Mid-cap stocks have a long history of being overlooked relative to their larger and smaller peers. Arguably, this status has been amplified in recent years as the artificial intelligence (AI) trade has compelled many investors to pile into megacap growth stocks.

Another reason investors gloss over mid-caps is that many of these names aren't as widely tracked by sell-side analysts as large caps. That leads to fewer headlines for mid-caps and the implication that it's challenging to pick stocks in this realm. But you can take advantage of exchange-traded funds (ETFs) to access mid-cap stocks.

This mid cap is perfect for investors looking to set and forget. Image source: Getty Images.

The Vanguard Mid-Cap ETF (VO 0.23%) is one of the largest and best mid-cap ETFs. Don't just take my word for it. This Vanguard ETF is showing up on lists from analysts for top recommendations for funds with exposure to smaller stocks in 2026.

A perfect ETF for buy-and-hold investors

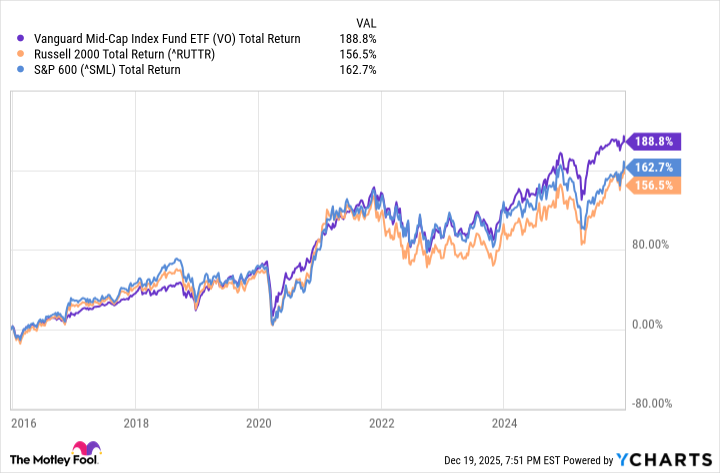

Mid-caps aren't just overlooked compared to their larger peers. When venturing outside the large-cap arena, investors typically head straight to small caps based on the notion that smaller companies offer better growth profiles and superior performance potential. This Vanguard ETF dispels that notion: Over the past decade, it has beaten the Russell 2000 and S&P 600 indexes.

Data by YCharts.

Past performance isn't a guarantee of future returns, but there are valid reasons to love this mid-cap ETF here and now. Increasing chatter among market watchers about a rise in concentration risk is a valid reason to buy into or stick with this Vanguard fund. These days, cap-weighted small-cap stocks dominate large-cap indexes, but mid-caps can mitigate some of that risk.

This $89.9 billion Vanguard ETF devotes just 12.7 percentage points of its weight to technology stocks, and none of its 292 holdings exceed a weight of 1.25%. Those data points confirm that with this ETF, investors are getting a product that's diverse at both the sector and holdings levels.

Another advantage offered by this mid-cap ETF is flexibility. The standard definition of a mid-cap stock is one with a market capitalization of $2 billion to $10 billion, but it's one that may be getting outdated as company valuations keep rising. The median market capitalization of this fund's holdings is $41.9 billion, and by leaning into larger stocks, this ETF can reduce volatility compared to mid-cap rivals that hone closer to the more traditional mid-cap valuations.

An excellent idea for cost-conscious investors

The mid-cap fund has something in common with many of its Vanguard relatives: a low expense ratio. An investor allocating $10,000 to this ETF today will pay just $4 a year on that stake, assuming no fee cuts come to pass. That's well below the category average of $86 per year on a $10,000 investment.

That minimal fee and the low portfolio turnover have helped this ETF outperform mid-cap competitors over the past decade, and they are excellent reasons to never part ways with this fund.