The hot hand fallacy, which gets its name from basketball, is the assumption that a player who is making baskets will keep doing so because they are on a "hot" streak. Similarly, flipping a coin on tails five times in a row may invoke recency bias. Surely, tails will come again, right?

Investors can make the same mistake with hot stocks by tracking price action over fundamentals. In reality, it's a company's earnings growth, much like a basketball player's shooting percentage, that smooths out variance in the long run.

2025 was an impeccable year for the broader U.S. stock market. But it's in the past. Investors should focus their attention on stocks that can soar in 2026 and beyond, rather than solely on those that performed well last year.

Here's why Amazon (AMZN +1.25%), Netflix (NFLX 2.13%), and Visa (V +0.33%) are top buys in the new year.

Image source: Getty Images.

Amazon is a reasonable value

Amazon has been a standout underperformer in 2025 -- up just 5.5% year to date at the time of this writing compared to a 17.3% gain in the S&P 500 (^GSPC +0.55%). Pullbacks in consumer discretionary spending affect Amazon's e-commerce segment and demand for services such as Amazon Prime, Audible, and Amazon Music. Amazon Web Services (AWS) is facing mounting competition from other major players, including Microsoft Azure, Alphabet's Google Cloud, and Oracle.

In the past, investors would often value Amazon based on its revenue. But the business is much different today, with AWS earning more than double the operating income in Amazon's third quarter of 2025 than the rest of the business combined. Amazon still aggressively spends on organic growth compared to other big-tech companies that return capital to shareholders through buybacks and dividends. But Amazon is also far more consistently profitable and free-cash-flow-positive than in past years.

Even with consumer spending pressures and cloud computing complications, Amazon is still growing earnings at a solid pace -- faster than the stock price has been going up, which has pushed Amazon's valuation down. In fact, investors can scoop up shares of Amazon for just 32.8 times forward earnings -- almost identical to Apple's 33.2 times forward multiple, even though Amazon is growing much faster than Apple.

NASDAQ: AMZN

Key Data Points

Mixed reactions to Netflix's acquisition aspirations

Netflix is down 29% in the last six months but has still increased in price by several fold since the start of 2023. But Netflix isn't cheap, with a forward price-to-earnings ratio of 37.

The market hates uncertainty, and right now there's a ton of it with Netflix as the streaming giant is paying a premium price for Warner Bros. Discovery in an effort to push back Paramount Skydance. Netflix has a track record of licensing, developing, and distributing its content rather than acquiring intellectual property and production houses.

NASDAQ: NFLX

Key Data Points

What's more, Netflix's operating expenses have been on the rise -- growing slightly more than revenue in 2025. Some reports indicate that Stranger Things Season 5 cost an estimated $400 million to $480 million, which is higher than the production budget of blockbuster hit Avengers: Endgame.

Visual effects and higher compensation for a cast that has gone from largely unknown to star-studded are undoubtedly driving up the cost. So while Netflix is a cash cow of a business, higher spending and a major acquisition make its future earnings growth less clear, which may be why some investors are selling out of the stock.

Those fears are overblown. For starters, Netflix has an impeccable balance sheet, using income earned from operations to fuel its growth rather than relying on debt. It should be able to leverage Warner Bros. Discovery's assets, like HBO, into a premium-tier subscription service that includes Netflix. It will also be able to drastically increase the size and range of its in-house production, potentially playing a bigger role in special releases and coordinating with experiences outside of at-home streaming, like movie theaters.

Visa's business model is built to last

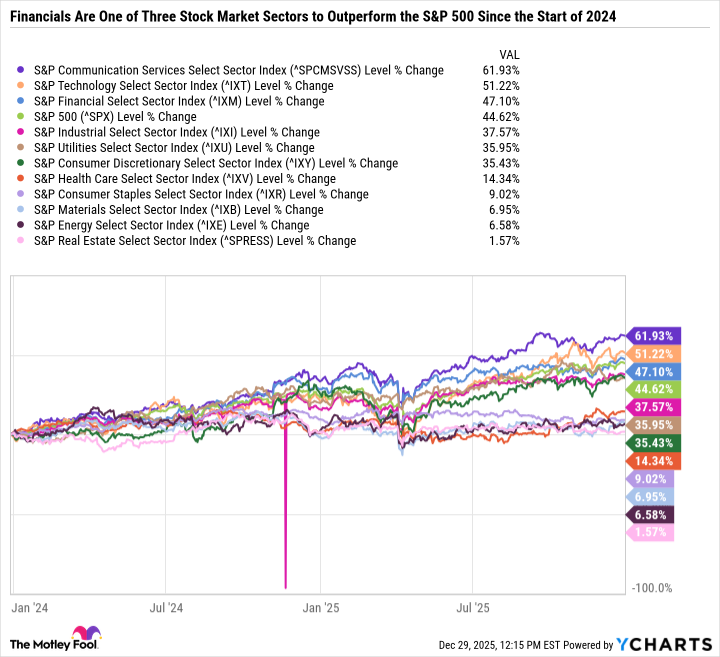

The financial sector has played a pivotal role in propelling the broader market to new heights in recent years. Big banks with massive market caps can move the market. And many of them are hovering around all-time highs -- with JPMorgan Chase within striking distance of joining the $1 trillion club.

Payment processors like Visa and Mastercard, as well as payment processor and card issuer American Express, represent the most compelling pocket of the financial sector for 2026. Even around an all-time high, Visa is arguably the most balanced buy of the bunch.

Visa is by far the largest payment processor by purchase volume in the U.S. and has a growing global network.

NYSE: V

Key Data Points

Visa makes money every time one of its debit or credit cards is swiped, inserted, tapped, or processed digitally. The fee structure is based on frequency and volume, with Visa collecting higher fees on larger transactions. But even during a recession, Visa is still a high-margin cash cow that can afford to reinvest in its core business and return capital to shareholders through buybacks and dividends.

The size and security of the Visa network make it an attractive partnership for financial institutions that issue Visa cards. Visa stands to benefit from economic growth and the ongoing shift toward digital transactions, as well as the decline in cash usage.

At just 27.7 times forward earnings, Visa isn't dirt cheap, but it's a reasonable price for an ultra-high-quality industry leader.