over-year increase, within reach of its all-time fastest growth that occurred back in the dot-com bubble.

One of the things driving this growth is demand for high-bandwidth memory (HBM). The AI trend doesn't only need memory, it also needs fast memory. And Micron is a market leader in HBM.

According to management, the HBM market is expected to triple from 2025 through 2028. In other words, demand for Micron's hottest product should soar over the next three years. Perhaps it's not surprising, then, that the company has already sold out its supply for 2026, and discussions with its customers for subsequent years' orders are also underway.

In past cycles, it has had too much supply when demand tapered off, leading to lower profit margins. But that's been true of many semiconductor players, including makers of GPUs. This time, the AI trends have sustained GPU demand far better than many expected.

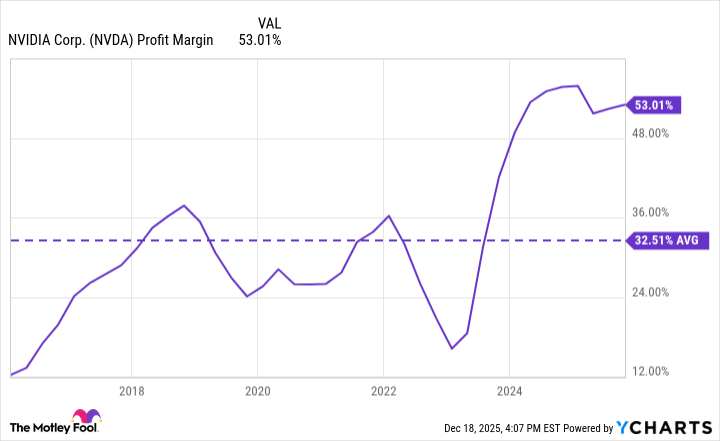

Nvidia's chart below demonstrates what can happen when demand exceeds supply by a large margin for a long time: Its profit margins are 60% higher than its 10-year average.

NVDA Profit Margin data by YCharts.

Don't look now, but a similar trend appears to be underway with Micron. In the first quarter, the company achieved a profit margin of 38%. For perspective, its 10-year average profit margin is 14%, according to YCharts. And for the second quarter, management expects earnings per share (EPS) of $8.19. That's more than the company has made in most years of its existence.

If revenue continues to grow over the next three years, as management has commented, the company could enjoy unprecedented profitability. For this reason, I believe Micron stock can keep soaring, even after jumping by so much in recent years.