Formerly known as telecom company CenturyLink, Lumen Technologies (LUMN 6.56%) has been in the midst of a rebrand and pivot since 2020 amid the artificial intelligence (AI) boom. Like many AI stocks this year, Lumen has put up market-beating returns: It's up 38% through Dec. 22, compared to the S&P 500's gain of 17%.

Despite the stock's recent success, let me be the first to say this to prospective investors: Wait until reality matches the hype before putting money into Lumen.

Image source: Getty Images.

The hype surrounding Lumen Technologies

A lot of the hype surrounding Lumen revolves around the deals it has struck with companies like Microsoft and Alphabet. The terms of these deals make Lumen a major provider of networking capabilities for these companies. On the surface, they look like significant wins for the business -- especially as AI infrastructure spending increases.

According to Lumen CEO Kate Johnson, the company is "building the backbone of the AI economy."

NYSE: LUMN

Key Data Points

The reality of Lumen Technologies' business

But when you pull back the curtain on the headlines and look into Lumen's finances, there are causes for pause. To begin with, Lumen has over $17.5 billion in long-term debt, which is more than double its nearly $8 billion market cap at the time of this writing. It was able to refinance $2.4 billion of that debt, saving it $135 million in annual interest, but it still expects to pay over $1 billion in interest this year alone.

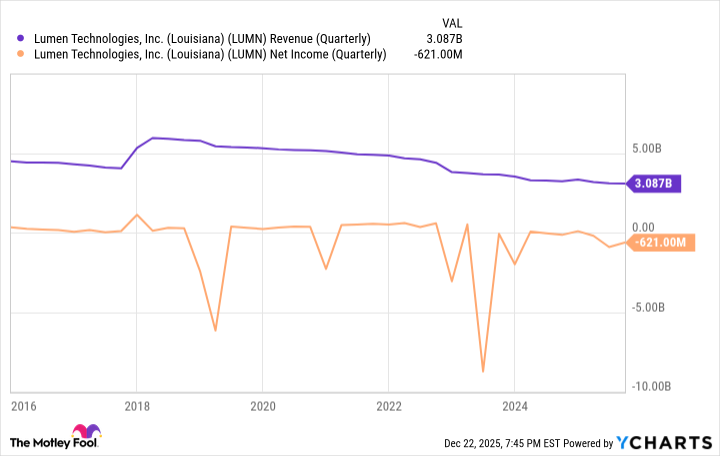

Take into account Lumen's debt, interest obligations, and the fact that it lost $621 million in the third quarter on $3.08 billion in revenue, and it's clear that it's burning through cash faster than its AI ambitions are paying off.

LUMN Revenue (Quarterly) data by YCharts.

Lumen's losses are expected to continue. On the company's latest earnings call, management said it didn't expect to get back to revenue growth until 2028. And operating at a loss isn't always a red flag because many growth stocks follow that model for a time as they prioritize expanding their top lines before shifting focus to profits.

However, in Lumen's case, it's not a new start-up building from scratch. It's a company that has been around since 1968, trying to pivot from a struggling legacy business into a high-growth industry while accumulating a lot of debt along the way.

Sure, aiming to be the "backbone of the AI economy" sounds enticing, but investors shouldn't take those words to heart until Lumen shows it can sustain profitability and chip away at the massive debt load that's holding it back from making key investments in other areas.